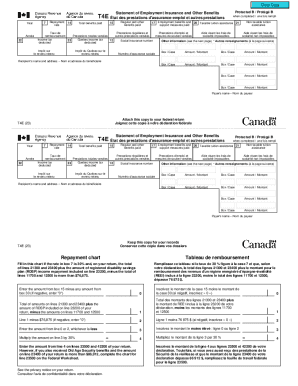

Canada T4E 2016 free printable template

Show details

Statement of Employment Insurance and Other Benefits T4E that DES prestations d 'assuranceemploi et actress prestations 7 Year Anne 22 Repayment rate 14 15 Total benefits paid Regular and other benefits

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign Canada T4E

Edit your Canada T4E form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Canada T4E form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Canada T4E online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit Canada T4E. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

Canada T4E Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out Canada T4E

How to fill out Canada T4E

01

Obtain a blank Canada T4E form from the Canada Revenue Agency (CRA) website or your employer.

02

Fill in your personal information at the top of the form, including your name, address, and Social Insurance Number (SIN).

03

Enter the issuing agency's name and the correct tax year.

04

Fill in box 14 for the total amount of Employment Insurance (EI) benefits you received.

05

If applicable, complete boxes for any additional amounts, such as tax withheld (box 22) or any other relevant earnings.

06

Review the completed form for accuracy and completeness.

07

Submit the T4E form to the CRA by mail or electronically, if allowed.

Who needs Canada T4E?

01

Individuals who have received Employment Insurance (EI) benefits in Canada need the T4E form for their tax return.

02

Those who are required to report their EI benefits to the Canada Revenue Agency (CRA) as part of their income.

Fill

form

: Try Risk Free

People Also Ask about

What should my T4 level be?

A normal Total T4 level in adults ranges from 5.0 to 12.0μg/dL.

What does it mean when your T4 is low?

Abnormally low free T 4 levels may signal hypothyroidism. This means your thyroid is not making enough hormones. An underlying condition, such as Hashimoto disease, another autoimmune disorder, could be the cause of an underactive thyroid.

How do I get my T4?

Ask your employer or the issuer of the slip for a copy.

What happens when T4 is high?

Elevated T4 levels may indicate hyperthyroidism. They may also indicate other thyroid problems, such as thyroiditis or toxic multinodular goiter. Other reasons for abnormal results may include: high levels of protein in the blood.

What is a T4?

The T4, also known as the Statement of Remuneration Paid, is a slip of information that reveals: How much money an employee earned during the entire year; and. How much was withheld and remitted to the Canada Revenue Agency (CRA) on the employee's behalf.

What does T4 stand for?

T4 (thyroxine) is the main hormone produced by the thyroid gland.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get Canada T4E?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific Canada T4E and other forms. Find the template you need and change it using powerful tools.

How do I edit Canada T4E online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your Canada T4E to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my Canada T4E in Gmail?

Create your eSignature using pdfFiller and then eSign your Canada T4E immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is Canada T4E?

Canada T4E is a tax form used to report Employment Insurance (EI) benefits and other types of income received from the Employment Insurance program.

Who is required to file Canada T4E?

Individuals who have received Employment Insurance benefits during the tax year are required to receive and review a T4E form from Service Canada.

How to fill out Canada T4E?

Filling out T4E involves entering the amounts received from EI in the appropriate sections of your tax return, as the information on the form will already be provided by Service Canada.

What is the purpose of Canada T4E?

The purpose of Canada T4E is to inform the Canada Revenue Agency (CRA) about the income received from Employment Insurance, ensuring that recipients report this income for tax purposes.

What information must be reported on Canada T4E?

The T4E form must report the total amount of Employment Insurance benefits received, any adjustments or overpayments, and the recipient's personal identification information.

Fill out your Canada T4E online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canada t4e is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.