Get the free MONITORING POLICY OF INSOLVENCY PROFESSIONAL AGENCY OF ...

Show details

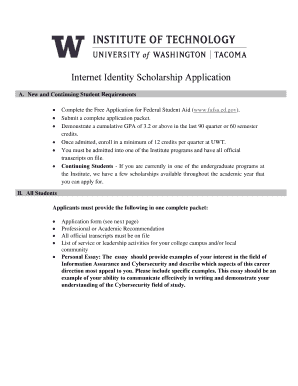

MONITORING POLICY

OF

INSOLVENCY PROFESSIONAL AGENCY

OF

INSTITUTE OF COST ACCOUNTANTS OF INDIA

(Pursuant to sub clause 15 of Clause VIII of Schedule of Insolvency and

Bankruptcy Board of India (Model

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign monitoring policy of insolvency

Edit your monitoring policy of insolvency form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your monitoring policy of insolvency form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing monitoring policy of insolvency online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit monitoring policy of insolvency. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out monitoring policy of insolvency

How to fill out monitoring policy of insolvency

01

To fill out a monitoring policy of insolvency, follow these steps:

02

Understand the purpose of the policy: The monitoring policy of insolvency is meant to outline the procedures and guidelines for monitoring and assessing the financial stability and solvency of a company.

03

Identify the key indicators: Determine the specific financial and operational indicators that will be monitored to assess the company's insolvency risk. These may include cash flow, debt-to-equity ratio, profitability, and liquidity ratios.

04

Establish monitoring procedures: Define the frequency and methods for monitoring the selected indicators. This may involve regular financial statement analysis, trend analysis, and benchmarking against industry standards.

05

Define thresholds and triggers: Set up specific thresholds or triggers that will indicate potential insolvency risks. For example, a certain level of increase in debt-to-equity ratio or a consistent negative cash flow over a certain period.

06

Assign responsibilities: Determine who will be responsible for monitoring the indicators and taking appropriate actions if insolvency risks are detected. This may involve the finance department, risk management team, or designated individuals.

07

Implement the policy: Communicate the monitoring policy to relevant stakeholders and ensure its proper implementation. Train the employees involved in monitoring and provide them with the necessary tools and resources.

08

Review and update: Regularly review the effectiveness of the monitoring policy and make updates as necessary. Adapt the policy to changes in the company's financial status, industry norms, or regulatory requirements.

Who needs monitoring policy of insolvency?

01

The monitoring policy of insolvency is essential for various stakeholders, including:

02

- Companies: Any company, regardless of size or industry, can benefit from having a monitoring policy of insolvency. It helps identify potential financial risks and enables proactive measures to mitigate such risks.

03

- Investors: Investors, both individual and institutional, rely on the monitoring policy of insolvency to assess the financial health of companies they plan to invest in. It helps them make informed decisions and manage their investment portfolios effectively.

04

- Creditors: Creditors, such as banks and financial institutions, need to monitor the solvency of their borrowers to assess the creditworthiness and potential repayment risks. The monitoring policy of insolvency provides a framework for such assessments.

05

- Regulators: Regulatory bodies responsible for overseeing the financial industry or specific sectors may require companies to have a monitoring policy of insolvency in place. It helps ensure compliance with regulations and promotes financial stability.

06

- Auditors and consultants: Professionals providing financial audit and consulting services rely on the monitoring policy of insolvency to assess the financial risks and stability of their clients. It guides their analysis and recommendations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my monitoring policy of insolvency in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your monitoring policy of insolvency directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I complete monitoring policy of insolvency on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your monitoring policy of insolvency, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

How do I fill out monitoring policy of insolvency on an Android device?

Complete monitoring policy of insolvency and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is monitoring policy of insolvency?

Monitoring policy of insolvency is a document outlining the procedures and guidelines for monitoring the financial stability of a company to prevent insolvency.

Who is required to file monitoring policy of insolvency?

Companies that are at risk of insolvency or have previously gone through insolvency proceedings are required to file monitoring policy of insolvency.

How to fill out monitoring policy of insolvency?

Monitoring policy of insolvency can be filled out by providing detailed information about the company's financial situation, risk factors, monitoring procedures, and steps to be taken in case of insolvency.

What is the purpose of monitoring policy of insolvency?

The purpose of monitoring policy of insolvency is to proactively manage financial risks and prevent insolvency by implementing monitoring procedures and taking timely actions.

What information must be reported on monitoring policy of insolvency?

Monitoring policy of insolvency must include information about the company's financial statements, cash flow projections, risk assessment, monitoring tools, and insolvency contingency plans.

Fill out your monitoring policy of insolvency online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Monitoring Policy Of Insolvency is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.