TX Comptroller 01-116-A 2015 free printable template

Show details

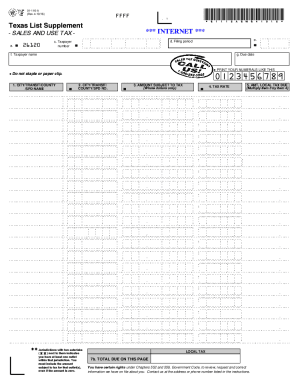

01116A (Rev.215/15)PRINT FORMFFFFTexas List Supplement×01116A0W021515* Instructions in English SALES AND USE TAX a.b26120c. Taxpayer numbering REQUIREMENTS e.d. Filing period. Taxpayer Namecheap

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign TX Comptroller 01-116-A

Edit your TX Comptroller 01-116-A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your TX Comptroller 01-116-A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit TX Comptroller 01-116-A online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit TX Comptroller 01-116-A. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller 01-116-A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out TX Comptroller 01-116-A

How to fill out TX Comptroller 01-116-A

01

Obtain the TX Comptroller 01-116-A form from the Texas Comptroller's website or local office.

02

Fill out the identification section, providing your name, address, and contact information.

03

Specify the type of exemption you are applying for by checking the appropriate box.

04

Provide details regarding the property or item for which the exemption is requested.

05

Include any required supporting documentation or evidence to substantiate your claim.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form before submission.

08

Submit the form to the appropriate tax office as indicated in the instructions.

Who needs TX Comptroller 01-116-A?

01

Individuals or businesses seeking tax exemptions in Texas.

02

Property owners applying for exemptions on their real or personal property.

03

Organizations that qualify for specific types of tax exemptions, such as nonprofit or religious organizations.

Fill

form

: Try Risk Free

People Also Ask about

Does Texas exemption certificate expire?

The resale certificate is the seller's evidence as to why sales tax was not collected on that transaction and should be retained in the seller's books and records for four years.

What is the penalty for filing sales tax late in Texas?

A $50 penalty is assessed on each report filed after the due date. If tax is paid 1-30 days after the due date, a 5 percent penalty is assessed. If tax is paid over 30 days after the due date, a 10 percent penalty is assessed.

How do I get sales tax exempt in Texas?

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

What is a Texas sales tax exemption certificate?

Description: This form is used to claim an exemption from payment of sales and use taxes (for the purchase of taxable items).

What tax exemptions can I claim in Texas?

What Property Tax Exemptions Are Available in Texas? General Residence Homestead. Age 65 or Older or Disabled. Manufactured and Cooperative Housing. Uninhabitable or Unstable Residence. Temporary Exemption for Disaster Damage.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify TX Comptroller 01-116-A without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your TX Comptroller 01-116-A into a dynamic fillable form that you can manage and eSign from anywhere.

Can I create an electronic signature for the TX Comptroller 01-116-A in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your TX Comptroller 01-116-A in minutes.

How do I edit TX Comptroller 01-116-A on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign TX Comptroller 01-116-A on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

What is TX Comptroller 01-116-A?

TX Comptroller 01-116-A is a form used for reporting information related to certain Texas tax obligations, particularly for businesses.

Who is required to file TX Comptroller 01-116-A?

Businesses that meet specific criteria under Texas tax law are required to file TX Comptroller 01-116-A, usually pertaining to sales and use tax or franchise tax.

How to fill out TX Comptroller 01-116-A?

To fill out TX Comptroller 01-116-A, one should gather all necessary financial and business information, complete all required fields, and ensure that calculations are accurate before submitting the form.

What is the purpose of TX Comptroller 01-116-A?

The purpose of TX Comptroller 01-116-A is to help the Texas Comptroller's office track and manage tax compliance among businesses operating in Texas.

What information must be reported on TX Comptroller 01-116-A?

Information that must be reported on TX Comptroller 01-116-A includes business name, tax identification number, income details, deductions, and any applicable exemptions.

Fill out your TX Comptroller 01-116-A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

TX Comptroller 01-116-A is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.