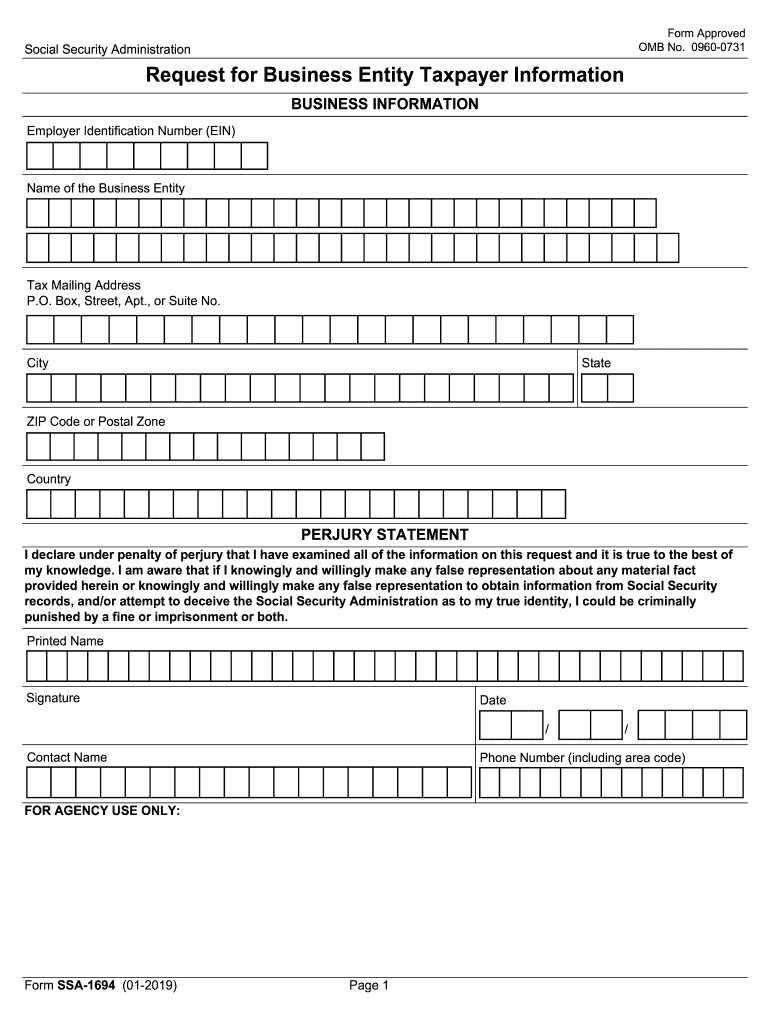

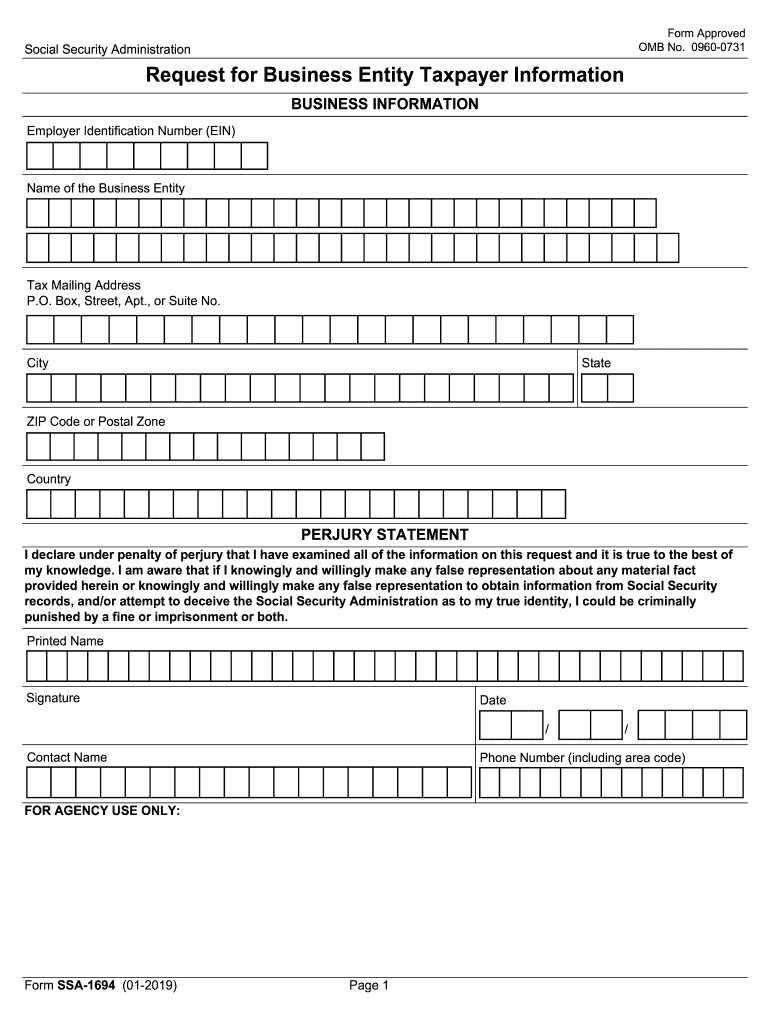

SSA-1694 2019 free printable template

Get, Create, Make and Sign irs verification

Editing irs verification online

Uncompromising security for your PDF editing and eSignature needs

SSA-1694 Form Versions

How to fill out irs verification

How to fill out SSA-1694

Who needs SSA-1694?

Instructions and Help about irs verification

Hi I'm Seth from citizens Disability Americas premier social security disability advocacy group a lot of the folks that we help are who are applying for Social Security disability insurance or SDI to get monthly benefits ask about a specific document called form 827 also known as the SSA 827 which you can see here to my left they want to know what it is what its for and what happens after they sign it, and I'll explain that as you can see here the title of SSA a 27 is authorization to disclose information to the Social Security Administration and in this section just below the title you can see that the SSA is looking for all of your medical records and other information regarding your treatment your hospitalization and outpatient care for your impairment or impairments, and then you can see it also lists some examples here of what those might be also importantly the SSA is looking to see how those impairments affect your ability to complete tasks and the activities of daily living and how they will affect your ability to work now that might seem like a lot of stuff to be asking for, and you might feel concerned giving out that kind of information you don't have to worry the Social Security Administration takes your privacy very seriously there's another really important reason to let the Social Security Administration have this information see if you're applying for monthly SDI disability benefits you're going to need to demonstrate to the Social Security Administration that you have medical conditions that will prevent you from sustaining work and to do that you'll need medical evidence this form is necessary to allow the SSA to ask for and to review the medical evidence that you're going to present to make your case now when you sign this form you are in effect telling your medical providers like your doctors and nurse practitioners for instance that it's okay for them to share your medical records with Social Security and as you can see on the form the purpose here is determining my eligibility for benefits providing this authorization to the SSA is a normal part of the SDI application process now if you're working with us here at citizens disability on your claim what you'll need to do is sign the form 827 and then return it to us, we will take the form along with all the other forms send it in to the SSA with your signature and they in turn will take that form and include it with request for records when they ask your various medical providers your medical providers will see that they're allowed to provide the records and then the SSA will have the medical evidence they need to help them make a decision about whether you qualify for Social Security disability benefits so if you are considering applying for SDI benefits you should be aware that this is just one of many forms that you'll need to fill out the process the application process can feel confusing or daunting and a little frustrating, but that's what citizens disability is here to...

People Also Ask about

What is a SSA-1696 U4?

What is a SSA 1699 form?

What is a SSA-1699 form?

Who fills out the SSA-1696 form?

What is form SSA 1694 used for?

What is form SSA-1696 used for?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute irs verification online?

Can I sign the irs verification electronically in Chrome?

Can I edit irs verification on an Android device?

What is SSA-1694?

Who is required to file SSA-1694?

How to fill out SSA-1694?

What is the purpose of SSA-1694?

What information must be reported on SSA-1694?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.