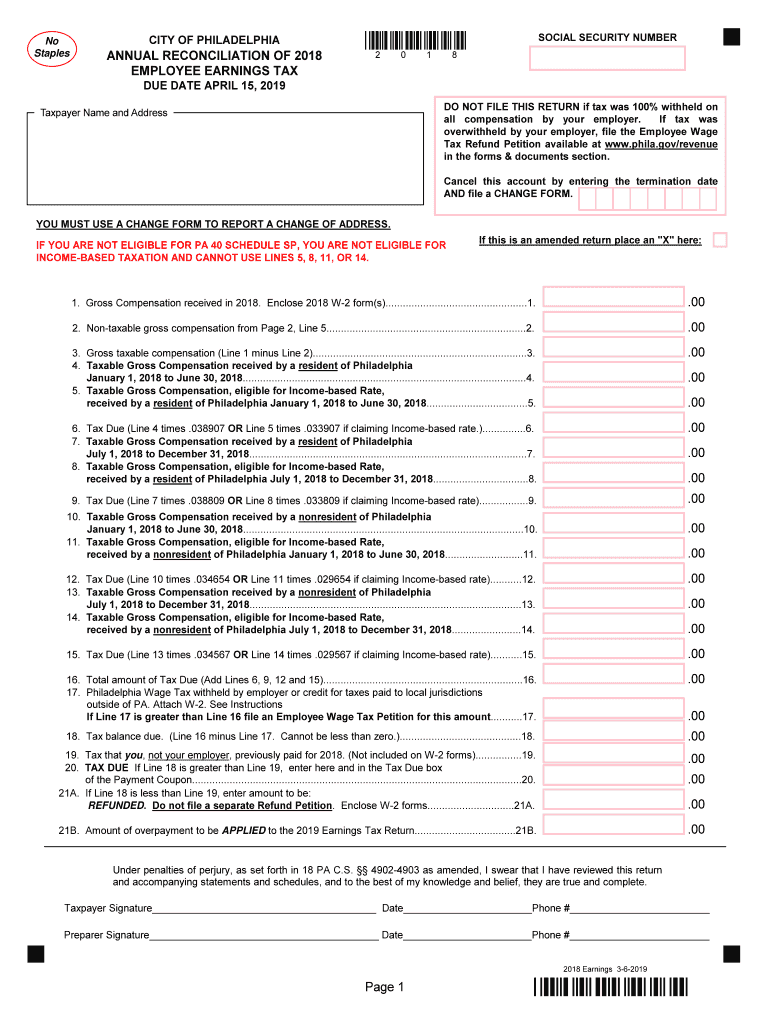

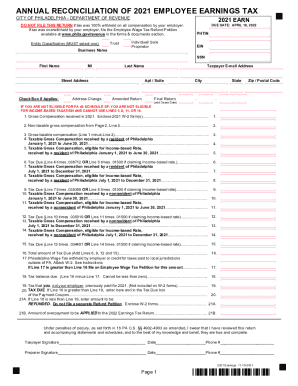

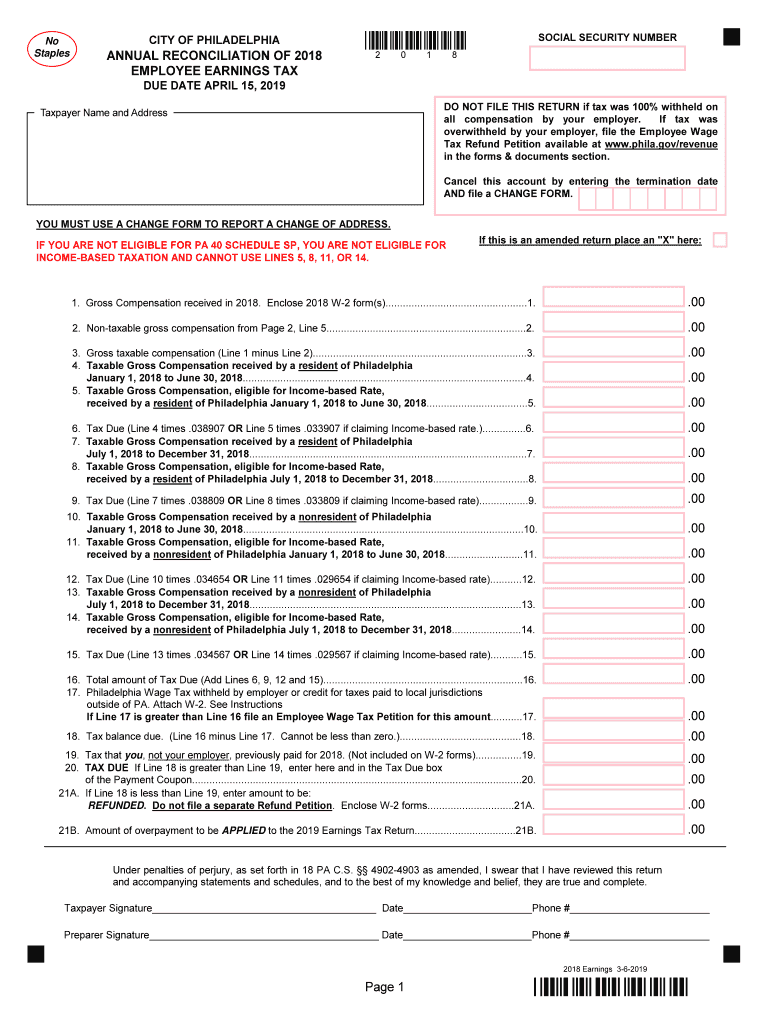

PA Annual Reconciliation Employee Earnings Tax - City of Philadelphia 2018 free printable template

Get, Create, Make and Sign PA Annual Reconciliation Employee Earnings Tax

How to edit PA Annual Reconciliation Employee Earnings Tax online

Uncompromising security for your PDF editing and eSignature needs

PA Annual Reconciliation Employee Earnings Tax - City of Philadelphia Form Versions

How to fill out PA Annual Reconciliation Employee Earnings Tax

How to fill out PA Annual Reconciliation Employee Earnings Tax

Who needs PA Annual Reconciliation Employee Earnings Tax?

Instructions and Help about PA Annual Reconciliation Employee Earnings Tax

Well its filled enough his soda tax a job killer you might remember in 2016 unions claim thousands of jobs would be lost due to the cities sugary beverage tax now two years since it's been implemented Eyewitness News reporter Matt Utrillo is looking into that claim during the lunchtime rush in Philadelphia when people want a soft drink its easy to knock the cities' soda tax to pay your soda makes is just its ridiculous I think its absurd the tax went into effect two years ago and now the impact can be seen out of the cities hustle and bustle and inside here at Spring Garden Academy in Philadelphia's Fairmount neighborhood here at Spring Guard Academy they have a curriculum they're learning numbers they're learning colors shapes Denise Picard cannot afford to pay the roughly 200 a week it would cost a cent her three-year-old daughter to Pre-K here, but the city picks up the tab for her, it uses money from its sweetened beverage tax I know a lot of people there was like oh I'm not reaping benefits they just made this up they're just trying to take our money and use it for themselves, and I was like well I can testify that my child is benefited for it because she is going to a private school for free do you still buy soda Philadelphia city leaders say money from the soda tax allows more than four thousand kids to attend Pre-K and Philly this year with no cost to their families plus nearly 280 Pre-K jobs have been created including several here at Spring Garden Academy we have seven new teachers as well as two new kitchen staff and a new director, but it takes a lot of soda to pay for it all Eyewitness News found Philadelphia sugary drink tax generated about a hundred forty-nine million dollars in its first two years a big chunk nearly 40 million of that went to Pre-K some went to Community Schools and parks, but it turns out about a hundred and two million dollars still sits in the cities bank account apparently collecting dust, so we caught up with Mayor Jim Kenney 149 million dollars has been raised in two years it's a lot of money most of it is sitting in the bank unspent why is that because we were in court for two-plus years but the so ninja mayor Kenney points out the soda tax money was tied up until last July when the city finally won a PA Supreme Court case the case was brought by the soda industry which sought to have the soda tax repealed they sue us we wind up having a hole under the money in case we lose the lawsuit, so we don't spend it all and have to pay it out of the general fund so were all were catching up with the delay that they caused now that Philadelphia can use the tax money generated by the soda tax it's expected to fully be spent in a few years meantime the Teamsters is the union that rallied against the soda tax when it was first proposed the union claimed it would kill jobs now two years into the tax we asked the Teamsters' spokesperson Kara Dennis how many jobs were lost we were told no comment Jim Angler is mayor of...

People Also Ask about

What is the Philadelphia resident earnings tax?

How do I file Philadelphia earnings tax?

Do I have to file a city of Philadelphia tax return?

Do I have to pay Philadelphia City wage tax if I work remotely?

How much is City wage tax in Philadelphia?

Do I have to pay Philadelphia City wage tax?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send PA Annual Reconciliation Employee Earnings Tax for eSignature?

Can I create an eSignature for the PA Annual Reconciliation Employee Earnings Tax in Gmail?

How do I fill out the PA Annual Reconciliation Employee Earnings Tax form on my smartphone?

What is PA Annual Reconciliation Employee Earnings Tax?

Who is required to file PA Annual Reconciliation Employee Earnings Tax?

How to fill out PA Annual Reconciliation Employee Earnings Tax?

What is the purpose of PA Annual Reconciliation Employee Earnings Tax?

What information must be reported on PA Annual Reconciliation Employee Earnings Tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.