Get the free Federal tax credits to provide 650 affordable homes in metro...

Show details

John Wall and Associates Market AnalysisEdgewood Center II Family (Formerly homeless persons) Tax Credit (Sec. 42) Apartments Atlanta, Georgia Fulton CountyPrepared For: Affordable Housing Solutions,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign federal tax credits to

Edit your federal tax credits to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal tax credits to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing federal tax credits to online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit federal tax credits to. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out federal tax credits to

How to fill out federal tax credits to

01

To fill out federal tax credits, follow these steps:

02

Gather all the necessary documents and information, including your W-2 forms, 1099 forms, and any other relevant tax documents.

03

Start by filling out the basic information, such as your name, address, and Social Security number, on the appropriate sections of the tax form.

04

Move on to the sections related to federal tax credits. These sections may vary depending on the specific tax form you are using, but typically include credits for child and dependent care expenses, education expenses, energy-efficient home improvements, and more.

05

Read the instructions carefully for each credit to understand the eligibility requirements, limitations, and documentation needed.

06

Provide the required information and documentation for each credit you are eligible for. This may include expenses incurred, receipts, or proof of qualification.

07

Calculate the amount of credit you are eligible for based on the provided instructions. Ensure that you accurately enter the calculated amounts on the appropriate lines of the tax form.

08

Double-check all the information you have entered to minimize errors. Make sure you have included all the necessary attachments and supporting documents.

09

Sign and date the completed tax form, and file it by the deadline. Make copies of the filled-out form and supporting documents for your records.

10

If you are unsure or need assistance, consider consulting a tax professional or utilizing tax preparation software to ensure accuracy and maximize your credits.

11

Remember to keep copies of your tax forms and supporting documents for future reference or in case of an audit.

Who needs federal tax credits to?

01

Federal tax credits are available to anyone who meets the eligibility criteria and qualifies for different credits. Some common groups of people who may benefit from federal tax credits include:

02

- Working individuals and families with children who are eligible for child and dependent care credits.

03

- Students or parents paying education-related expenses who may qualify for education credits.

04

- Homeowners who have made energy-saving improvements to their homes and are eligible for energy tax credits.

05

- Individuals or businesses involved in renewable energy production or investments who may qualify for alternative energy credits.

06

It is important to review the specific requirements for each credit to determine if you are eligible and can benefit from filing for federal tax credits.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send federal tax credits to to be eSigned by others?

When your federal tax credits to is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I execute federal tax credits to online?

Filling out and eSigning federal tax credits to is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

Can I create an electronic signature for the federal tax credits to in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

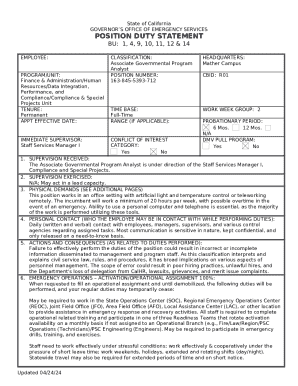

What is federal tax credits to?

Federal tax credits are incentives provided by the government to encourage certain behaviors or investments, such as using renewable energy sources or hiring disadvantaged workers.

Who is required to file federal tax credits to?

Individuals or businesses who have participated in activities that qualify for federal tax credits are required to file them.

How to fill out federal tax credits to?

Federal tax credits can be filled out by following the instructions provided by the IRS and using the appropriate forms.

What is the purpose of federal tax credits to?

The purpose of federal tax credits is to incentivize certain behaviors or investments that benefit the economy, society, or environment.

What information must be reported on federal tax credits to?

Information such as the specific activity or investment that qualifies for the credit, the amount of credit claimed, and any supporting documentation may need to be reported.

Fill out your federal tax credits to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Tax Credits To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.