Get the free 97 Traditional IRA Trust Application, Plan Agreement and Disclosure (5/2012) - lifecu

Show details

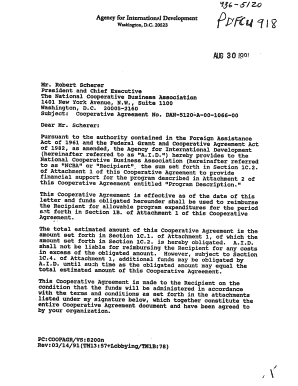

TRADITIONAL IRA Simplified INDIVIDUAL RETIREMENT ACCOUNT APPLICATION PART 1. IRA OWNER PART 2. IRA TRUSTEE To be completed by the IRA trustee Name (First/MI/Last) Name Address Line 1 Address Line

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 97 traditional ira trust

Edit your 97 traditional ira trust form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 97 traditional ira trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 97 traditional ira trust online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 97 traditional ira trust. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 97 traditional ira trust

How to fill out a 97 traditional IRA trust:

01

Consult a financial advisor or tax professional to understand the specific requirements and regulations related to a 97 traditional IRA trust.

02

Gather all relevant documents, such as the trust agreement, beneficiary designations, and legal identification for all individuals involved.

03

Review the terms of the trust to ensure you understand the responsibilities and obligations as the trustee.

04

Complete the necessary paperwork to establish the 97 traditional IRA trust, including providing personal information, identifying beneficiaries, and specifying the terms and conditions.

05

Transfer the assets into the trust account, ensuring all necessary documentation is provided to the financial institution.

06

Keep detailed records of all transactions, distributions, and any changes made to the trust.

07

Monitor the trust's performance and make any necessary adjustments or decisions to ensure it aligns with the intended purpose and goals.

08

Consider seeking professional help for annual tax filing requirements related to the trust.

09

Communicate with the beneficiaries to keep them informed about the trust's progress and any changes that may affect their interests.

Who needs a 97 traditional IRA trust:

01

Individuals who have amassed substantial assets in their individual retirement accounts (IRA) and want to ensure proper management and preservation of those assets for their beneficiaries.

02

Those who want to designate specific beneficiaries and outline detailed provisions regarding the distribution and management of their IRA assets after their death.

03

People who wish to protect their IRA assets from potential creditors and ensure a smooth transfer of wealth to their loved ones.

04

Individuals who have unique circumstances or specific goals that cannot be fulfilled within the standard IRA structure and need additional flexibility and control over their retirement assets.

05

Estate planning professionals who need to advise clients on strategies for asset protection, tax planning, and wealth transfer using a 97 traditional IRA trust.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in 97 traditional ira trust without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit 97 traditional ira trust and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for the 97 traditional ira trust in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your 97 traditional ira trust in minutes.

How do I edit 97 traditional ira trust on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share 97 traditional ira trust from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your 97 traditional ira trust online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

97 Traditional Ira Trust is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.