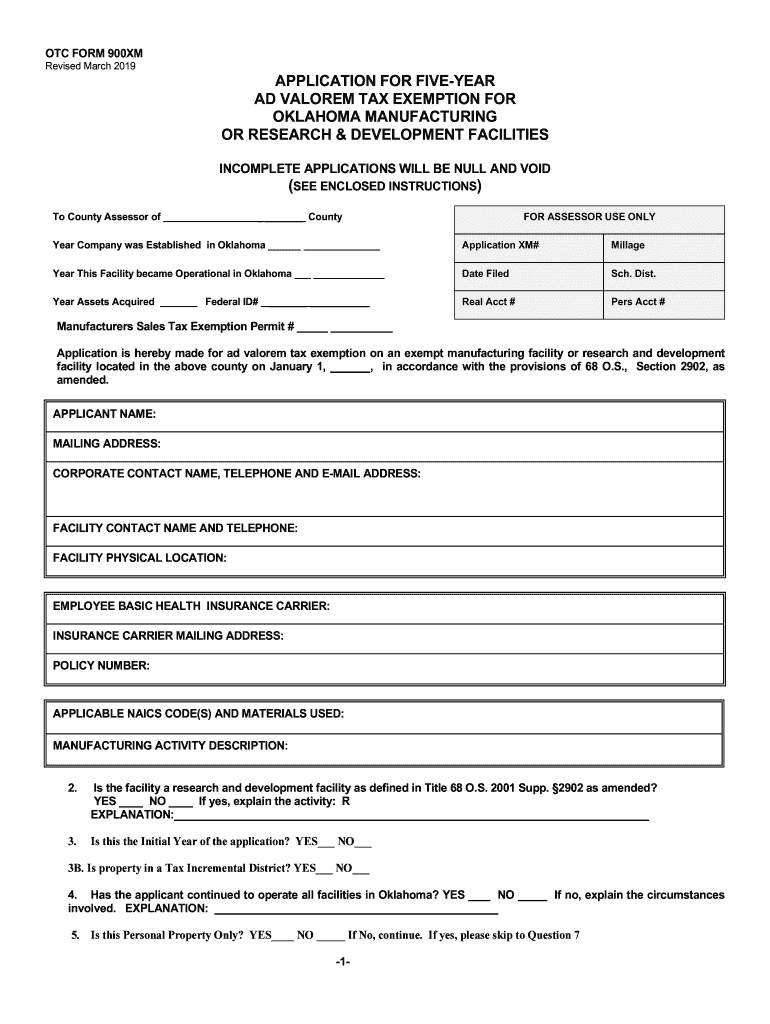

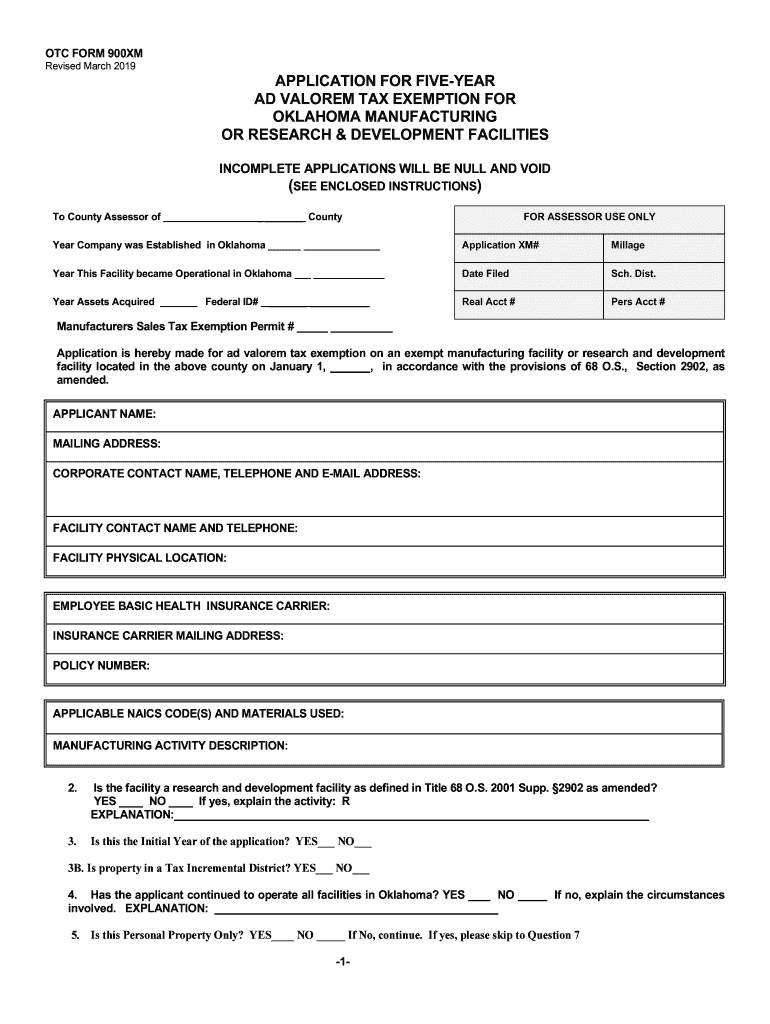

OK OTC 900-XM 2019 free printable template

Show details

The Oklahoma Tax Commission reserves the right to request additional -a- TAX EXEMPT REFERENCE INFORMATION OKLA CONSTITUTION ARTICLE 10 SECTION 6B http //www. oscn.net/applications/oscn/DeliverDocument. asp CiteID 438357 TITLE 68 O. S. 2001 2902 RULES TITLE 710 CHAPTER 10 https //www. ok. gov/tax/documents/CHAPTER10AdValorem.pdf -9- Form BT-129 Revised 5-2015 Oklahoma Tax Commission m.c. connors building 2501 North lincoln boulevard Oklahoma City Oklahoma 73194 Power of Attorney Please Type...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign oklahoma exemption certificate

Edit your oklahoma exemption certificate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oklahoma exemption certificate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing oklahoma exemption certificate online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit oklahoma exemption certificate. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OK OTC 900-XM Form Versions

Version

Form Popularity

Fillable & printabley

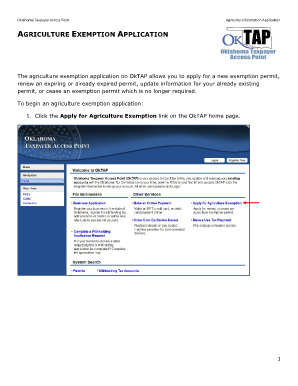

How to fill out oklahoma exemption certificate

How to fill out OK OTC 900-XM

01

Start by gathering all necessary personal information, including your name, address, and contact details.

02

Review the specific section relating to the purpose of the application and ensure all criteria are met.

03

Fill out the required fields, making sure to provide accurate and complete information.

04

Double-check for any additional documentation required, such as identification or proof of eligibility.

05

Sign and date the form at the designated areas.

06

Submit the completed OK OTC 900-XM form through the appropriate channel (online or postal) as instructed.

Who needs OK OTC 900-XM?

01

Individuals seeking to apply for over-the-counter medication coverage.

02

Healthcare providers assisting patients with medication access.

03

Insurance companies reviewing claims related to over-the-counter medications.

Fill

form

: Try Risk Free

People Also Ask about

What happens if you owe Oklahoma state taxes?

The Tax Commission will automatically apply a penalty when unpaid taxes are due. If at least 90% of the original tax liability has not been paid by the due date, a penalty of 5% will be assessed. You'll also be assessed interest on the balance due at a rate of 1.25% per month.

Who Must file Oklahoma partnership tax return?

If federal and Oklahoma distributive net incomes are the same, you may complete Part Three, Columns A and B, line 15; then complete Part Five. A copy of your Federal Form 1065 and K-1s must be provided with your Oklahoma return. An Oklahoma return must be filed by all partnerships having Oklahoma source income.

How many animals do you need for an ag exemption in Florida?

A minimum of six adult goats/sheep shall be required and granted on a three animal per acre ratio in most cases (herd of fifteen for five acres). A minimum of five calves is required. 4. If property is leased, the lease must be in effect as of January 1st.

What is Oklahoma Form 512 S?

All corporations having an election in effect under Subchapter S of the IRC engaged in business or deriving income from property located in Oklahoma and that are required to file a federal income tax return using Form 1120-S, must file an Oklahoma income tax return on Form 512-S.

How many acres do you need for a tax deduction?

Specifically, farmers are able to take 20 to 75 percent off their property tax bill if they agree not to develop their land for ten years and do so with at least 100 acres.

How do I get exempt from Oklahoma taxes?

501(c)(3) qualify to be exempt from sales tax in Oklahoma. To qualify for an exemption you must complete the application and provide the necessary documentation listed under the exemption for which you are applying. Supporting documentation required.

How do you become tax-exempt in Oklahoma?

501(c)(3) qualify to be exempt from sales tax in Oklahoma. To qualify for an exemption you must complete the application and provide the necessary documentation listed under the exemption for which you are applying. Supporting documentation required.

What qualifies for Oklahoma farm tax exemption?

Nearly all items used in production agriculture are exempt from sales tax in the state including seed, feed, fertilizer, livestock pharmaceuticals and farm machinery.

Who is exempt from paying property taxes in Oklahoma?

You may qualify for a real and personal property tax exemption. You must be an Oklahoma resident and eligible for homestead exemption. An exemption from property tax on homesteads is available for 100% disabled veterans. The exemption would apply to 100% disability rated veterans and their surviving spouses.

What is Oklahoma 511 A?

Interest on US bonds reported on the federal return may be subtracted from the Oklahoma return. Social Security benefits that are included in the Federal AGI shall be subtracted.

How many acres is considered a farm in KY?

The Kentucky Revised Statute 132.010 (9, 10, 11) defines agricultural land as any tract of land, including all income producing improvements of at least 10 contiguous acres in area used for the production of livestock, livestock products, poultry, poultry products and/or the growing of tobacco and/or crops including

What qualifies a person as tax-exempt?

Typically, you can be exempt from withholding tax only if two things are true: You got a refund of all your federal income tax withheld last year because you had no tax liability. You expect the same thing to happen this year. Internal Revenue Service.

Who has to file Oklahoma state income tax?

Oklahoma residents are required to file an Oklahoma income tax return when they have enough income that they must file a federal income tax return. Nonresidents are also required to file an Oklahoma income tax return if they have at least $1,000 of income from an Oklahoma employer or other source.

What is the Oklahoma retirement exclusion?

Section 710:50-15-49 - Deduction for retirement income (a)General provisions applicable to Oklahoma or federal government retirement income. Each individual taxpayer may deduct up to Five Thousand Five Hundred Dollars ($5,500.00) of retirement benefits paid by the State of Oklahoma or by the federal government.

What qualifies as a farm to the IRS?

A farm includes livestock, dairy, poultry, fish, fruit, and truck farms. It also includes plantations, ranches, ranges, and orchards.

What is Oklahoma form 512 S?

All corporations having an election in effect under Subchapter S of the IRC engaged in business or deriving income from property located in Oklahoma and that are required to file a federal income tax return using Form 1120-S, must file an Oklahoma income tax return on Form 512-S.

What is Oklahoma form 511ef?

2021 Form 511-EF Oklahoma Individual Income Tax Declaration for Electronic Filing. Page 1.

What qualifies as a farm in Arkansas?

A farm is “any place from which $1,000 or more of agricultural products were produced and sold, or normally would have been sold, during the year.” Government payments are included in sales.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in oklahoma exemption certificate?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your oklahoma exemption certificate to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for the oklahoma exemption certificate in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your oklahoma exemption certificate in seconds.

How can I fill out oklahoma exemption certificate on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your oklahoma exemption certificate, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is OK OTC 900-XM?

OK OTC 900-XM is a form used for reporting certain financial transactions in the Over-the-Counter (OTC) market, particularly focusing on trading activities under the appropriate regulatory frameworks.

Who is required to file OK OTC 900-XM?

Entities engaged in OTC trading activities, including brokers, dealers, and various financial institutions, are required to file OK OTC 900-XM.

How to fill out OK OTC 900-XM?

To fill out OK OTC 900-XM, filers should provide detailed information regarding transaction types, amounts, involved parties, and other required data as specified in the form's instructions.

What is the purpose of OK OTC 900-XM?

The purpose of OK OTC 900-XM is to ensure transparency and regulatory compliance in the OTC market by collecting data that can help monitor trading activities and detect potential market abuses.

What information must be reported on OK OTC 900-XM?

The information that must be reported on OK OTC 900-XM includes transaction dates, security identifiers, transaction prices, volumes, and participant details as required by regulatory guidelines.

Fill out your oklahoma exemption certificate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oklahoma Exemption Certificate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.