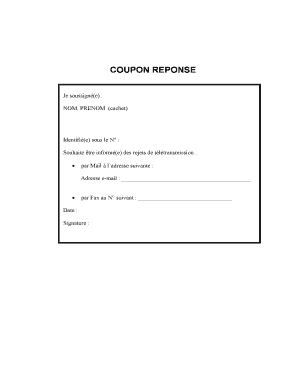

Get the free Employer request for refund

Show details

Employer request for refund

or adjustment of contribution

Use this form to request a refund or reclassification of a super payment you've made

to an employees Mine Super account. Before you start...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employer request for refund

Edit your employer request for refund form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employer request for refund form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employer request for refund online

Follow the guidelines below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit employer request for refund. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employer request for refund

How to fill out employer request for refund

01

Start by gathering all relevant documents, including any receipts, invoices, or proof of payment related to the refund you are requesting.

02

Identify the specific refund policy or procedure provided by the employer. This information should be outlined in the employment contract, company handbook, or any policy documents related to refunds.

03

Understand the timeline for submitting the request. Some employers may require the request to be made within a certain number of days from the date of purchase or incident.

04

Prepare a written statement explaining the reason for the refund request. Be clear and concise, providing any necessary details or supporting evidence.

05

Use a professional tone and format when drafting the request. Address it to the appropriate department or individual within the organization.

06

Attach copies of all relevant documents to support your claim. Make sure to keep the originals for your records.

07

Double-check the request for accuracy and completeness before submitting it. Ensure that all required information is included and that it meets the employer's refund request guidelines.

08

Submit the request through the designated channel specified by the employer. This could be via email, online form, or in-person submission.

09

Keep a record of the date and method used to submit the request. It may be necessary to follow up if you do not receive a response within the specified timeframe.

10

Follow any additional instructions or requirements outlined by the employer while waiting for a response. Be patient and allow sufficient time for the employer to process and evaluate the refund request.

Who needs employer request for refund?

01

Employer request for refund may be needed by employees who have made a payment or incurred expenses on behalf of the company and are eligible for reimbursement.

02

It can also be required by employees who have experienced a financial loss or have a valid reason for seeking a refund from the employer.

03

Furthermore, individuals who have overpaid for a service or product provided by the employer may also need to submit an employer request for refund.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send employer request for refund for eSignature?

When you're ready to share your employer request for refund, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

How do I complete employer request for refund online?

pdfFiller makes it easy to finish and sign employer request for refund online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit employer request for refund on an iOS device?

Create, modify, and share employer request for refund using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is employer request for refund?

Employer request for refund is a formal request made by an employer to refund overpaid taxes or contributions to a government agency.

Who is required to file employer request for refund?

Employers or their authorized representatives are required to file employer request for refund.

How to fill out employer request for refund?

Employers must fill out the employer request for refund form provided by the relevant government agency, including all required information and documentation.

What is the purpose of employer request for refund?

The purpose of employer request for refund is to reclaim any overpaid taxes or contributions that have been made to the government.

What information must be reported on employer request for refund?

Employers must report details of the overpaid taxes or contributions, amount to be refunded, and any supporting documentation required.

Fill out your employer request for refund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employer Request For Refund is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.