Get the free new tax 'totally unfair ' - Last modified

Show details

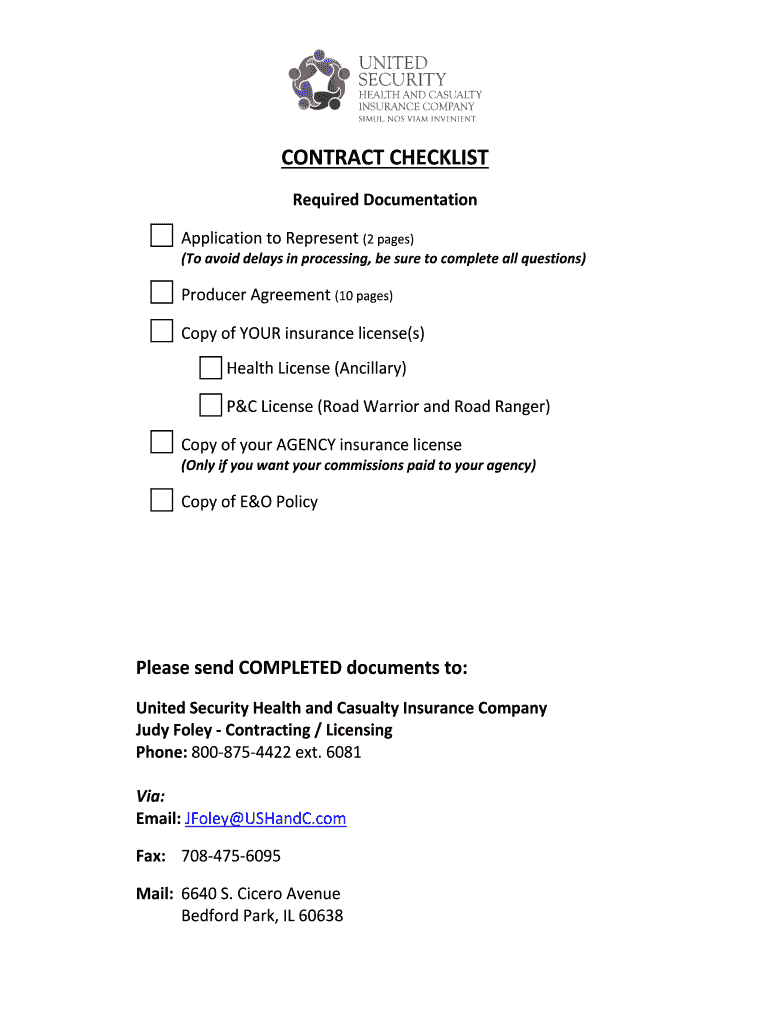

CONTRACT CHECKLIST Required Documentation Application to Represent (2 pages)(To avoid delays in processing, be sure to complete all questions)Producer Agreement (10 pages) Copy of YOUR insurance license(s)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new tax totally unfair

Edit your new tax totally unfair form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new tax totally unfair form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new tax totally unfair online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit new tax totally unfair. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new tax totally unfair

How to fill out new tax totally unfair

01

To fill out new tax forms that you believe are totally unfair, follow these steps:

02

Start by gathering all the necessary documents, such as your income statements, expense receipts, and any other relevant financial information.

03

Carefully review the instructions provided on the tax form to understand the different sections and requirements.

04

Begin filling out the form by entering your personal information, such as your name, address, and Social Security number.

05

Proceed to complete the sections related to your income. Provide accurate details about your sources of income, including wages, investments, and any other applicable earnings.

06

In the expense or deduction sections, carefully report any eligible deductions you believe you are entitled to claim. Make sure to have appropriate documentation to support these deductions.

07

Take your time to double-check all the entries and calculations before submitting the form.

08

If you have any specific concerns or objections about the fairness of the new tax regulations, consider seeking professional advice or consulting a tax attorney to explore your options.

09

Finally, submit the filled-out tax form within the designated deadline and keep copies for your records.

10

Please note that these are general guidelines, and it's important to consult with a tax professional or refer to specific instructions provided by the tax authorities in your jurisdiction for accurate guidance.

Who needs new tax totally unfair?

01

The question of who needs a new tax that is perceived as totally unfair is subjective and varies depending on individual perspectives and circumstances.

02

However, it is important to consider that new taxes are often implemented by governments to generate revenue for public services, infrastructure development, social welfare programs, or to address economic challenges.

03

Those who support the new tax may argue that it serves a greater public good or promotes socio-economic equity.

04

On the other hand, individuals or groups who oppose the new tax may feel it disproportionately affects certain demographics, negatively impacts businesses or stifles economic growth.

05

Ultimately, the answer to who needs a new tax perceived as unfair will involve a complex analysis of the specific tax policies, their intended goals, and their potential impact on different stakeholders.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit new tax totally unfair from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including new tax totally unfair, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

Where do I find new tax totally unfair?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific new tax totally unfair and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for signing my new tax totally unfair in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your new tax totally unfair and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

What is new tax totally unfair?

The new tax is considered totally unfair because it disproportionately affects lower income individuals.

Who is required to file new tax totally unfair?

All taxpayers are required to file the new tax, regardless of income level.

How to fill out new tax totally unfair?

To fill out the new tax, taxpayers must gather all necessary documents and accurately report their income and deductions.

What is the purpose of new tax totally unfair?

The purpose of the new tax is to generate revenue for the government and fund public services.

What information must be reported on new tax totally unfair?

Taxpayers must report their income, deductions, and any other relevant financial information on the new tax form.

Fill out your new tax totally unfair online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Tax Totally Unfair is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.