Get the free REPLACEMENT OF LIFE INSURANCE OR ANNUITy CONTRACT

Show details

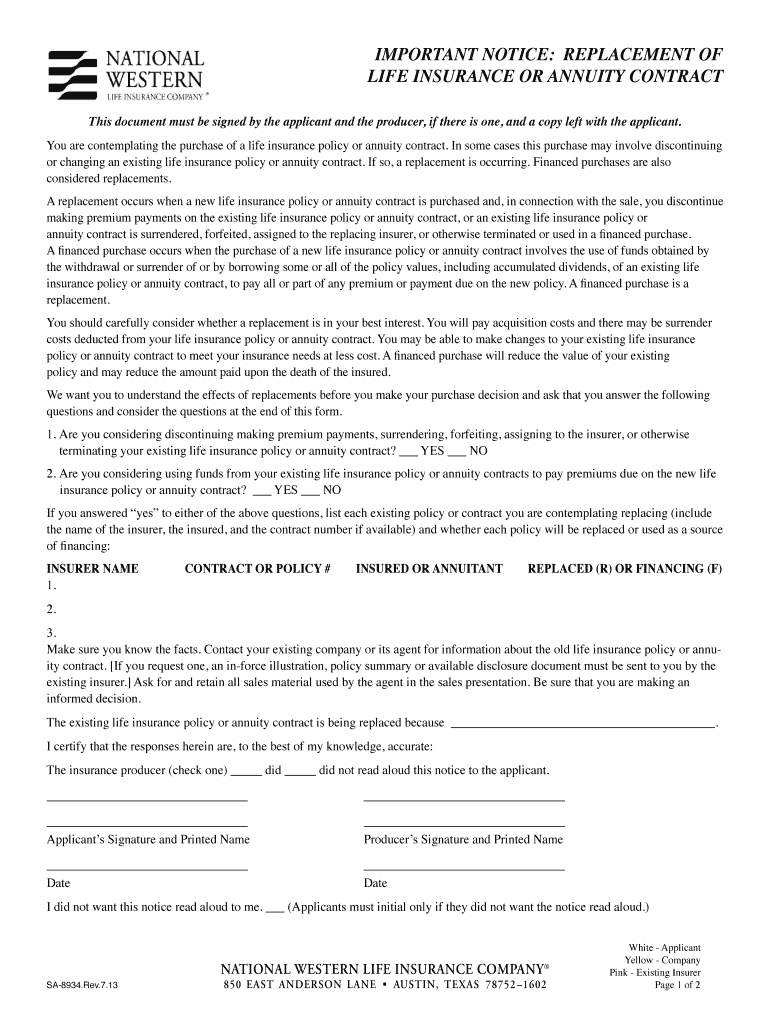

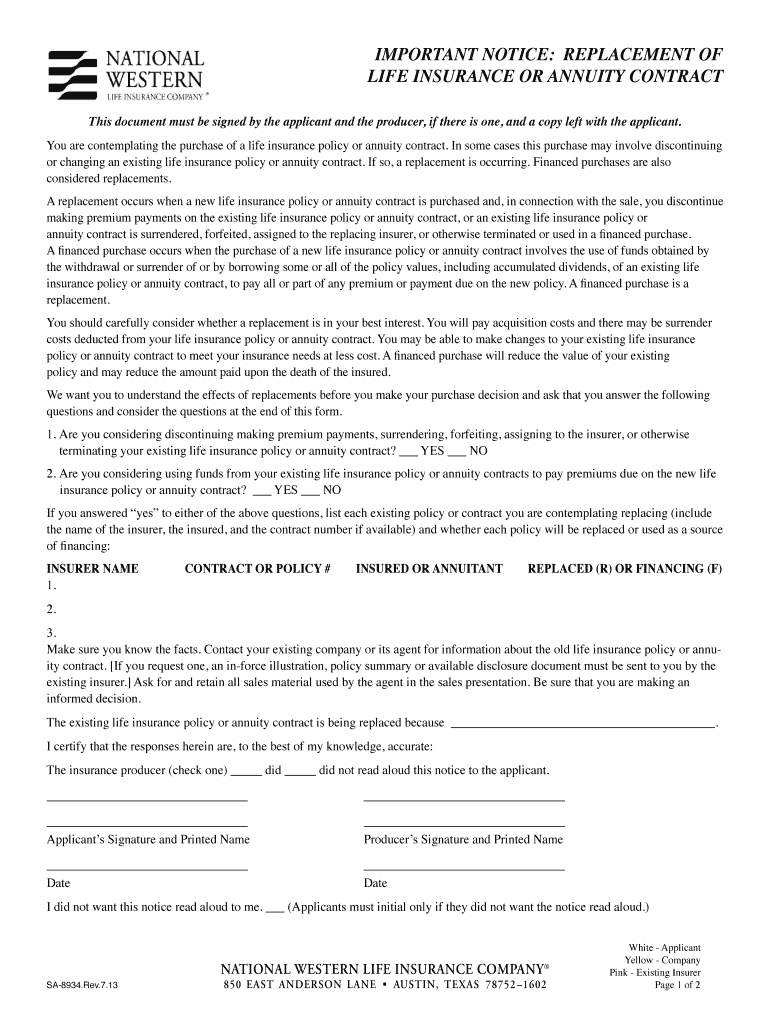

IMPORTANT NOTICE: REPLACEMENT OF LIFE INSURANCE OR Annuity CONTRACT This document must be signed by the applicant and the producer, if there is one, and a copy left with the applicant. You are contemplating

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign replacement of life insurance

Edit your replacement of life insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your replacement of life insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing replacement of life insurance online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit replacement of life insurance. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out replacement of life insurance

01

Review your current life insurance policy: Before filling out a replacement of life insurance form, it's important to thoroughly review your existing policy. Understand the details, coverage, and benefits offered by your current insurance policy.

02

Determine the need for replacement: Consider the reasons why you are considering a replacement of life insurance. Perhaps you want to increase your coverage, change beneficiaries, or find a better policy that suits your changing needs.

03

Research and compare different insurance options: Take the time to research and compare different life insurance providers. Look for companies that offer policies that align with your needs and budget. Consider factors like premiums, coverage options, benefits, and customer reviews.

04

Contact the insurance company: Once you have identified a suitable replacement policy, reach out to the insurance company. Request the necessary forms or information required to initiate the replacement process.

05

Fill out the replacement form: Carefully fill out all the required information on the replacement form. Provide accurate personal details, policy numbers, and any other relevant information requested. Be sure to double-check all the information you have provided for accuracy.

06

Understand the consequences: It's crucial to understand the consequences of replacing your current life insurance policy. Review the terms and conditions of your existing policy, paying attention to any penalties, loss of benefits, or coverage changes that may occur.

07

Seek professional advice if needed: If you're unsure about any aspect of the replacement process, it's wise to seek advice from a qualified insurance professional. They can guide you through the process, provide expert opinions, and help you make an informed decision.

08

Submit the replacement form: After completing the form, submit it to the insurance company as instructed. Be sure to keep a copy of the submitted form and any accompanying documents for your records.

Who needs replacement of life insurance?

01

Individuals looking for better coverage: Some individuals may want to replace their current life insurance policy to obtain better coverage or higher benefits. This could be due to changes in financial circumstances, such as an increase in income or family responsibilities.

02

Those who want to change beneficiaries: Life circumstances can change, and individuals might need to update their beneficiaries. If you want to change the recipients of your life insurance benefits, a replacement policy can help facilitate that change.

03

People seeking more affordable options: If your current life insurance policy has become unaffordable, you may want to explore other options. A replacement policy can offer more affordable premiums that better align with your budget.

04

Individuals with changing needs: Life insurance needs can change over time. For example, as you get older, you may want a policy that focuses more on providing financial protection for your loved ones rather than accumulating cash value. A replacement policy can help address these changing needs.

05

Those who are dissatisfied with current provider: If you are unsatisfied with your current life insurance provider, whether it's due to poor customer service, lack of transparency, or any other reason, you may want to explore other options through a replacement policy.

In conclusion, filling out a replacement of life insurance form requires a thorough review of your current policy, researching different options, and carefully filling out the necessary forms. Individuals who may need a replacement policy include those seeking better coverage, changes in beneficiaries, more affordable options, changing needs, or dissatisfaction with their current provider.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit replacement of life insurance online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your replacement of life insurance to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for the replacement of life insurance in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your replacement of life insurance in minutes.

How can I fill out replacement of life insurance on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your replacement of life insurance. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is replacement of life insurance?

Replacement of life insurance refers to the process of exchanging an existing life insurance policy for a new one.

Who is required to file replacement of life insurance?

Insurance agents, brokers, and companies are required to file replacement of life insurance when recommending a client to replace their existing policy.

How to fill out replacement of life insurance?

To fill out replacement of life insurance, one must gather all necessary information about the existing policy and the new policy being considered, then complete the required forms accurately and submit them to the insurance company.

What is the purpose of replacement of life insurance?

The purpose of replacement of life insurance is to ensure that the new policy is suitable for the policyholder's current needs and financial situation, and to protect consumers from unsuitable replacements.

What information must be reported on replacement of life insurance?

Information such as the policyholder's name, existing policy details, new policy details, reasons for replacement, and signatures of the policyholder and the recommending agent must be reported on replacement of life insurance.

Fill out your replacement of life insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Replacement Of Life Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.