AZ CSE-1129A 2019 free printable template

Show details

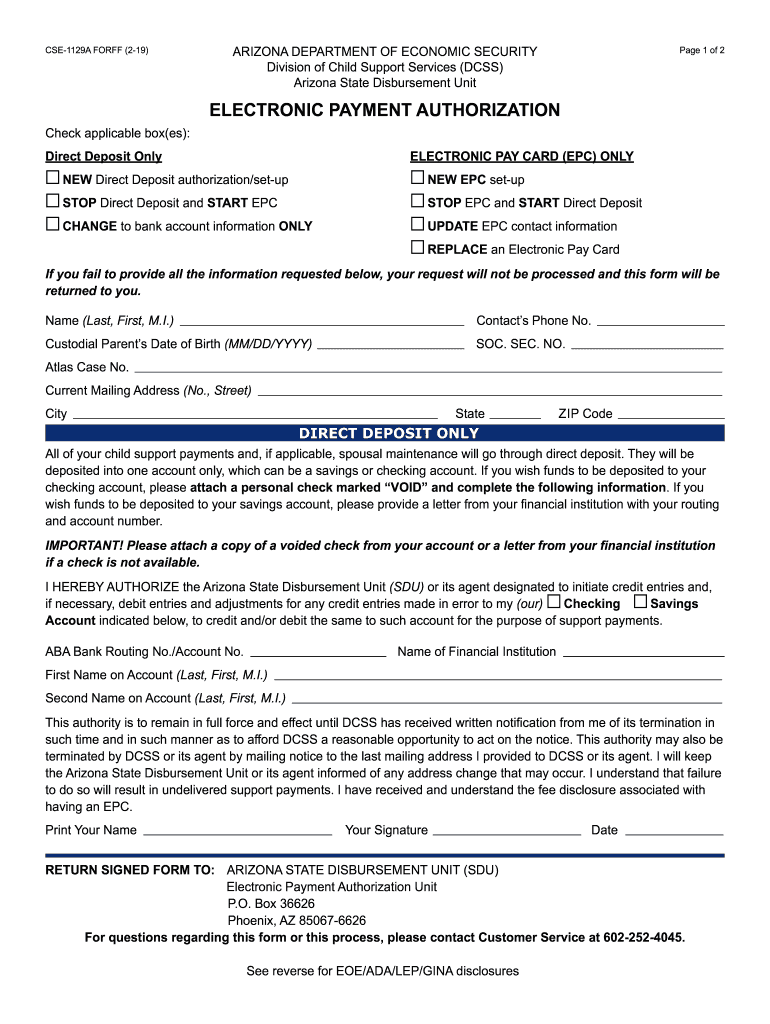

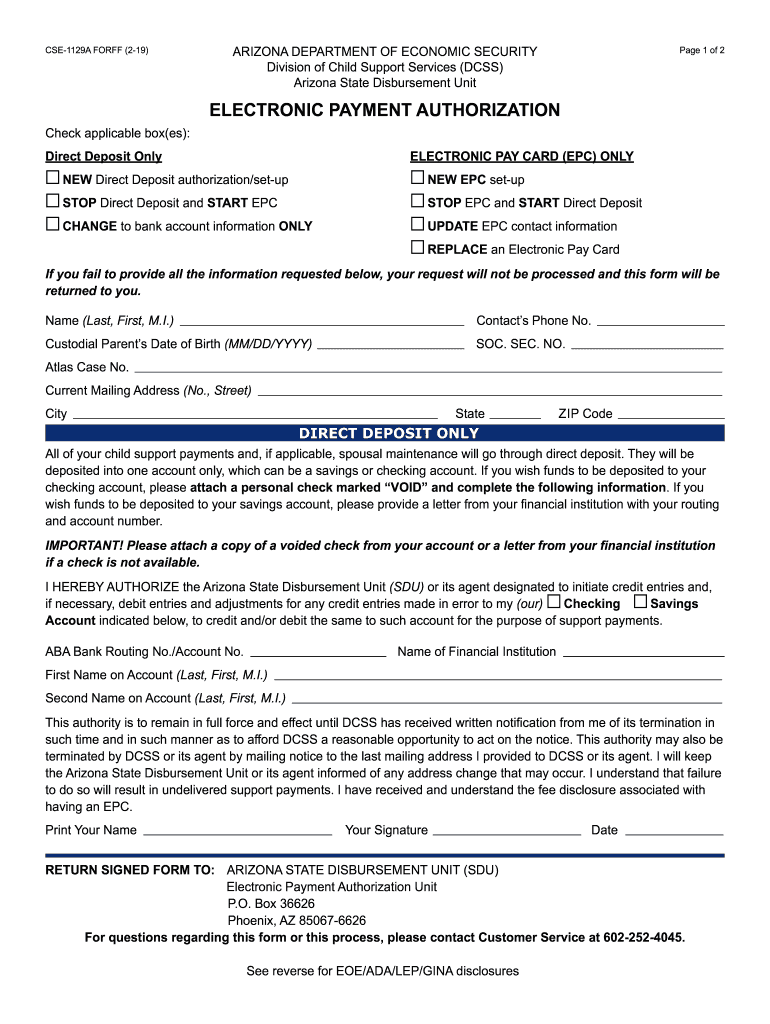

CSE1129A FOR FF (219)ARIZONA DEPARTMENT OF ECONOMIC SECURITY

Division of Child Support Services (CSS)

Arizona State Disbursement Unit Page 1 of 2ELECTRONIC PAYMENT AUTHORIZATION

Check applicable box(BS):

Direct

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign AZ CSE-1129A

Edit your AZ CSE-1129A form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AZ CSE-1129A form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit AZ CSE-1129A online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit AZ CSE-1129A. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AZ CSE-1129A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AZ CSE-1129A

How to fill out AZ CSE-1129A

01

Obtain the AZ CSE-1129A form from the official Arizona government website or local office.

02

Read the instructions carefully before starting to fill out the form.

03

Begin with your personal information: fill in your full name, address, and contact details in the designated fields.

04

Enter the relevant case information, including case number and any other required identifiers.

05

Provide details about the services or assistance you are requesting.

06

If necessary, attach any required documentation or supporting information as specified in the form instructions.

07

Review all the information you've entered to ensure accuracy and completeness.

08

Sign and date the form in the designated areas.

09

Submit the completed form as instructed, either by mailing it to the appropriate address or delivering it in person.

Who needs AZ CSE-1129A?

01

Individuals seeking assistance or services related to the Arizona Child Support Enforcement program.

02

Parents or guardians involved in child support cases.

03

Custodial or non-custodial parents who need to document their case or change existing arrangements.

Fill

form

: Try Risk Free

People Also Ask about

What is Arizona form 210?

Use Form 210 to notify the Arizona Department of Revenue of a fiduciary relationship for a decedent's estate. A fiduciary for a decedent's estate may be any of the following: • an executor, • an administrator, • a personal representative, or • a person in possession of property of a decedent.

What is an Arizona form 140?

Form 140 - Resident Personal Income Tax Form -- Calculating Personal income tax return filed by resident taxpayers. You may file Form 140 only if you (and your spouse, if married filing a joint return) are full year residents of Arizona.

What is Arizona form 343?

343. Renewable Energy Production Tax Credit.

What is the Arizona State Solar tax credit 2023?

The state tax credit is valued at 25% of the total system cost, up to a maximum of $1,000 in total. Those who are eligible may claim the credit for up to five tax years, but the amount of the credit cannot exceed $1,000 total.

What is AZ form 343?

Arizona individuals, corporations, S corporations and partners in a partnership can claim a renewable energy production tax credit using a form 343. This document can be obtained from the website of the Arizona Department of Revenue.

What is Arizona form 323?

Arizona State income tax forms 301, 323, and 348 are used for claiming the Original and PLUS/Overflow Tuition Tax Credits. Form 335 is used in claiming the Corporate Tax Credit. You can retrieve Arizona tax forms from the Arizona Department of Revenue's website or click on the below links.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send AZ CSE-1129A for eSignature?

AZ CSE-1129A is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make changes in AZ CSE-1129A?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your AZ CSE-1129A to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit AZ CSE-1129A in Chrome?

AZ CSE-1129A can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is AZ CSE-1129A?

AZ CSE-1129A is a form used in Arizona for reporting and managing child support payments and related information.

Who is required to file AZ CSE-1129A?

Individuals involved in child support cases, including custodial parents, non-custodial parents, and other legal guardians, are typically required to file AZ CSE-1129A.

How to fill out AZ CSE-1129A?

To fill out AZ CSE-1129A, provide personal information, details about the child support order, payment history, and any other required information as instructed on the form.

What is the purpose of AZ CSE-1129A?

The purpose of AZ CSE-1129A is to facilitate the recording and reporting of child support payments and ensure compliance with legal obligations.

What information must be reported on AZ CSE-1129A?

Information required includes the names and addresses of the parties involved, the child's details, the amount of child support paid or received, and any relevant dates.

Fill out your AZ CSE-1129A online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AZ CSE-1129a is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.