Get the free Nonprofit Corporation - Ohio Secretary of State

Show details

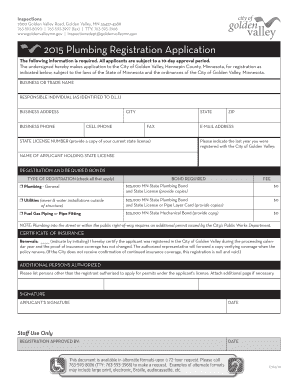

Toll Free: (877) HOSTILE (8777673453) Central Ohio: (614) 4663910 www.OhioSecretaryofState.gov Busier OhioSecretaryofState.gov File online or for more information: www.OHBusinessCentral.comFiling

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nonprofit corporation - ohio

Edit your nonprofit corporation - ohio form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nonprofit corporation - ohio form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nonprofit corporation - ohio online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit nonprofit corporation - ohio. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nonprofit corporation - ohio

How to fill out nonprofit corporation - ohio

01

To fill out a nonprofit corporation in Ohio, follow these steps:

02

Choose a name for your nonprofit corporation. Make sure the name is unique and does not conflict with any existing organizations.

03

File Articles of Incorporation with the Ohio Secretary of State. This document includes basic information about your organization, such as its name, purpose, registered agent, and initial board of directors.

04

Create bylaws for your nonprofit corporation. Bylaws outline the internal rules and procedures of your organization.

05

Hold an organizational meeting with your initial board of directors to approve the bylaws, elect officers, and handle any other necessary business.

06

Obtain an Employee Identification Number (EIN) from the Internal Revenue Service (IRS). This is necessary for tax purposes and allows your nonprofit corporation to open bank accounts and apply for grants.

07

Apply for tax-exempt status with the IRS. This involves completing Form 1023 or Form 1023-EZ, depending on the size and activities of your organization.

08

Register with the Ohio Attorney General's Office to solicit donations. This is required if your nonprofit corporation plans to fundraise.

09

Comply with ongoing filing and reporting requirements, such as filing annual reports with the Ohio Secretary of State and maintaining accurate financial records.

10

Consider seeking legal and accounting advice to ensure compliance with all applicable laws and regulations.

11

Continuously fulfill the mission and purpose of your nonprofit corporation to make a positive impact in your community.

Who needs nonprofit corporation - ohio?

01

Nonprofit corporations in Ohio are typically needed by individuals, groups, or organizations who:

02

- Want to provide charitable, educational, religious, scientific, or other beneficial services to the community.

03

- Wish to have limited liability protection for their members or directors.

04

- Intend to seek grants or donations to support their activities.

05

- Aim to be recognized as tax-exempt by the IRS for federal income tax purposes.

06

- Desire to have a formal legal structure to govern their operations and decision-making processes.

07

- Seek to engage in fundraising activities.

08

- Wish to create a separate legal entity that can own property, enter into contracts, and sue or be sued in its own name.

09

By forming a nonprofit corporation in Ohio, these individuals or organizations can enjoy the benefits and legal protections that come with this structure while pursuing their charitable or beneficial objectives.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send nonprofit corporation - ohio for eSignature?

nonprofit corporation - ohio is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I edit nonprofit corporation - ohio on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share nonprofit corporation - ohio on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I complete nonprofit corporation - ohio on an Android device?

Use the pdfFiller mobile app to complete your nonprofit corporation - ohio on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is nonprofit corporation - ohio?

Nonprofit corporation in Ohio is a legal entity incorporated for purposes other than generating a profit. It is organized to benefit the public or specific groups rather than to make money.

Who is required to file nonprofit corporation - ohio?

Nonprofit corporations in Ohio are required to file with the Secretary of State's office.

How to fill out nonprofit corporation - ohio?

To fill out nonprofit corporation in Ohio, one must submit the necessary forms and information to the Secretary of State's office and pay the required fees.

What is the purpose of nonprofit corporation - ohio?

The purpose of nonprofit corporation in Ohio is to provide benefit to the public or specific groups as outlined in its mission statement.

What information must be reported on nonprofit corporation - ohio?

Nonprofit corporations in Ohio must report their financial activities, board members, organizational structure, and mission statement.

Fill out your nonprofit corporation - ohio online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nonprofit Corporation - Ohio is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.