Get the free Arizona lost $83M after firing tax collectors. Ducey wants to ...

Show details

Dental Tax and FinanceHelping Dentists Make Smart Decisions about MoneyDeadlines & Misc. Second Quarter Estimated Tax Payments are due by Friday, June 15, 2018. See Page 2.DEADLINES July 31 is the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign arizona lost 83m after

Edit your arizona lost 83m after form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your arizona lost 83m after form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing arizona lost 83m after online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit arizona lost 83m after. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out arizona lost 83m after

How to fill out arizona lost 83m after

01

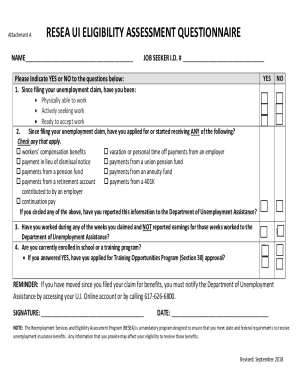

Start by gathering all the necessary information and documents related to the Arizona lost 83m case.

02

Inspect and review the case thoroughly to understand the specific details and circumstances involved.

03

Ensure you have access to accurate financial records, legal documents, and any other relevant evidence that may aid in filling out the report.

04

Begin by creating a comprehensive report template or using an existing standardized form provided by the relevant authorities.

05

Carefully fill out all the required fields in the report, providing clear and concise information.

06

Include a detailed description of the incident, including the nature of the loss, how it occurred, and any potential contributing factors.

07

Provide a timeline of events leading up to the loss, if applicable.

08

If there were any witnesses or individuals involved, ensure their names and contact information are accurately recorded.

09

Attach any supporting documentation and evidence, such as receipts, invoices, or photographs, that help substantiate the reported loss.

10

Review the completed report for any errors or inconsistencies and make necessary revisions before submitting it.

11

Submit the filled-out Arizona lost 83m report to the appropriate authorities as instructed or required.

12

Keep a copy of the report and any accompanying documents for your records.

Who needs arizona lost 83m after?

01

The individuals or organizations that need information about the Arizona lost 83m after are:

02

Law enforcement agencies or investigative bodies looking into the case.

03

Legal professionals involved in handling the legal aspects of the case.

04

Insurance companies or adjusters who may be assessing claims related to the loss.

05

Auditors or regulatory agencies responsible for financial oversight.

06

Any parties involved in potential civil or criminal legal proceedings related to the loss.

07

Government agencies or departments overseeing financial matters.

08

Researchers or analysts studying similar cases or financial fraud.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send arizona lost 83m after for eSignature?

Once you are ready to share your arizona lost 83m after, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit arizona lost 83m after in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing arizona lost 83m after and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I create an electronic signature for the arizona lost 83m after in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your arizona lost 83m after.

What is arizona lost 83m after?

Arizona lost 83m after failing to collect enough revenue from taxes.

Who is required to file arizona lost 83m after?

All taxpayers in Arizona are required to file arizona lost 83m after.

How to fill out arizona lost 83m after?

To fill out arizona lost 83m after, taxpayers need to provide detailed information about their income, expenses, and deductions.

What is the purpose of arizona lost 83m after?

The purpose of arizona lost 83m after is to ensure that taxpayers are accurately reporting their financial information and paying the correct amount of taxes.

What information must be reported on arizona lost 83m after?

Taxpayers must report their income, expenses, deductions, credits, and any other relevant financial information on arizona lost 83m after.

Fill out your arizona lost 83m after online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Arizona Lost 83m After is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.