Get the free REGISTRATION BY PAYROLL DEDUCTION - events palmettohealthfoundation

Show details

WALK FOR LIFE REGISTRATION BY PAYROLL Deduction internal use only. Initial: Date: Saturday, Oct. 14 Spirit Communications Park, Columbia Hot Pink Hotline: 8034342898 WalkForLife PalmettoHealth. Orator

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign registration by payroll deduction

Edit your registration by payroll deduction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your registration by payroll deduction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit registration by payroll deduction online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit registration by payroll deduction. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out registration by payroll deduction

How to fill out registration by payroll deduction

01

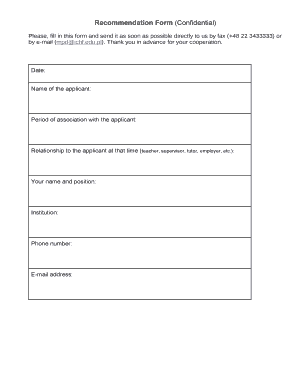

Begin by obtaining the necessary registration form from your employer. This form should be specifically for registration by payroll deduction.

02

Fill in your personal information accurately, such as your full name, address, contact details, and social security number. Ensure that all the information provided is correct and up to date.

03

Enter your bank account details, including the account number and routing number. This is necessary for the employer to deduct the specified amount from your paycheck.

04

Indicate the desired amount or percentage of your wages that you want to be deducted for the registration. Make sure to double-check this information before submitting the form.

05

Review the form to ensure all the fields are complete and accurate. Make any necessary corrections if required.

06

Sign and date the registration form to certify that all the information provided is true and accurate.

07

Submit the completed form to your employer or follow any specific instructions provided by them.

08

Keep a copy of the registration form for your records in case of any future reference or discrepancies.

Who needs registration by payroll deduction?

01

Registration by payroll deduction is typically needed by individuals who want to set up automatic deductions from their wages for various purposes.

02

This is commonly used for retirement savings plans, healthcare insurance premiums, union dues, charitable contributions, loan repayments, or any other authorized deductions.

03

Employees who prefer the convenience of having certain amounts deducted directly from their paycheck find this method beneficial.

04

It helps in ensuring timely payments and reducing the hassle of manual payments or missed deadlines.

05

Although not everyone may require registration by payroll deduction, it can be a useful option for those seeking automated and regular deductions from their wages.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my registration by payroll deduction directly from Gmail?

It's easy to use pdfFiller's Gmail add-on to make and edit your registration by payroll deduction and any other documents you get right in your email. You can also eSign them. Take a look at the Google Workspace Marketplace and get pdfFiller for Gmail. Get rid of the time-consuming steps and easily manage your documents and eSignatures with the help of an app.

How do I execute registration by payroll deduction online?

pdfFiller has made filling out and eSigning registration by payroll deduction easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I fill out registration by payroll deduction using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign registration by payroll deduction and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

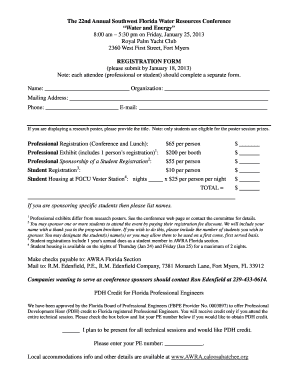

What is registration by payroll deduction?

Registration by payroll deduction is the process of enrolling in a program where a certain amount of money is deducted directly from an employee's paycheck for a specific purpose.

Who is required to file registration by payroll deduction?

Employers and employees may be required to file registration by payroll deduction depending on the specific program or service being offered.

How to fill out registration by payroll deduction?

To fill out registration by payroll deduction, employees typically need to complete a form provided by their employer indicating the amount to be deducted from their paycheck and the purpose of the deduction.

What is the purpose of registration by payroll deduction?

The purpose of registration by payroll deduction is to facilitate automatic contributions or payments towards a specific program or service without the need for separate payments.

What information must be reported on registration by payroll deduction?

Information such as the employee's name, employee ID, deduction amount, purpose of deduction, and duration of the deduction must typically be reported on registration by payroll deduction.

Fill out your registration by payroll deduction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Registration By Payroll Deduction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.