Canada T4E 2018 free printable template

Show details

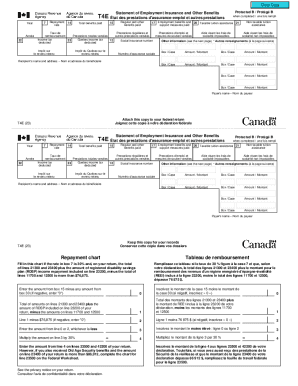

Statement of Employment Insurance and Other BenefitsT4E that DES prestations d\'assuranceemploi et actress prestations

7YearAnne

22Repayment

rate1415Total benefits irregular and other

benefits paid17Employment

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Canada T4E

Edit your Canada T4E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T4E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada T4E online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit Canada T4E. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T4E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T4E

How to fill out Canada T4E

01

Gather all relevant employment information.

02

Obtain a blank Canada T4E form from the Canada Revenue Agency (CRA) website.

03

Enter your name, address, and Social Insurance Number (SIN) at the top of the form.

04

Complete the 'Income' section by recording the total amount of Employment Insurance (EI) benefits received during the year.

05

Fill out any deductions or taxable benefits if applicable.

06

Review the completed form for accuracy.

07

Submit the form to the CRA along with your income tax return, or provide it to your employer if they need it for filing.

Who needs Canada T4E?

01

Individuals who received Employment Insurance (EI) benefits during the tax year.

02

Employees who need to report their EI benefits on their income tax return.

03

Anyone who is required to file a tax return and has received EI payments.

Fill

form

: Try Risk Free

People Also Ask about

Is it mandatory to pay EI in Canada?

All employers are required by law to deduct Canada Pension Plan (CPP) contributions and employment insurance (EI) premiums from most amounts they pay to their employees. Employers must remit these amounts to the Canada Revenue Agency (CRA) along with their share of CPP contributions and EI premiums.

What is an example of a benefit statement?

Your company sells compact, sustainable camping stoves. Benefit statement: Carrying our lightweight, collapsible burner stove means you'll have hot meals with the push of a button, without carrying an extra, cumbersome 20 pounds on your pack.

What is a statement of benefits?

Your Explanation of Benefits, or EOB, statement shows you the costs associated with the medical care you've received.

How much is EI a month in Canada?

For most people, the basic rate for calculating Employment Insurance (EI) benefits is 55% of their average insurable weekly earnings, up to a maximum amount. As of January 1, 2023, the maximum yearly insurable earnings amount is $61,500. This means that you can receive a maximum amount of $650 per week.

How long can you get EI in Canada?

How long will my EI claim last? Your EI entitlement will depend on the number of insurable hours in your qualifying period and your region of residence. The maximum number of weeks ranges from 14 to 45.

What is EI in Canada?

The Employment Insurance (EI) program provides temporary income support to unemployed workers while they look for employment or to upgrade their skills. The EI program also provides special benefits to workers who take time off work due to specific life events: illness.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send Canada T4E for eSignature?

To distribute your Canada T4E, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete Canada T4E online?

Filling out and eSigning Canada T4E is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I make changes in Canada T4E?

With pdfFiller, it's easy to make changes. Open your Canada T4E in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

What is Canada T4E?

Canada T4E is a tax form used in Canada to report Employment Insurance (EI) benefits and other related income that individuals receive during a tax year.

Who is required to file Canada T4E?

Individuals who receive Employment Insurance benefits or other similar income from the Government of Canada are required to file the T4E form.

How to fill out Canada T4E?

To fill out Canada T4E, you need to complete the information about the recipient, including their Social Insurance Number, the amount of benefits received, and any deductions made. The form can be filled out online or by paper, following specific guidelines provided by the Canada Revenue Agency.

What is the purpose of Canada T4E?

The purpose of Canada T4E is to provide the Canada Revenue Agency (CRA) with the necessary information about the Employment Insurance benefits and income received by individuals, which is used for tax assessment purposes.

What information must be reported on Canada T4E?

The information that must be reported on Canada T4E includes the recipient's name, address, Social Insurance Number, the total amount of EI benefits paid, any deductions taken from those benefits, and other relevant income details.

Fill out your Canada T4E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t4e is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.