PA DoR REV-1196 2018-2026 free printable template

Show details

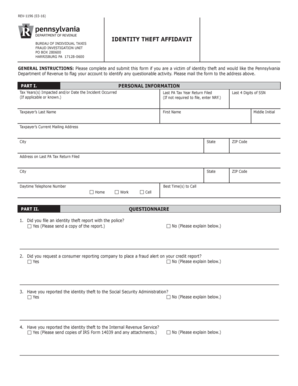

(EX) 1118REV1196OFFICIAL USE ONLYBurEau of Individual taxes

fraud detection and analysis unit

Po Box 280607

Harrisburg, Pa 171280607IDENTITY THEFT AFFIDAVITPlease complete and submit this form if

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pennsylvania identity theft affidavit form

Edit your 497309161 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pa identity theft form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing identity theft form rev1196 printable online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit pa identity theft form rev online. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA DoR REV-1196 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out 497332468 form

How to fill out PA DoR REV-1196

01

Start by downloading the PA DoR REV-1196 form from the official Pennsylvania Department of Revenue website.

02

Read the instructions carefully to understand the requirements and gather necessary information.

03

Fill out your personal information in the designated fields, including your name, address, and Social Security Number.

04

Provide details of your income sources, including wages, self-employment earnings, and any other income.

05

List any deductions you are eligible for, such as business expenses or personal exemptions.

06

Calculate your total taxable income based on the information provided.

07

Double-check all entries for accuracy and completeness before submission.

08

Sign and date the form in the appropriate section.

09

Submit the completed form either electronically or by mailing it to the designated address.

Who needs PA DoR REV-1196?

01

Individuals or businesses filing their taxes in Pennsylvania who need to report their income and deductions.

02

Anyone who has received a notice from the Pennsylvania Department of Revenue requiring the completion of this form.

03

Taxpayers who are claiming specific deductions or credits that require additional documentation.

Fill

attorney civil litigation

: Try Risk Free

People Also Ask about employment contract sample pdf

Where do I file a PA-40?

Where do I mail my personal income tax (PA-40) forms? For RefundsPA DEPT OF REVENUE REFUND OR CREDIT REQUESTED 3 REVENUE PLACE HARRISBURG PA 17129-0003For Balance DuePA DEPT OF REVENUE PAYMENT ENCLOSED 1 REVENUE PLACE HARRISBURG PA 17129-00012 more rows • Feb 6, 2023

What is a form PA-40?

2022 Pennsylvania Income Tax Return (PA-40)

How do I get a PA Revenue ID number?

Pennsylvania Tax Account Numbers If you are a new business, register online with the PA Department of Revenue to retrieve your account number and filing frequency. You can also contact the agency at 1-888-PATAXES (1-888-728-2937).

Where do I pick up PA state tax forms?

If you are trying to locate, download, or print state of Pennsylvania tax forms, you can do so on the Pennsylvania Department of Revenue. The most common Pennsylvania income tax form is the PA-40.

Where do I get a PA-40 form?

You may call 1-888-PATAXES (1-888-728-2937) to leave a message to have forms mailed to you.

How do I verify my identity for PA state taxes?

Taxpayers will receive a letter asking them to complete a six-question ID Validation Quiz to verify their identity. The questions may be based on a taxpayer's individual credit background. Letters are mailed to the address on the taxpayer's PA-40 (Personal Income Tax Return).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send PA DoR REV-1196 for eSignature?

Once your PA DoR REV-1196 is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Where do I find PA DoR REV-1196?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific PA DoR REV-1196 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I fill out PA DoR REV-1196 on an Android device?

Use the pdfFiller mobile app and complete your PA DoR REV-1196 and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is PA DoR REV-1196?

PA DoR REV-1196 is a tax document used by the Pennsylvania Department of Revenue for reporting certain types of income or financial activity.

Who is required to file PA DoR REV-1196?

Individuals or entities that have certain taxable income or financial activities as defined by the Pennsylvania Department of Revenue are required to file PA DoR REV-1196.

How to fill out PA DoR REV-1196?

To fill out PA DoR REV-1196, you need to provide accurate financial details as requested on the form, including income, deductions, and other required information.

What is the purpose of PA DoR REV-1196?

The purpose of PA DoR REV-1196 is to report specific types of income to ensure compliance with Pennsylvania tax regulations and to calculate any owed taxes.

What information must be reported on PA DoR REV-1196?

Information that must be reported on PA DoR REV-1196 includes income sources, amounts, relevant deductions, and personal or business identification details.

Fill out your PA DoR REV-1196 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA DoR REV-1196 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.