Get the free US Bank OVERDRAFT FEES EXORBITANT Internet - Ripoff Report

Show details

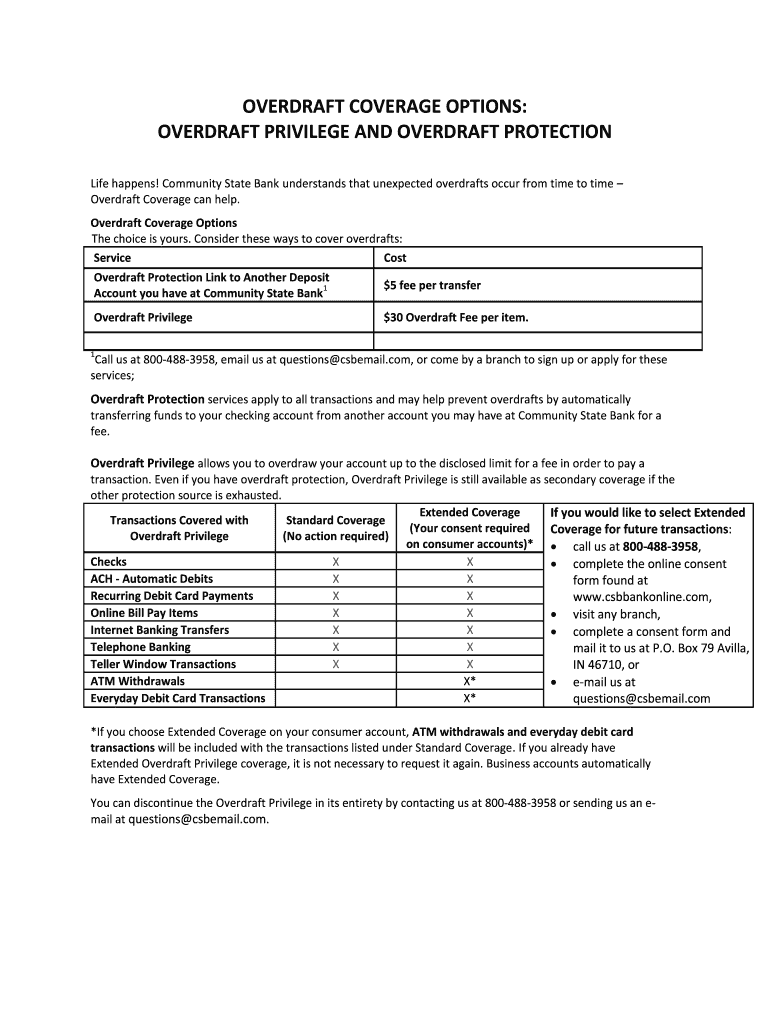

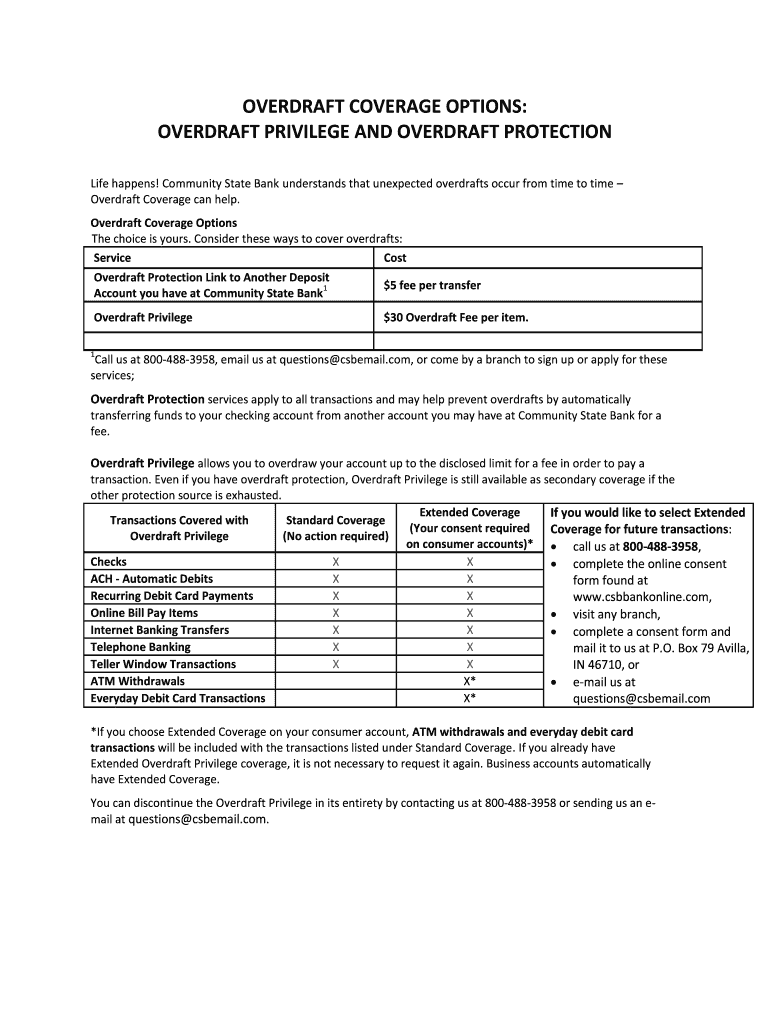

OVERDRAFT COVERAGE OPTIONS: OVERDRAFT PRIVILEGE AND OVERDRAFT PROTECTION Life happens! Community State Bank understands that unexpected overdrafts occur from time to time Overdraft Coverage can help.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign us bank overdraft fees

Edit your us bank overdraft fees form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your us bank overdraft fees form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing us bank overdraft fees online

Follow the steps down below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit us bank overdraft fees. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out us bank overdraft fees

How to fill out us bank overdraft fees

01

To fill out US bank overdraft fees, follow these steps:

02

Gather all necessary documents and information, including your bank account details and recent transactions.

03

Review your bank's terms and conditions regarding overdraft fees to ensure you understand the process and associated costs.

04

Log in to your US bank account online or visit a local branch in person.

05

Access your account summary or transaction history to identify any instances of overdraft.

06

Make note of the specific fees charged for each overdraft occurrence.

07

Calculate the total overdraft fees by summing up the charges.

08

If you have any questions or concerns about the fees, contact your bank's customer service for clarification.

09

Pay the overdraft fees promptly to avoid any further penalties or consequences.

10

Monitor your account closely to prevent future instances of overdraft and minimize fees.

11

Consider implementing budgeting strategies and opting for overdraft protection to prevent costly fees in the future.

Who needs us bank overdraft fees?

01

There are various circumstances where individuals may need US bank overdraft fees:

02

- People who frequently struggle to maintain a positive balance in their bank accounts may need overdraft fees to cover temporary shortfalls.

03

- Those who rely on regular payments or direct deposits, which may sometimes be delayed or interrupted, may find overdraft fees helpful to bridge the gaps in their cash flow.

04

- Individuals who prefer not to have their transactions declined or returned due to insufficient funds can benefit from having access to overdraft fees, ensuring important payments go through.

05

- Business owners or self-employed individuals may need overdraft fees to manage cash flow fluctuations, especially during periods of uneven income or unexpected expenses.

06

- Anyone who wants a safety net to handle unforeseen expenses or emergencies without facing declined transactions can opt for US bank overdraft fees.

07

It's important to note that while overdraft fees can be helpful in specific situations, they can also become costly if not managed responsibly. Therefore, individuals should carefully consider their needs and financial circumstances before opting for overdraft fees.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify us bank overdraft fees without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including us bank overdraft fees. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send us bank overdraft fees for eSignature?

When you're ready to share your us bank overdraft fees, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I create an electronic signature for the us bank overdraft fees in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is us bank overdraft fees?

Us bank overdraft fees are charges imposed when a customer withdraws more money than is available in their account.

Who is required to file us bank overdraft fees?

Customers who overdraw their accounts and incur fees are required to file us bank overdraft fees.

How to fill out us bank overdraft fees?

Us bank overdraft fees can be filled out by following the instructions provided by the bank, typically online or in person.

What is the purpose of us bank overdraft fees?

The purpose of us bank overdraft fees is to discourage customers from overdrawing their accounts and to cover the cost of processing the overdraft.

What information must be reported on us bank overdraft fees?

Information such as the date of the overdraft, the amount overdrawn, and any additional fees charged must be reported on us bank overdraft fees.

Fill out your us bank overdraft fees online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Us Bank Overdraft Fees is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.