Get the free LOS ANGELES COUNTY TAX-DEFAULTED PROPERTY

Show details

AGREEMENT TO PURCHASE LOS ANGELES COUNTY DEFAULTED PROPERTY (Public/Taxing Agency) This Agreement is made this day of, 20, by and between the Board of Supervisors of Los Angeles County, State of California,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign los angeles county tax-defaulted

Edit your los angeles county tax-defaulted form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

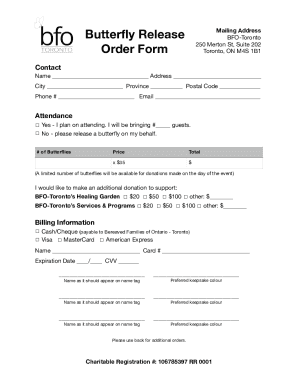

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your los angeles county tax-defaulted form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing los angeles county tax-defaulted online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit los angeles county tax-defaulted. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out los angeles county tax-defaulted

How to fill out los angeles county tax-defaulted

01

Obtain the tax-defaulted property list from the Los Angeles County Treasurer and Tax Collector's Office.

02

Review the list to identify properties of interest.

03

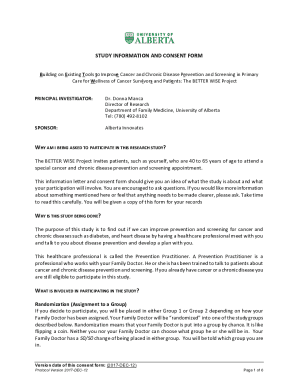

Research each property to gather information about its current condition, potential value, and any potential issues or liabilities.

04

Determine the amount of outstanding taxes owed on each property.

05

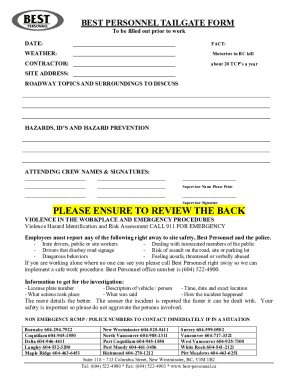

Prepare the necessary forms and documents required by the Los Angeles County Tax Collector's Office for the purchase of tax-defaulted properties.

06

Submit the required forms, along with the necessary payment, to the Tax Collector's Office.

07

Await the results of the tax-defaulted property sale process and any subsequent auctions or redemption periods.

08

If successful, complete the purchase of the tax-defaulted property and fulfill any required obligations or responsibilities as the new owner.

Who needs los angeles county tax-defaulted?

01

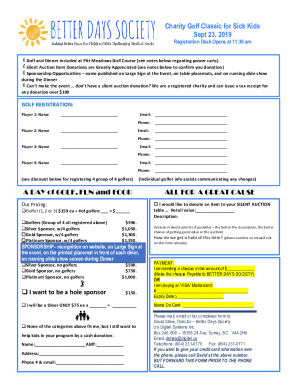

Investors or individuals looking to purchase properties at potentially discounted prices.

02

Real estate developers or flippers interested in acquiring properties for development or resale.

03

Individuals or organizations specializing in property rehabilitation and foreclosure sales.

04

Those seeking opportunities for investment or diversification in the real estate market.

05

Anyone interested in exploring alternative methods of property acquisition or investment.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send los angeles county tax-defaulted to be eSigned by others?

When your los angeles county tax-defaulted is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make changes in los angeles county tax-defaulted?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your los angeles county tax-defaulted to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I complete los angeles county tax-defaulted on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your los angeles county tax-defaulted. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is los angeles county tax-defaulted?

Los Angeles County tax-defaulted properties are properties in which the tax payments have not been made and the county has placed a lien on the property.

Who is required to file los angeles county tax-defaulted?

Property owners who have failed to pay their property taxes are required to file for tax-defaulted status.

How to fill out los angeles county tax-defaulted?

To fill out the los angeles county tax-defaulted form, property owners must provide information about the property, the amount of unpaid taxes, and any other relevant details requested by the county.

What is the purpose of los angeles county tax-defaulted?

The purpose of los angeles county tax-defaulted is to notify property owners of their unpaid taxes and to give them the opportunity to pay the overdue amount in order to avoid foreclosure.

What information must be reported on los angeles county tax-defaulted?

Property owners must report information such as the property address, the amount of unpaid taxes, and any relevant documentation requested by the county.

Fill out your los angeles county tax-defaulted online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Los Angeles County Tax-Defaulted is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.