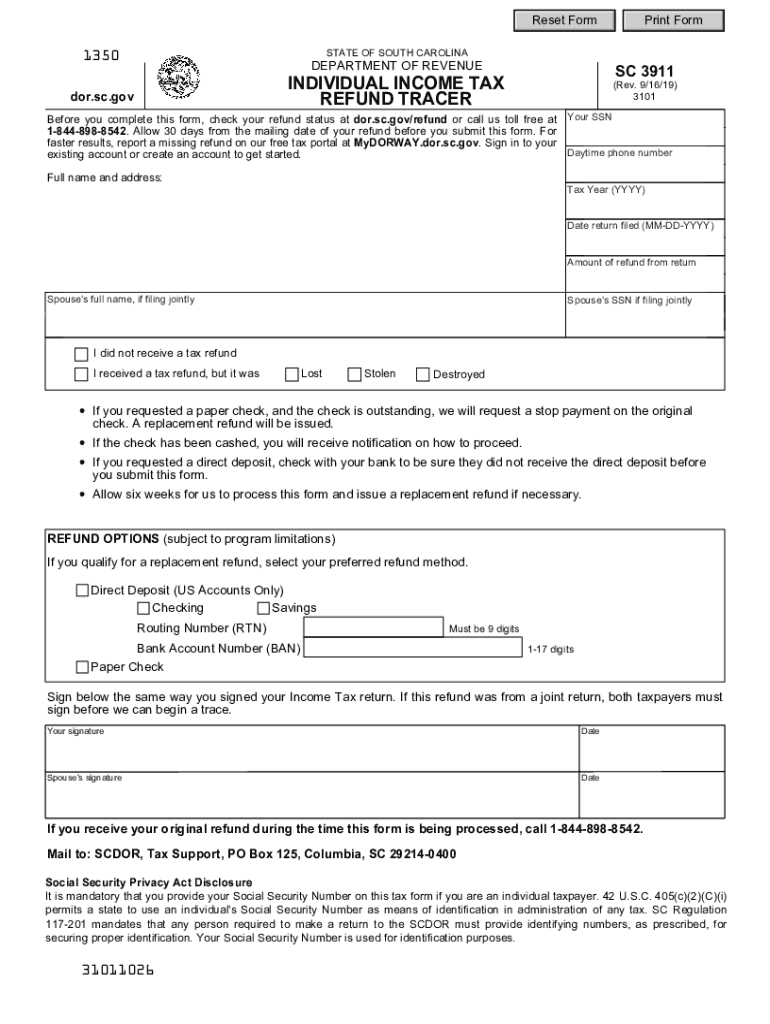

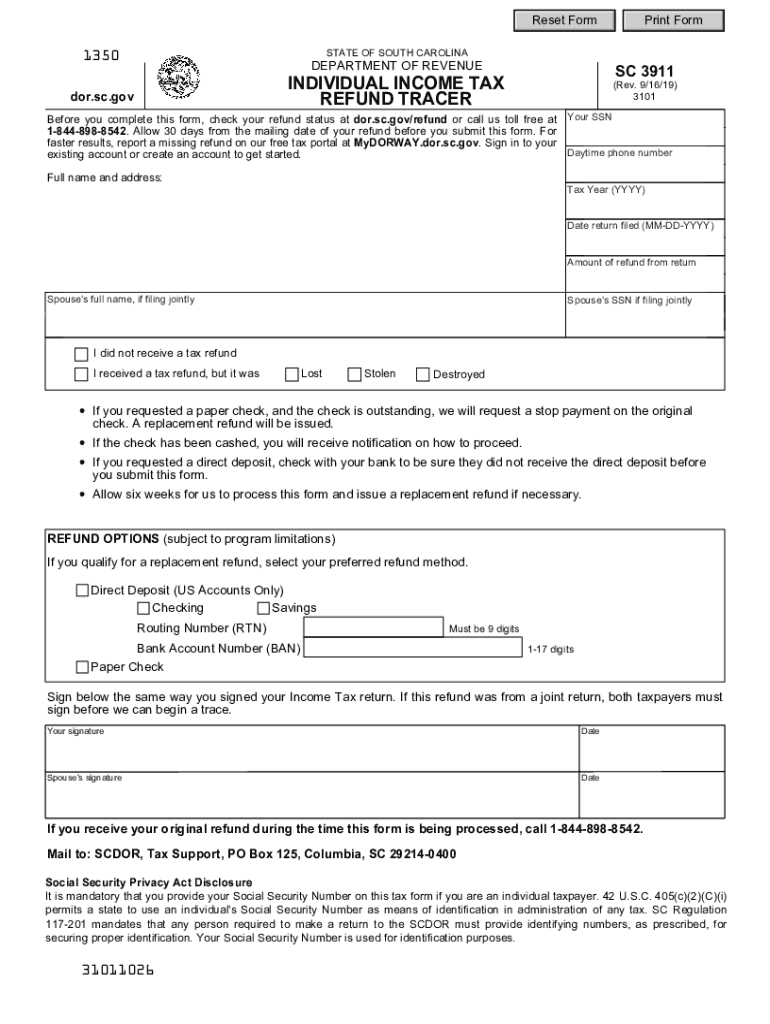

SC SC 3911 2019 free printable template

Show details

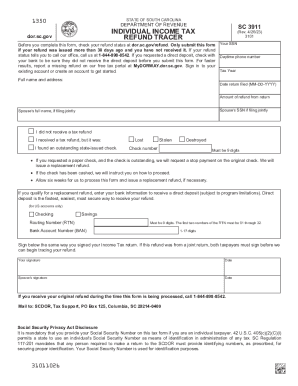

Reset Footprint Formulate OF SOUTH CAROLINA1350DEPARTMENT OF REVENUEINDIVIDUAL INCOME TAX

REFUND Traced.SC.gov SC 3911(Rev. 2/11/19)

3101Before you complete this form, check your refund status at

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign SC SC 3911

Edit your SC SC 3911 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your SC SC 3911 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing SC SC 3911 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit SC SC 3911. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

SC SC 3911 Form Versions

Version

Form Popularity

Fillable & printabley

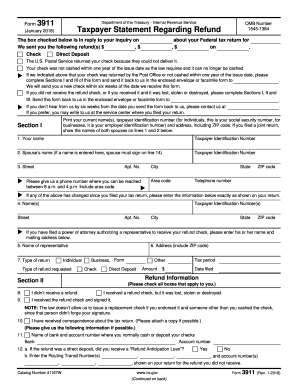

How to fill out SC SC 3911

How to fill out SC SC 3911

01

Obtain the SC SC 3911 form from the relevant website or office.

02

Read the instructions carefully before beginning to fill out the form.

03

Provide your personal information, including your name, address, and Social Security number.

04

Indicate the reason for filling out the form, such as a specific request or inquiry.

05

Fill in any additional required details based on the instructions.

06

Double-check all the information for accuracy and completeness.

07

Sign and date the form at the bottom.

08

Submit the completed form to the appropriate agency as instructed.

Who needs SC SC 3911?

01

Individuals seeking to request information or clarification regarding a specific issue related to their Social Security benefits.

02

People who need to dispute a decision made by the Social Security Administration.

03

Claimants who want to verify their eligibility for benefits or receive assistance.

Fill

form

: Try Risk Free

People Also Ask about

Is the $800 South Carolina rebate taxable?

The good news is South Carolina's rebate checks are not being taxed by the state, so your state filing is in the clear.

What is a sc8453 form?

About Form 8453, U.S. Individual Income Tax Transmittal for an IRS e-file Return | Internal Revenue Service.

What is the SC surplus refund for 2023?

As outlined in the legislation approving the rebates, the SCDOR set the rebate cap – the maximum amount taxpayers can receive – at $800. Rebates issued in March 2023 will also be capped at $800. Tax liability is what's left after subtracting your credits from the Individual Income Tax that you owe.

What is the $800 refund in SC?

Rebates are based on your 2021 tax liability, up to a cap. The rebate cap – the maximum rebate amount a taxpayer can receive – is $800. If your tax liability is less than $800, your rebate will be the same amount as your tax liability. If your tax liability is over the $800 cap, you will receive a rebate for $800.

What is the SC form 2210 for 2021?

Use this form to determine if you paid enough Income Tax during the year. If you did not pay enough, you may owe a penalty based on the amount of your underpayment. You may be charged a penalty if: you did not pay enough Estimated Tax.

What is form SC1040?

If you file as a full-year resident, file the SC1040. Report all your income as though you were a resident for the entire year. You will be allowed a credit for taxes paid on income taxed by South Carolina and another state. Complete the SC1040TC and attach a copy of the other state's Income Tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit SC SC 3911 from Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your SC SC 3911 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

Can I create an eSignature for the SC SC 3911 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your SC SC 3911 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I fill out SC SC 3911 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your SC SC 3911. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is SC SC 3911?

SC SC 3911 is a specific tax form used for reporting certain financial information to the South Carolina Department of Revenue.

Who is required to file SC SC 3911?

Individuals and entities that have received certain types of income or performed specific financial transactions as defined by South Carolina tax regulations are required to file SC SC 3911.

How to fill out SC SC 3911?

To fill out SC SC 3911, the filer should gather all necessary financial documentation, follow the form's instructions step-by-step, and provide accurate financial data as requested.

What is the purpose of SC SC 3911?

The purpose of SC SC 3911 is to ensure compliance with state tax laws by reporting income and transactions that may be subject to taxation.

What information must be reported on SC SC 3911?

The SC SC 3911 must report details such as the nature of the income, amounts received, applicable dates, and any other required identification information pertaining to the taxpayer.

Fill out your SC SC 3911 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

SC SC 3911 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.