Get the free AUDITED REPOlg3

Show details

18008070RER3×lg...:32350123Expires:

August 31, 2020,

Estimated averageburdenAUDITED REPOlg3

FORM X17A54ANNUALWas impart Ill0Eursperresponse......12.route\'sSECFILENUMBERs68781FACING PAGEInformation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign audited repolg3

Edit your audited repolg3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your audited repolg3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit audited repolg3 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit audited repolg3. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out audited repolg3

How to fill out audited repolg3

01

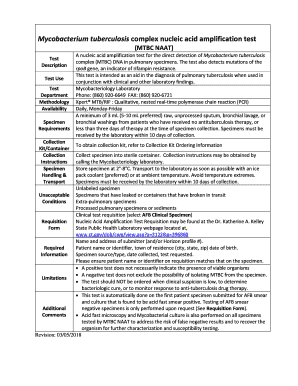

Start by gathering all the necessary financial information and documents, such as income statements, balance sheets, and cash flow statements.

02

Review the guidelines and requirements provided by the auditing authority to ensure you have a clear understanding of what needs to be included in the audited report.

03

Prepare the audit working papers, which should consist of supporting documentation and evidence for all the financial transactions and assertions made in the report.

04

Perform audit procedures, such as testing the accuracy of financial records, confirming balances with external parties, and assessing the adequacy of internal controls.

05

Document any findings or discrepancies uncovered during the audit process, along with recommendations for improvement or corrective actions.

06

Summarize the audit results in a comprehensive report, providing an overview of the financial position, performance, and compliance of the audited entity.

07

Review and validate the audited report with the relevant stakeholders, such as management, shareholders, or regulatory authorities.

08

Make any necessary revisions or adjustments to the audited report based on feedback and additional requirements.

09

Finalize the audited report by obtaining necessary signatures or approvals, ensuring compliance with legal and regulatory obligations.

10

Distribute the final audited report to the intended recipients, such as investors, lenders, or government agencies, as per the specified deadlines and distribution channels.

Who needs audited repolg3?

01

Audited repolg3 is typically required by stakeholders such as investors, lenders, regulatory authorities, and government agencies.

02

Companies seeking external financing or planning for an Initial Public Offering (IPO) often need to prepare audited reports to provide transparency and assurance to potential investors.

03

Publicly traded companies are also generally required to have their financial statements audited by an independent auditing firm to comply with stock exchange regulations and meet investor expectations.

04

Government agencies may request audited reports from businesses to ensure compliance with taxation, legal, or regulatory requirements.

05

In some cases, internal stakeholders and management may also request audited reports to assess the financial health and performance of the organization.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my audited repolg3 in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your audited repolg3 and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out audited repolg3 using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign audited repolg3 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Can I edit audited repolg3 on an Android device?

You can make any changes to PDF files, like audited repolg3, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is audited repolg3?

Audited repolg3 is a financial report that has been examined by an independent auditor to ensure its accuracy and compliance with accounting standards.

Who is required to file audited repolg3?

Companies or organizations that meet certain criteria, such as annual revenue thresholds or regulatory requirements, are typically required to file audited repolg3.

How to fill out audited repolg3?

To fill out audited repolg3, you will need to gather financial data, documentation, and other relevant information, and work with an auditor to ensure accuracy and compliance with accounting standards.

What is the purpose of audited repolg3?

The purpose of audited repolg3 is to provide stakeholders, such as investors, regulators, and creditors, with assurance that the financial statements are reliable and accurately reflect the financial position of the company.

What information must be reported on audited repolg3?

Audited repolg3 typically includes a balance sheet, income statement, cash flow statement, and notes to the financial statements, as well as any other required disclosures or supporting documentation.

Fill out your audited repolg3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Audited repolg3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.