Get the free Home Loan Options - Virginia Housing Development Authority

Show details

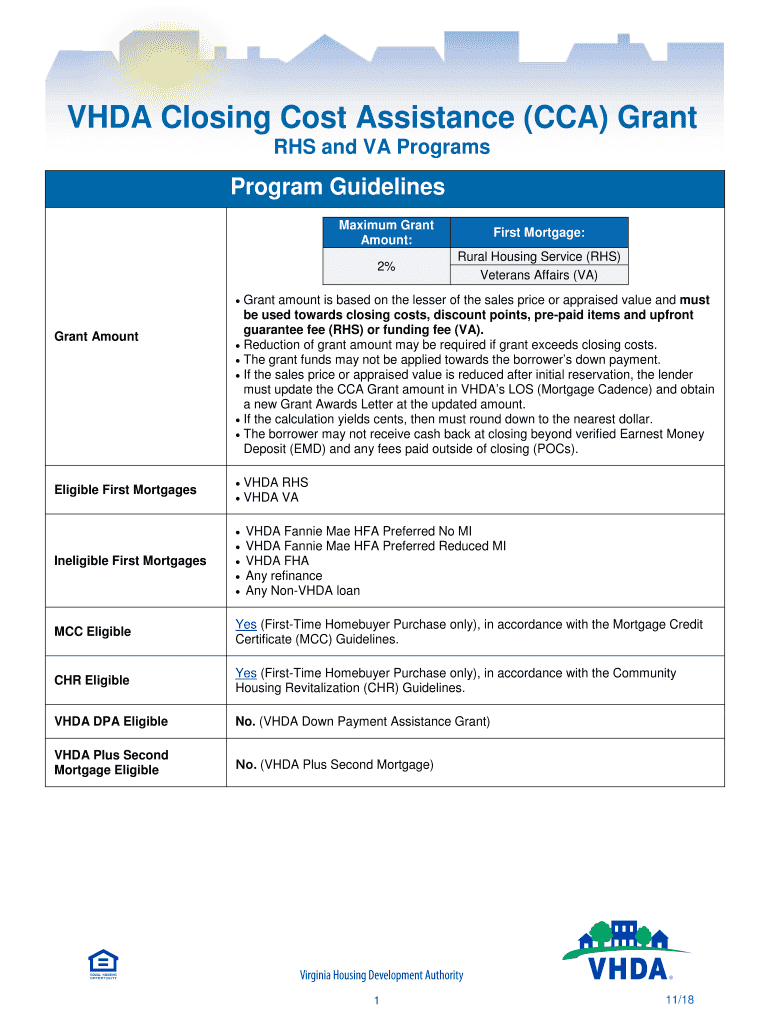

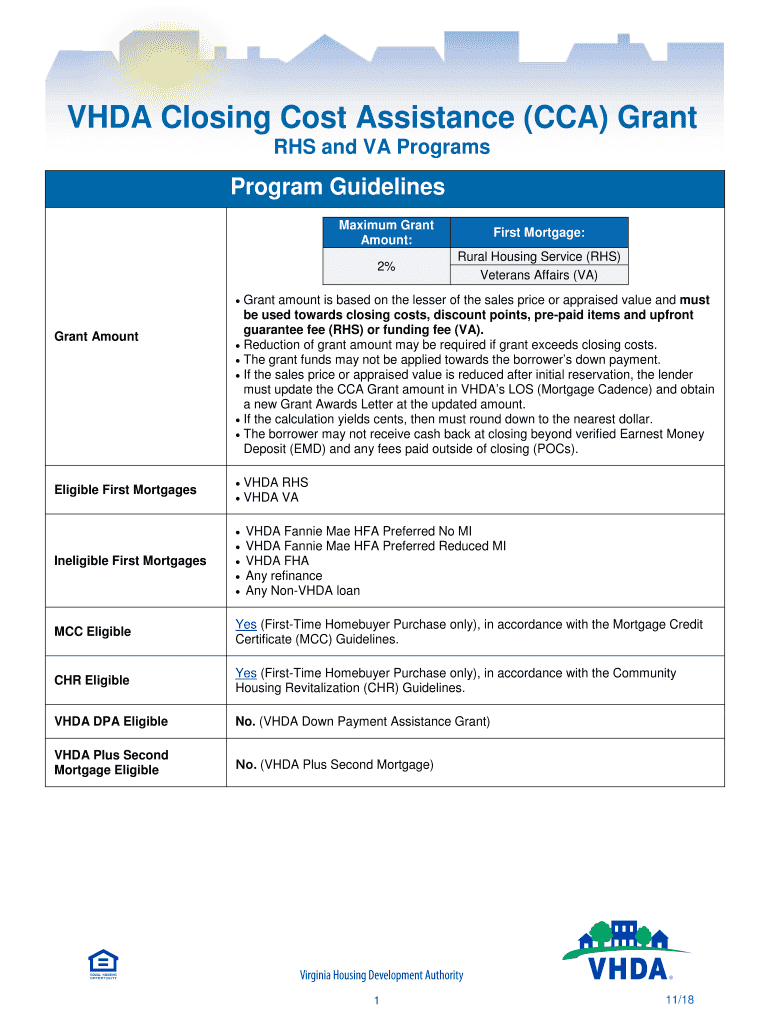

VEDA Closing Cost Assistance (CCA) Grant RHS and VA ProgramsProgram Guidelines Maximum Grant Amount:First Mortgage:2×Rural Housing Service (RHS) Veterans Affairs (VA)Grant Amount is based on the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home loan options

Edit your home loan options form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home loan options form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing home loan options online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit home loan options. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home loan options

How to fill out home loan options

01

To fill out home loan options, follow these steps:

02

Research and compare different home loan options offered by various lenders.

03

Understand the terms and conditions of each option, including interest rates, loan amount, repayment period, etc.

04

Determine your eligibility for each option based on factors like credit score, income, employment history, etc.

05

Gather all the necessary documents required by the lenders, such as income proof, identification proof, bank statements, etc.

06

Fill out the application form for each option accurately and provide all the requested information.

07

Review and double-check the filled-out application forms for any errors or missing information.

08

Submit the completed application forms along with the required documents to the respective lenders.

09

Wait for the lenders to assess your application and provide you with the loan offers and terms.

10

Compare the loan offers carefully, consider the interest rates, repayment options, and any additional fees or charges.

11

Choose the home loan option that best suits your needs and financial situation.

12

Complete any additional formalities or paperwork required by the chosen lender.

13

Sign the loan agreement and fulfill all requirements to finalize the home loan option.

14

Follow up with the lender for any further instructions or documentation required during the loan disbursal process.

15

Once the loan is approved, ensure timely repayment of the loan installments as per the agreed terms.

16

Seek professional advice if you are unsure about any step or aspect of filling out home loan options.

Who needs home loan options?

01

Anyone who is planning to purchase a house or property but lacks the complete funds to do so can benefit from home loan options.

02

Individuals who want to invest in real estate or buy their own home but cannot pay the entire amount upfront can also consider home loan options.

03

Home loan options are suitable for those who prefer to spread the cost of a property purchase over a longer period of time and can manage the regular loan repayments.

04

People looking for financial assistance to build or renovate their existing home may also need home loan options.

05

Home loan options are available for both salaried individuals and self-employed individuals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my home loan options in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your home loan options as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send home loan options to be eSigned by others?

When you're ready to share your home loan options, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How can I fill out home loan options on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your home loan options. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is home loan options?

Home loan options refer to the different types of loans available to individuals for purchasing a home, such as fixed-rate mortgages, adjustable-rate mortgages, and government-backed loans.

Who is required to file home loan options?

Individuals who are seeking to purchase a home and need financing are required to explore and select the best home loan options that suit their needs.

How to fill out home loan options?

To fill out home loan options, individuals need to research different types of loans, compare interest rates, terms, and requirements, and submit an application to the chosen lender.

What is the purpose of home loan options?

The purpose of home loan options is to provide individuals with the opportunity to finance the purchase of a home by offering various loan products with different terms and conditions.

What information must be reported on home loan options?

Information such as the loan amount, interest rate, loan term, down payment amount, and any relevant fees must be reported on home loan options.

Fill out your home loan options online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Loan Options is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.