MI GR-1040NR 2018 free printable template

Show details

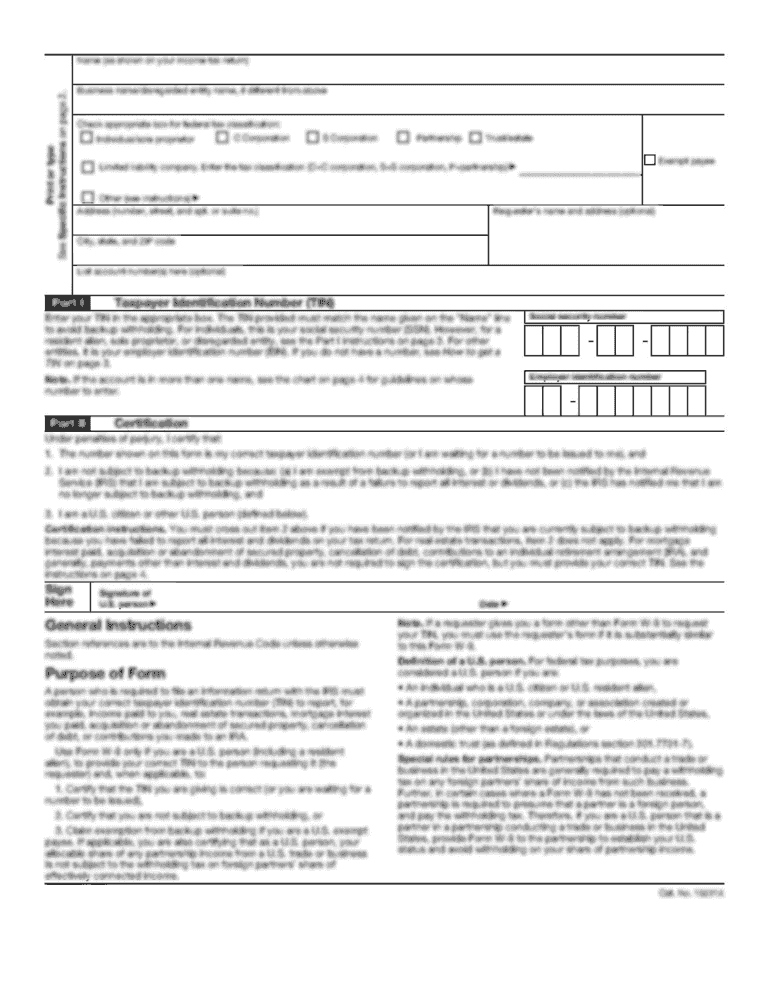

CITY OF GRAND RAPIDS INCOME TAX GR-1040 NR 2002 NR INDIVIDUAL RETURN - NONRESIDENT - DUE April 30 2003 Initial Last name Your social security number Spouse s soc sec number PLEASE TYPE OR PRINT Your first name If joint return spouse s first name Initial Last name Spouse s occupation If married is spouse filing a separate return Present home address Number and street including apartment number Enter name and address used on 2001 return. If same as...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI GR-1040NR

Edit your MI GR-1040NR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI GR-1040NR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MI GR-1040NR online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MI GR-1040NR. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI GR-1040NR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI GR-1040NR

How to fill out MI GR-1040NR

01

Gather all necessary documents, including W-2s and 1099s.

02

Download the MI GR-1040NR form from the Michigan Department of Treasury website.

03

Fill in your personal information, including your name, address, and Social Security number.

04

Report your total income earned during the year on the designated lines.

05

Calculate your Michigan taxable income by following the instructions provided in the form.

06

Claim any applicable deductions or credits to reduce your taxable income.

07

Review your completed form for accuracy and completeness.

08

Sign and date the form at the bottom.

09

Mail the completed MI GR-1040NR form to the appropriate address as listed in the instructions.

Who needs MI GR-1040NR?

01

Non-residents of Michigan who earned income in the state.

02

Individuals who are required to file a Michigan tax return despite not being residents.

03

Those who have income from Michigan sources but live in another state.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a Grand Rapids tax return?

You will need to file if you lived in the city during any part of the tax year and had taxable income. If you did not live in the city, but earned taxable income from within city limits you will also need to file.

Does Grand Rapids have a city income tax?

For 2021 the following Michigan cities levy an income tax of 1% on residents and 0.5% on nonresidents.What cities impose an income tax? CityResidentsNonresidentsGrand Rapids1.5%0.75%Highland Park2%1%Saginaw1.5%0.75%1 more row

What is a MI-1040 form?

2022 Michigan Individual Income Tax Return MI-1040.

How to order Michigan income tax forms?

If you are trying to locate, download, or print state of Michigan tax forms, you can do so on the Michigan Department of Treasury website.

Where can I get a Michigan income tax form?

In addition, current year commonly used forms will continue to be available at Michigan Department of Treasury offices, most public libraries, Northern Michigan post offices, and Michigan Department of Health and Human Services (MDHHS) county offices.

Can you file Grand Rapids city taxes online?

Make your payment The City allows you to pay your income tax online.

Where can I get paper IRS tax forms?

These forms and publications are available on the Internet, on CD-ROM, through fax on demand, over the telephone, through the mail, at local IRS offices, at some banks, post offices, and libraries, and even at some grocery stores, copy centers and office supply stores.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the MI GR-1040NR in Gmail?

Create your eSignature using pdfFiller and then eSign your MI GR-1040NR immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I edit MI GR-1040NR on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing MI GR-1040NR.

How can I fill out MI GR-1040NR on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your MI GR-1040NR. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

What is MI GR-1040NR?

MI GR-1040NR is a Michigan tax form used by non-resident individuals to report income earned in Michigan and to calculate personal income tax obligations.

Who is required to file MI GR-1040NR?

Non-resident individuals who have income sourced from Michigan, such as wages, business income, or rental income, are required to file MI GR-1040NR.

How to fill out MI GR-1040NR?

To fill out MI GR-1040NR, individuals need to provide personal information, report MI-sourced income, claim relevant deductions or credits, and calculate tax owed based on the instructions provided with the form.

What is the purpose of MI GR-1040NR?

The purpose of MI GR-1040NR is to ensure that non-residents accurately report their taxable income generated from Michigan and pay the appropriate state taxes.

What information must be reported on MI GR-1040NR?

Individuals must report their total income from Michigan sources, any deductions or credits relevant to their situation, and the calculated tax liability on MI GR-1040NR.

Fill out your MI GR-1040NR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI GR-1040nr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.