Get the free 9034 Resale Surplus

Show details

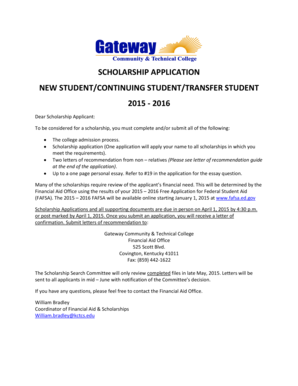

KAY COUNTY CLERK CITIES AND TOWNS BLA General 9034 Resale Surplus 9218 (Cost) MTR VH Cities Weed Tax 9225 (6314) Beverage Tax 6,466.07 4,307.12 656.86 2,457.04 TOTAL General Warrant Date Apportionment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 9034 resale surplus

Edit your 9034 resale surplus form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 9034 resale surplus form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 9034 resale surplus online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 9034 resale surplus. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 9034 resale surplus

How to fill out 9034 resale surplus:

01

Begin by gathering all relevant information and documentation related to the surplus resale. This may include invoices, receipts, and any other paperwork related to the items being sold.

02

Ensure that you have a complete and accurate inventory of the items being sold. This should include a detailed description of each item, its quantity, and its condition. It is important to be as specific as possible to provide an accurate representation of the items being sold.

03

Determine the appropriate price at which to sell each item. This can be done by researching market prices, considering the condition and age of the items, and factoring in any relevant expenses such as shipping or handling fees.

04

Once the prices have been determined, calculate the total value of the items being sold. This can be done by multiplying the price of each item by its quantity and summing up the results.

05

Fill out the necessary fields on the 9034 resale surplus form. This form typically requires information such as the seller's name, address, contact details, and a detailed description of the items being sold. Make sure to carefully review the form and provide all requested information accurately.

06

Attach any supporting documentation, such as invoices or receipts, to the resale surplus form. This will help provide proof of the legitimacy of the items being sold and the prices charged.

07

Double-check all the information provided on the form and supporting documents for accuracy. Any errors or discrepancies could delay the processing of the surplus resale.

Who needs 9034 resale surplus:

01

Businesses or individuals who regularly engage in the sale of surplus items may need to fill out the 9034 resale surplus form. This could include retailers, wholesalers, or even individual sellers who have excess inventory to liquidate.

02

Government agencies or organizations that deal with surplus assets may also require the use of the 9034 resale surplus form. This could include departments responsible for managing surplus equipment or stock.

03

The 9034 resale surplus form may also be required when selling surplus items as part of an estate sale or liquidation process. Executors or administrators of an estate may need to complete this form to properly document the sale of assets.

In summary, filling out the 9034 resale surplus form involves gathering relevant information, accurately documenting the items being sold, determining appropriate prices, and carefully completing the form itself. This form may be required by various entities, including businesses, government agencies, and estate administrators, when engaging in the sale of surplus items.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 9034 resale surplus?

9034 resale surplus refers to the excess of funds received from selling a property or asset over the original purchase price of that property or asset.

Who is required to file 9034 resale surplus?

Individuals or companies who have sold a property or asset at a profit are required to file 9034 resale surplus.

How to fill out 9034 resale surplus?

To fill out 9034 resale surplus, you will need to provide details such as the original purchase price, selling price, and any related expenses.

What is the purpose of 9034 resale surplus?

The purpose of 9034 resale surplus is to calculate the profit made from selling a property or asset and to determine any tax liability associated with that profit.

What information must be reported on 9034 resale surplus?

Information such as the original purchase price, selling price, expenses related to the sale, and any capital gains made must be reported on 9034 resale surplus.

How can I edit 9034 resale surplus from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your 9034 resale surplus into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit 9034 resale surplus in Chrome?

Install the pdfFiller Google Chrome Extension to edit 9034 resale surplus and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out 9034 resale surplus using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign 9034 resale surplus and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your 9034 resale surplus online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

9034 Resale Surplus is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.