Get the free Life Insurance Personal Statement - OnePath

Show details

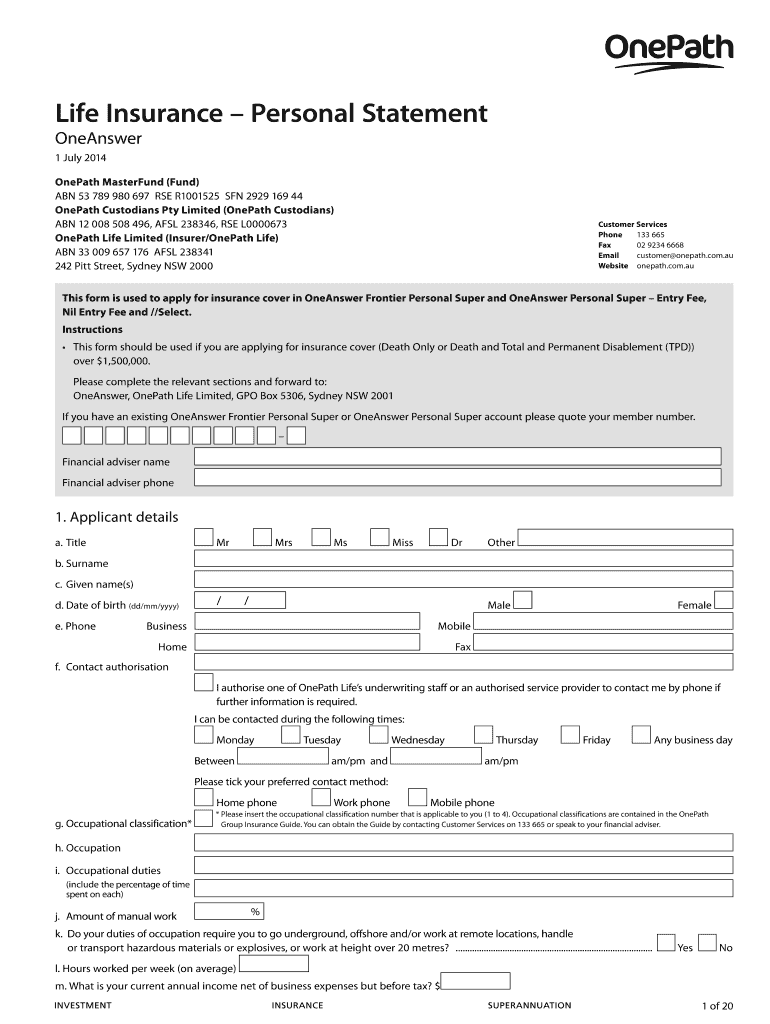

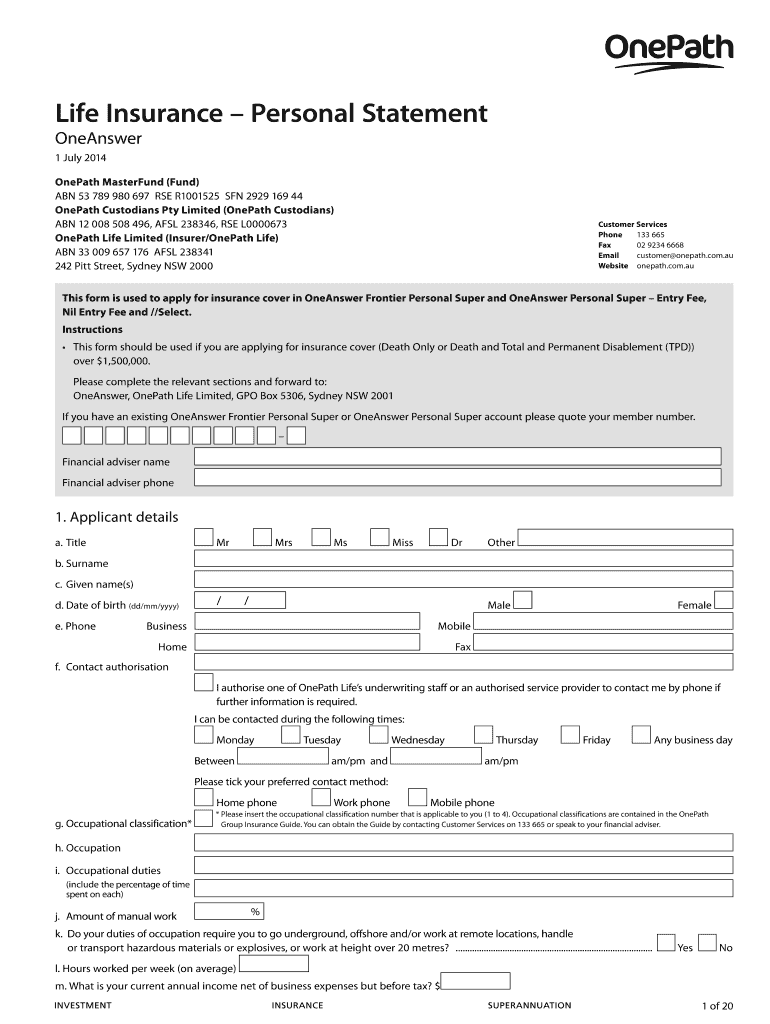

Life Insurance Personal Statement Answer 1 July 2014 Neath Mastermind (Fund) ABN 53 789 980 697 RSE R1001525 SON 2929 169 44 Neath Custodians Pty Limited (Neath Custodians) ABN 12 008 508 496, ADSL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign life insurance personal statement

Edit your life insurance personal statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your life insurance personal statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit life insurance personal statement online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit life insurance personal statement. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out life insurance personal statement

How to fill out a life insurance personal statement:

01

Begin by gathering all necessary information such as personal details, contact information, and relevant financial and medical information. This includes your full name, date of birth, address, social security number, and any existing health conditions or medical history.

02

Clearly state the purpose of the life insurance personal statement, which is to provide the insurance company with a comprehensive understanding of your background, lifestyle, and overall risk profile. This information helps insurers assess the level of risk they would be undertaking by issuing you a life insurance policy.

03

Provide detailed information about your occupation, income, and financial situation. This may include your current employment status, annual income, and any investments or assets you possess. It is important to be transparent and accurate in disclosing this information, as it can greatly impact the terms and premiums of your life insurance policy.

04

Disclose any existing life insurance policies you have and provide details about the coverage and beneficiaries. This will help the insurance company assess your overall insurance needs and determine if any adjustments or additional coverage is necessary.

05

In the personal statement, consider including any relevant lifestyle factors that may impact your insurance risk, such as hobbies or activities that carry a higher level of risk, such as skydiving or extreme sports. Be honest and transparent about these activities as insurance companies take these factors into consideration when underwriting policies.

06

Discuss any existing health conditions or medical history in detail, including any past surgeries, chronic illnesses, or medications you are currently taking. It is essential to provide accurate information to ensure the insurance company has a complete understanding of your health status.

07

Consider including information about your smoking or alcohol consumption habits, as these factors can impact your life insurance rates. Insurance companies typically consider smokers or heavy drinkers to be higher risk individuals and may adjust the premium accordingly.

08

Lastly, provide a clear and concise summary of why you believe you need life insurance and how it will benefit your loved ones. This can include financial support for dependents, mortgage or debt repayment, or funeral expenses. Be sure to express your intentions clearly and honestly as insurance companies take this into consideration when assessing your risk profile.

Who needs a life insurance personal statement:

01

Individuals who are applying for a new life insurance policy and are required by the insurance company to provide a personal statement.

02

Applicants who have a complex medical history or existing health conditions that may require additional documentation to assess their insurability.

03

Those who engage in high-risk activities or have dangerous hobbies that may impact their risk profile and require further explanation.

04

Individuals with a significant net worth or complex financial situation that may require additional disclosure to assess their insurance needs accurately.

05

Applicants who already have existing life insurance policies or coverage and need to provide updated information or make adjustments to their current policies.

Remember, it is essential to consult with an insurance professional or financial advisor to ensure you accurately complete the personal statement and meet all the requirements set forth by the insurance company.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send life insurance personal statement to be eSigned by others?

When you're ready to share your life insurance personal statement, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete life insurance personal statement online?

Easy online life insurance personal statement completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit life insurance personal statement straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing life insurance personal statement.

What is life insurance personal statement?

The life insurance personal statement is a form that details personal information about the insured individual in order to assess their eligibility for life insurance coverage.

Who is required to file life insurance personal statement?

Individuals who are applying for a life insurance policy are required to file a life insurance personal statement.

How to fill out life insurance personal statement?

To fill out a life insurance personal statement, the applicant must provide accurate and truthful information about their personal details, medical history, and lifestyle choices.

What is the purpose of life insurance personal statement?

The purpose of the life insurance personal statement is to assess the risk associated with insuring an individual and to determine the premium rates for the policy.

What information must be reported on life insurance personal statement?

Information such as personal details, medical history, lifestyle choices, and any other relevant information that may impact the insurance policy must be reported on the life insurance personal statement.

Fill out your life insurance personal statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Life Insurance Personal Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.