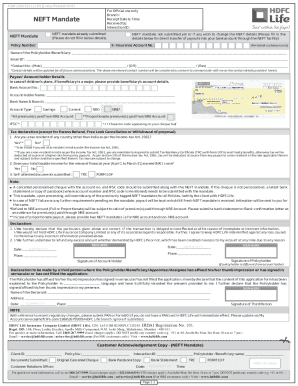

India HDFC Life NEFT Mandate 2017 free printable template

Show details

PSRF138722111729 Comp/Feb/Int/4747 For Official use only Branch : Receipt Date & Time: Received by: Interaction ID:NEFT Mandate already submitted (Please do not fill in below details)NEFT MandateNEFT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign India HDFC Life NEFT Mandate

Edit your India HDFC Life NEFT Mandate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your India HDFC Life NEFT Mandate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing India HDFC Life NEFT Mandate online

Use the instructions below to start using our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit India HDFC Life NEFT Mandate. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

India HDFC Life NEFT Mandate Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out India HDFC Life NEFT Mandate

How to fill out India HDFC Life NEFT Mandate

01

Obtain the India HDFC Life NEFT Mandate form from the official HDFC Life website or your nearest HDFC Life branch.

02

Fill in your personal details such as name, address, phone number, and email address.

03

Provide your bank details including the bank name, account number, and IFSC code.

04

Indicate the frequency of payments (e.g., monthly, quarterly, annually) and the amount to be transferred.

05

Sign and date the form at the designated area.

06

Submit the completed form to your nearest HDFC Life branch or send it to the designated address mentioned on the form.

Who needs India HDFC Life NEFT Mandate?

01

Individuals who hold an insurance policy with HDFC Life and wish to set up automated payments for premium contributions.

02

Customers who prefer electronic fund transfers for their premium payments instead of traditional methods.

Fill

form

: Try Risk Free

People Also Ask about

Where can I get mandate form?

You can download the bank mandate form from the designated website. Fill in the requested details, sign, and send it to your AMC. The AMC will send it to your bank branch on your behalf to get an authorisation.

How can I submit NEFT form?

If you have to make a NEFT Transaction offline at a branch, you have to fill up a Bank of India NEFT Form and submit it to the branch. The details mentioned in the NEFT form are punched into the system physically by the official at the branch. Following this, the NEFT transaction takes place as it would online.

How do you create a mandate form?

How To Generate Mandate Form Select “Generate Mandate Form” after a successful log in. Select “New Mandate Number” Confirm to generate mandate. Code and other details would be sent through SMS.

How can I submit online NEFT mandate?

Step 1: Log in to the LIC portal. Step 2: Select Service request to Register NEFT online. Step 3: Policy Selection for NEFT Registration. Step 4: OTP validation for verification register NEFT details in LIC online. Step 5: Fill in your bank details. Step 6: Generate the NEFT form.

How can I submit NEFT mandate form?

Step 1: Log in to the LIC portal. Step 2: Select Service request to Register NEFT online. Step 3: Policy Selection for NEFT Registration. Step 4: OTP validation for verification register NEFT details in LIC online. Step 5: Fill in your bank details. Step 6: Generate the NEFT form.

What is a NEFT mandate form?

A cancelled personalised cheque with the account no. and IFSC code should be submitted along with the NEFT mandate. If the cheque is not personalised, a latest bank statement or copy of passbook (where account number and IFSC code is mentioned) needs to be submitted with the mandate.

What is meant by mandate form?

Mandate Form means the form by which you have instructed us on the number and identity of the person(s) authorised to operate the Account. This includes the Account opening application form.

What is an NEFT mandate?

It is a nationwide system that facilitates to transfer a fund from one account of any bank branch to. another account of any bank branch. This system is operated by Reserve Bank of India. For transfer of. funds the participating banks have to be NEFT enabled.

How can I check my NEFT status in LIC policy online?

How To Check NEFT Status of LIC Policy online? Visit the official website of LIC and log in to the LIC 'customer portal'. Then, click on Service Request. A window will open that shows two options on the left-hand panel which is service request and track request status. Then choose the category 'NEFT registration'.

Where can I get a mandate form?

You can download the bank mandate form from the designated website. Fill in the requested details, sign, and send it to your AMC. The AMC will send it to your bank branch on your behalf to get an authorisation. Once the bank authorises, your SIP amount will be automatically collected.

What is a mandate in Quebec?

About the protection mandate (mandate in case of incapacity) The protection mandate allows a person to express their wishes and names who will look after their person and their property in case of incapacity.

What is NEFT mandate form from bank?

A cancelled personalised cheque with the account no. and IFSC code should be submitted along with the NEFT mandate. If the cheque is not personalised, a latest bank statement or copy of passbook (where account number and IFSC code is mentioned) needs to be submitted with the mandate.

Can we fill NEFT form online?

# Once you login to the customer portal, you will now be prompted with the message “Online NEFT Registration facility is now available to Customer Portal users. To avail the facility, click here.”. Click on that link. # In the next screen, from dropdown, select 'NEFT Registration' option under 'Select Service Request'.

Can I fill NEFT mandate form online?

NEFT Mandate form is available in all offices or can be downloaded from LIC website under Download forms. NEFT details can be downloaded online. Submit claim discharge forms and policy document. Submit KYC and Update- Residential Address, Phone/Mobile No, Email ID etc.

Why is NEFT form required?

This piece of document is basically a written authorization to allow the bank to debit money from the remitter's bank account to the payee's account. It is important to note here that those who have an active internet banking facility with their respective banks can initiate a NEFT transfer online.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send India HDFC Life NEFT Mandate for eSignature?

When you're ready to share your India HDFC Life NEFT Mandate, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Can I edit India HDFC Life NEFT Mandate on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute India HDFC Life NEFT Mandate from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I fill out India HDFC Life NEFT Mandate on an Android device?

On an Android device, use the pdfFiller mobile app to finish your India HDFC Life NEFT Mandate. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is India HDFC Life NEFT Mandate?

India HDFC Life NEFT Mandate is a formal request that authorizes HDFC Life Insurance to debit a specified amount from a customer's bank account through the National Electronic Funds Transfer (NEFT) system for premium payments or other transactions.

Who is required to file India HDFC Life NEFT Mandate?

Individuals who hold a policy with HDFC Life and wish to set up automated payments for their insurance premiums through NEFT are required to file the India HDFC Life NEFT Mandate.

How to fill out India HDFC Life NEFT Mandate?

To fill out the India HDFC Life NEFT Mandate, one must provide details such as the policy number, bank account information (including bank name, account number, IFSC code), the amount to be debited, and sign the mandate.

What is the purpose of India HDFC Life NEFT Mandate?

The purpose of the India HDFC Life NEFT Mandate is to facilitate the automatic transfer of funds from the policyholder's bank account to HDFC Life, ensuring timely payment of insurance premiums without the need for manual transactions.

What information must be reported on India HDFC Life NEFT Mandate?

The information that must be reported on the India HDFC Life NEFT Mandate includes the policyholder's name, policy number, bank account details (bank name, account number, IFSC code), the amount to be debited, and the signature of the policyholder.

Fill out your India HDFC Life NEFT Mandate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

India HDFC Life NEFT Mandate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.