AU C113 2018 free printable template

Show details

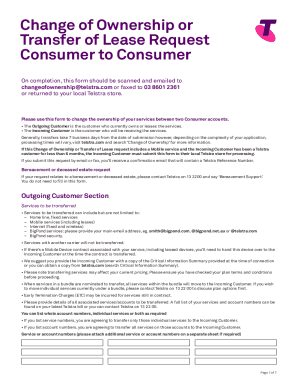

Change of Ownership or Transfer of Lease Request Consumer to Consumer On completion, this form should be scanned and emailed to changeofownership telstra.com or faxed to 03 8601 2361 or returned to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign AU C113

Edit your AU C113 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU C113 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AU C113 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit AU C113. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU C113 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU C113

How to fill out AU C113

01

Gather all necessary documents related to your business affairs.

02

Begin filling out the AU C113 form with your personal information.

03

Provide details about your business, including the nature of the business and its registration number.

04

Outline the reason for filling out the form and the specific tax obligations you are addressing.

05

Double-check all entries for accuracy and completeness.

06

Sign and date the form at the bottom.

07

Submit the completed AU C113 through the designated channel, whether online or by mail.

Who needs AU C113?

01

Individuals or entities that need to address their tax obligations with the Australian Taxation Office.

02

Business owners seeking to register for an Australian Business Number (ABN).

03

Tax agents or accountants assisting clients with their tax filing requirements.

Fill

form

: Try Risk Free

People Also Ask about

Can you transfer ownership of a SIM card?

You have to visit authorised local operator store. Then you have to submit few documents for address and photo proof. Proof of Address and Proof of Identity is required from both customer (Existing and new customer). No Objection Certificate from existing customer.

How do I change my name with Telstra?

Telstra account holders will need to log into their account and upload proof of their name change. Choose to provide either a document from Births, Deaths and Marriages (eg: marriage, amended birth or legal name change certificate). You may instead upload 2 forms of photo ID showing both old and new names.

Can you transfer a Telstra account to someone else?

Yes, you can transfer ownership of mobiles, landlines, internet services or your Telstra account to another individual or business. For more information and forms for this process, visit our page on transferring ownership of your account.

Can you transfer a phone plan to another person?

You can give your mobile phone, phone number and contract to another person or a company that will continue to use the service and accept legal responsibility for paying the bills. We call this changing ownership of your phone.

How do I remove a phone from My Telstra account?

Go to Services and find your service. Select Manage internet or select Manage home phone. Under your plan name, select Change or cancel.

How do I transfer My Telstra number to someone else?

If the new owner is, or is eligible to be, a Priority Assistance customer and the service is on an Upfront plan, call us on 13 22 00 to discuss your options.

How do I transfer ownership of a Telstra phone?

If the new owner is, or is eligible to be, a Priority Assistance customer and the service is on an Upfront plan, call us on 13 22 00 to discuss your options.

Can I add someone to My Telstra plan?

It's better when you bundle - now you can add family to your plan - Telstra Exchange.

How do I add authority to My Telstra account?

How do I add a full or limited authority contact in the My Telstra app and Web? Open the My Telstra app and select Profile on the top of the screen. Select Security settings, then Account contacts. Scroll down and select Add authorised contact. Choose either Limited authority or Full authority and select Add.

Can I transfer phone contract to another person?

You can give your mobile phone, phone number and contract to another person or a company that will continue to use the service and accept legal responsibility for paying the bills. We call this changing ownership of your phone.

How do I change phone owner?

Switch users on Android Go From the Home screen, tap Switch user . Tap a different user. That user can now sign in.

Can I add another mobile number to My Telstra account?

Yes, you can change your Telstra mobile number by contacting us. We'll provide you with a list of new numbers to choose from.

How can I transfer a number to my name?

Transfer your company paid number to your name Self-attested copy of Identity proof & Address proof. 1 passport sized photograph. No Objection Certificate on company letterhead signed by company's authorized signatory. To download form, click here.

Can you transfer a Telstra plan to someone else?

Yes, you can transfer ownership of mobiles, landlines, internet services or your Telstra account to another individual or business. For more information and forms for this process, visit our page on transferring ownership of your account.

How do I transfer ownership of a phone number?

Fill out the paperwork Complete any necessary forms with the appropriate details and lodge them with your provider. You will be notified once the ownership transfer is complete. Good to know: The process will work the same if you want to transfer your number to someone else. Just ask them to initiate the process.

How can I change owner of phone?

If you're a user who isn't the device owner Open the device's Settings app. Tap System. Multiple users. If you can't find this setting, try searching your Settings app for users . Tap More . Tap Delete [username] from this device. Important: You can't undo this. The device will switch to the owner's profile.

Can phone number be transferred to another person?

You must have permission from the legal owner to port the number to your name. Porting a number that does not belong to you is illegal.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete AU C113 online?

Filling out and eSigning AU C113 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit AU C113 online?

The editing procedure is simple with pdfFiller. Open your AU C113 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I edit AU C113 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute AU C113 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is AU C113?

AU C113 is a form used by organizations to report their compensation and benefits information to the Australian Taxation Office (ATO).

Who is required to file AU C113?

Employers and organizations that provide reportable fringe benefits and are subject to the Fringe Benefits Tax (FBT) obligations are required to file AU C113.

How to fill out AU C113?

To fill out AU C113, organizations must gather necessary financial information related to employee fringe benefits and accurately complete each section of the form according to the ATO guidelines.

What is the purpose of AU C113?

The purpose of AU C113 is to ensure transparency and compliance in reporting employee benefits, allowing the ATO to assess tax liabilities and monitor compliance with the tax laws.

What information must be reported on AU C113?

The information that must be reported on AU C113 includes the total value of fringe benefits provided, details of the employees who received them, and any relevant tax liabilities associated with these benefits.

Fill out your AU C113 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU c113 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.