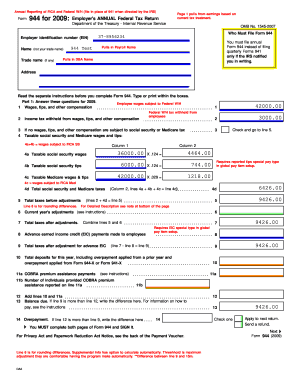

This Limited Power of Attorney form provides for a limited power of attorney for stock transactions only. It used by a shareholder to authorize another person to vote stock and to conduct other corporate powers. The document must be signed before two witnesses.

Get the free Limited Power of Attorney for Stock Transactions

Show details

This document grants an individual the authority to act on behalf of the principal in stock transactions and other corporate powers, specifying the scope and limitations of that authority.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign limited power of attorney

Edit your limited power of attorney form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your limited power of attorney form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out limited power of attorney

How to fill out Limited Power of Attorney for Stock Transactions

01

Obtain a Limited Power of Attorney form, which can be found online or from a financial institution.

02

Fill in the principal's details (the person granting the power), including their name, address, and contact information.

03

Specify the agent's details (the person receiving the authority), including their name, address, and contact information.

04

Clearly outline the specific stock transactions that the agent is authorized to perform on behalf of the principal.

05

Include any limitations or conditions regarding the authority granted to the agent.

06

Date the document and sign it, ensuring that the principal's signature is notarized if required by state law.

07

Provide a copy of the completed document to the agent and any relevant brokers or financial institutions.

Who needs Limited Power of Attorney for Stock Transactions?

01

Individuals who want to delegate stock trading decisions to another person.

02

Investors who may be unable to manage their investment accounts due to health issues or travel.

03

Those who want to facilitate an investment strategy while maintaining control over the account.

Fill

form

: Try Risk Free

People Also Ask about

What three decisions cannot be made by a legal power of attorney?

When someone makes you the agent in their power of attorney, you cannot: Write a will for them, nor can you edit their current will. Take money directly from their bank accounts. Make decisions after the person you are representing dies. Give away your role as agent in the power of attorney.

How to write a limited power of attorney?

How to fill out a limited power of attorney form Part 1: Specify who is the principal (you) and who is the agent (who will act on your behalf). Part 2: Describe the powers you (the principal) are assigning to your agent. Part 3: Define the timescale i.e. when will the power of attorney be effective?

What is the purpose of a stock power?

A power of attorney that allows a person to transfer ownership of stock. Stock powers are commonly used in secured lending transactions. If certificated securities owned by a borrower are collateral in a loan transaction, a stock power is delivered to the secured party along with a stock certificate.

What is a power of attorney for a stock power?

In connection with the transfer of a certificate or instrument, a Stock Power or Allonge acts as a power of attorney, in each case appointing an agent to the transfer on the company's books or on behalf of the transferor or assignor. Each will also be signed by the transferor or assignor, often done under seal.

What is a limited power of attorney for an investment advisor?

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.

What is the difference between a stock certificate and a stock power?

A Stock Power is delivered to the secured party with a stock certificate where certificated securities owned by the borrower are collateral in a loan transaction. When completed and signed, the Stock Power transfers the ownership interest in the certificate from the borrower to the secured party.

What do you mean by power stock?

Power stocks in India refer to shares of companies operating within the country's energy sector. These entities are involved in the generation, distribution, and transmission of electricity, with a focus on both traditional and renewable energy sources.

What is a power of attorney on a brokerage account?

A power of attorney (POA) is a binding legal document that gives a person (known as the agent or attorney-in-fact) the ability to act on the behalf of the principal or account owner.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Limited Power of Attorney for Stock Transactions?

A Limited Power of Attorney for Stock Transactions is a legal document that authorizes a designated person to act on behalf of another individual specifically for managing and executing stock transactions.

Who is required to file Limited Power of Attorney for Stock Transactions?

Individuals who wish to delegate the authority to manage their stock accounts or transactions to another person, typically a broker or financial advisor, are required to file a Limited Power of Attorney for Stock Transactions.

How to fill out Limited Power of Attorney for Stock Transactions?

To fill out a Limited Power of Attorney for Stock Transactions, you need to provide your personal information, the details of the agent you are authorizing, specify the powers being granted, and sign the document in accordance with state laws and any requirements set by the financial institution.

What is the purpose of Limited Power of Attorney for Stock Transactions?

The purpose of a Limited Power of Attorney for Stock Transactions is to provide a trusted individual the authority to make stock trades, buy or sell securities, and handle other related financial decisions on your behalf, while still maintaining control over other aspects of your finances.

What information must be reported on Limited Power of Attorney for Stock Transactions?

The information that must be reported on a Limited Power of Attorney for Stock Transactions typically includes the names and addresses of the principal and the agent, a description of the powers granted, the duration of the authority, and any specific conditions or limitations imposed.

Fill out your limited power of attorney online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Limited Power Of Attorney is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.