KY DoR 42A804 Form K-4 2019 free printable template

Get, Create, Make and Sign kentucky 4 form

How to edit kentucky 4 form online

Uncompromising security for your PDF editing and eSignature needs

KY DoR 42A804 Form K-4 Form Versions

How to fill out kentucky 4 form

How to fill out KY DoR 42A804 Form K-4

Who needs KY DoR 42A804 Form K-4?

Instructions and Help about kentucky 4 form

Any guidance provided by DCC related to the completion of income tax withholding forms should not be considered professional tax or legal advice if you have questions or concerns you should consult a tax professional it is important that you complete tax withholding forms as accurately as possible to ensure that the proper amount is withheld from your wages failure to have the correct amount withheld may result in additional taxes and penalties at the time you file your income taxes as required by law be sure to review your first few paycheck stubs closely to be sure that your withholding are as you want them to be you may adjust your withholding sat any time by completing a new withholding form in line a please enter your first name and middle initial in line B please enter your last name in line c you will enter your social security number and D will enter your home address in line 8 please enter your city state and zip code in which you live in for line F this is how you claim yourself and your spouse you will mark either single married or married but withholding at a higher single rate in G or line 5 you will enter the total number of allowances you're claiming during the year this is normally a number between 0 and 9 this is the number of dependents you would like to claim throughout the year please note you can change this at any time H or line 6 if you wish to have an additional dollar amount deducted from your paycheck in addition to the amount already deducted by your elections you will enter the dollar amount you wish deducted please note this is an optional deduction, and you do not have to complete line 6

People Also Ask about

Do I need to file a nonresident Kentucky tax return?

What states have no w4?

What is Kentucky K-4 form?

Does Kentucky have a w4?

How is Kentucky withholding tax calculated?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send kentucky 4 form to be eSigned by others?

Where do I find kentucky 4 form?

Can I create an electronic signature for the kentucky 4 form in Chrome?

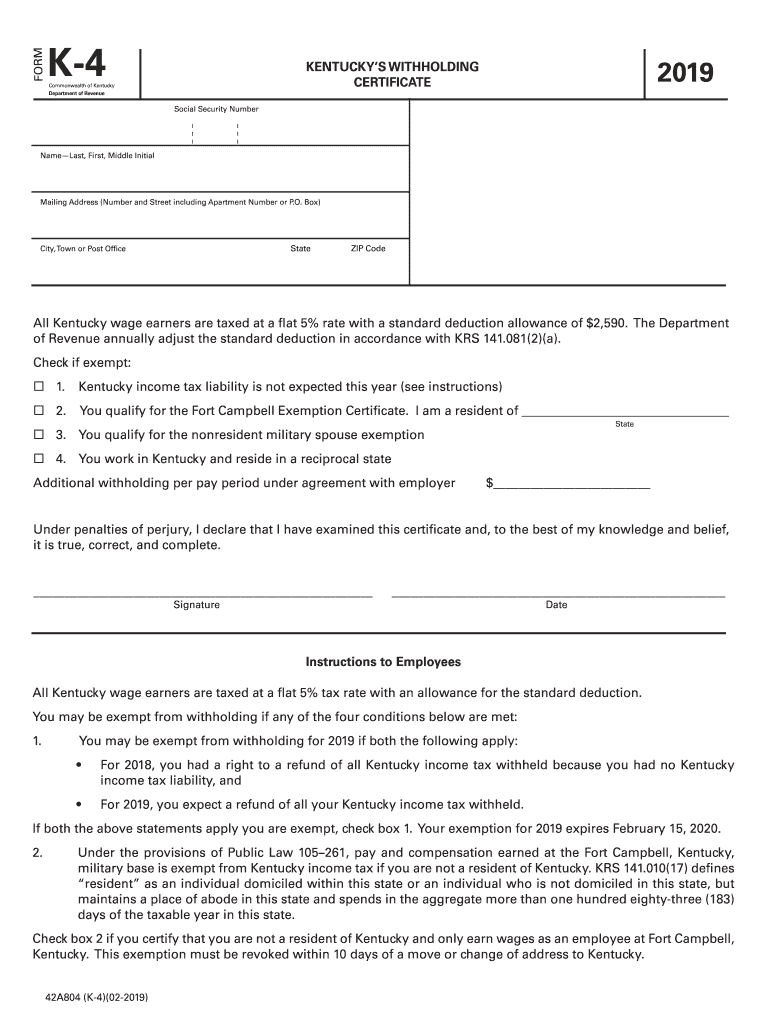

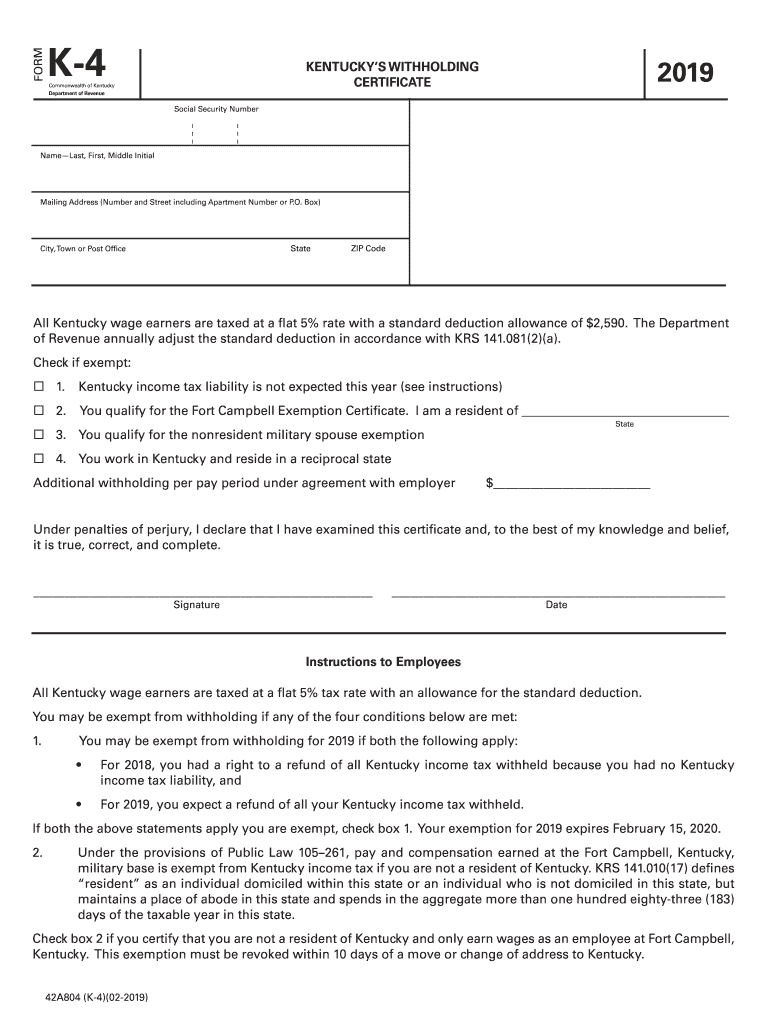

What is KY DoR 42A804 Form K-4?

Who is required to file KY DoR 42A804 Form K-4?

How to fill out KY DoR 42A804 Form K-4?

What is the purpose of KY DoR 42A804 Form K-4?

What information must be reported on KY DoR 42A804 Form K-4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.