Get the free Risk Mangement Through

Show details

Risk Management Through

Record keeping:

Applying Minnesota\'s Minimum

Record keeping StandardsRISK MANAGEMENT THROUGH RECORDKEEPING:

Applying Minnesota's Minimum Record keeping StandardsThorough records

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign risk mangement through

Edit your risk mangement through form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your risk mangement through form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing risk mangement through online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit risk mangement through. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out risk mangement through

How to fill out risk mangement through

01

Identify potential risks: Start by identifying all the potential risks that your organization may face. This involves assessing all areas of your business operations, such as financial risks, operational risks, legal risks, and strategic risks.

02

Analyze and assess risks: Once you have identified the risks, analyze and assess the potential impact and likelihood of each risk. This will help you prioritize and understand the significance of each risk.

03

Develop risk management strategies: Based on your analysis, develop strategies to mitigate the identified risks. This may involve implementing control measures, transferring certain risks through insurance, or accepting and managing certain risks.

04

Implement risk management plan: Put your risk management plan into action by implementing the identified strategies. This may involve training employees, updating policies and procedures, and monitoring risk mitigation activities.

05

Monitor and review: Continuously monitor and review your risk management efforts to ensure their effectiveness. Regularly assess the success of your strategies and make adjustments as needed.

06

Communicate and educate: Ensure that all relevant stakeholders are aware of the risk management plan and their roles and responsibilities in implementing it. Educate employees about the importance of risk management and the steps they can take to contribute to a risk-aware culture.

07

Regularly update and adapt: Risk management is an ongoing process, so it's essential to regularly update and adapt your strategies to address new risks that may arise. Stay informed about industry trends, legal requirements, and other external factors that may impact your risk profile.

Who needs risk mangement through?

01

Risk management through is needed by any organization, regardless of its size or industry. Every business faces risks, and effectively managing these risks can help prevent financial losses, reduce legal liabilities, ensure business continuity, and protect the reputation and brand image of the organization.

02

Risk management is particularly important for industries that operate in high-risk environments, such as construction, healthcare, manufacturing, and finance. However, all businesses, no matter their sector, can benefit from implementing a comprehensive risk management process.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the risk mangement through form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign risk mangement through and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I edit risk mangement through on an iOS device?

You certainly can. You can quickly edit, distribute, and sign risk mangement through on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Can I edit risk mangement through on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as risk mangement through. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

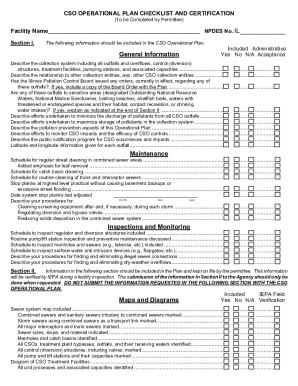

What is risk management through?

Risk management through is the process of identifying, assessing, and prioritizing risks followed by coordinated and economical application of resources to minimize, monitor, and control the probability and impact of unfortunate events.

Who is required to file risk management through?

All individuals, organizations, and businesses involved in activities that carry risks are required to file risk management through.

How to fill out risk management through?

Risk management through can be filled out by gathering information on potential risks, assessing their likelihood and impact, developing strategies to mitigate them, and implementing monitoring and control measures.

What is the purpose of risk management through?

The purpose of risk management through is to proactively identify and address potential risks to prevent or minimize negative impacts on individuals, organizations, or businesses.

What information must be reported on risk management through?

Information such as identified risks, risk assessment methods, mitigation strategies, monitoring and control measures, and responsible parties must be reported on risk management through.

Fill out your risk mangement through online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Risk Mangement Through is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.