Get the free Manitoba Book Publishing Tax Credit

Show details

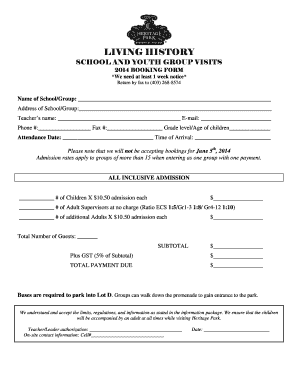

Protected Manitoba Book Publishing Tax Credit (Individuals)when completedComplete this form to calculate your Manitoba book publishing tax credit for individuals. If you are completing a return for

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign manitoba book publishing tax

Edit your manitoba book publishing tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your manitoba book publishing tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing manitoba book publishing tax online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit manitoba book publishing tax. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out manitoba book publishing tax

How to fill out manitoba book publishing tax

01

To fill out the Manitoba book publishing tax form, follow these steps:

02

Start by obtaining the Manitoba book publishing tax form. This form can usually be found on the official website of the Manitoba Finance Department.

03

Read the instructions provided with the form carefully to understand the requirements and eligibility criteria.

04

Gather all the necessary information and supporting documents, such as sales revenue, production costs, Manitoba-based staff salaries, and other relevant financial details.

05

Complete the form by filling in the required information accurately. Make sure to provide detailed information where required and double-check for any errors or omissions.

06

Attach any supporting documents as requested by the form instructions.

07

Review the completed form and supporting documents to ensure everything is accurate and complete.

08

Sign and date the form as the authorized representative of the book publishing company.

09

Submit the completed form and supporting documents according to the instructions provided. This can be done either through mail or online submission, depending on the specified method.

10

Keep a copy of the completed form and all submitted documents for your records.

11

Wait for the processing of your Manitoba book publishing tax form. You may be contacted by the Manitoba Finance Department if further information or clarification is required.

12

Once processed, you will receive a notification regarding the outcome of your tax claim.

13

It is recommended to seek professional guidance or consult the Manitoba Finance Department directly for any specific queries or concerns.

Who needs manitoba book publishing tax?

01

Manitoba book publishing tax is needed by individuals or companies involved in book publishing activities in Manitoba. This includes publishers, authors, illustrators, editors, agents, and other related professionals.

02

To be eligible for the Manitoba book publishing tax credit, the activities must meet the criteria set by the Manitoba Finance Department, such as publishing books with recognizable literary or artistic merit, having a permanent establishment in Manitoba, and meeting the eligibility requirements outlined in the Manitoba book publishing tax legislation.

03

It is advisable to review the specific criteria and requirements provided by the Manitoba Finance Department or consult a professional tax advisor to determine if you qualify for the Manitoba book publishing tax credit.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the manitoba book publishing tax in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your manitoba book publishing tax in seconds.

Can I create an electronic signature for signing my manitoba book publishing tax in Gmail?

Create your eSignature using pdfFiller and then eSign your manitoba book publishing tax immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I edit manitoba book publishing tax on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing manitoba book publishing tax.

What is manitoba book publishing tax?

Manitoba book publishing tax is a tax imposed on book publishing activities in the province of Manitoba.

Who is required to file manitoba book publishing tax?

Any individual or business engaged in book publishing activities in Manitoba is required to file manitoba book publishing tax.

How to fill out manitoba book publishing tax?

Manitoba book publishing tax can be filled out and submitted online through the Manitoba government website or by mail.

What is the purpose of manitoba book publishing tax?

The purpose of manitoba book publishing tax is to generate revenue for the province and regulate book publishing activities within Manitoba.

What information must be reported on manitoba book publishing tax?

Information such as total sales, expenses related to book publishing, and any tax credits or exemptions claimed must be reported on manitoba book publishing tax.

Fill out your manitoba book publishing tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Manitoba Book Publishing Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.