Get the free Guide to Your Remortgage

Show details

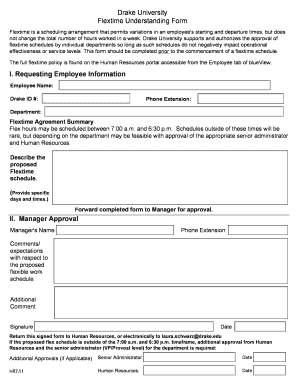

Guide to Your Remortgagel2Gorvins Solicitors Your Conveyancing Guide to Your RemortgageCall 0161 930 5350Gorvins Solicitors Your Conveyancing Guide to Your RemortgagelCONTENTSSECTION 1:INTRODUCTION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign guide to your remortgage

Edit your guide to your remortgage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your guide to your remortgage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing guide to your remortgage online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit guide to your remortgage. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out guide to your remortgage

How to fill out guide to your remortgage

01

Gather all necessary documents such as your current mortgage statement, income proof, bank statements, and identification documents.

02

Research different remortgage options and compare interest rates, terms, and fees to find the most suitable deal for you.

03

Contact your current mortgage lender to inform them about your intention to remortgage and request a redemption statement.

04

Submit a remortgage application with a new lender or your existing lender. Provide all the required information accurately.

05

Arrange for a new property valuation or survey, if needed, to determine the current market value of your property.

06

Review and negotiate the terms of the new mortgage offer, including interest rate, repayment terms, and any additional fees.

07

Once satisfied with the offer, sign the remortgage agreement and any other required documents.

08

Notify your solicitor or conveyancer about the remortgage process and provide them with all relevant documentation.

09

Your solicitor will handle the legal aspects of the remortgage, including transferring the funds to pay off your existing mortgage.

10

After completion, ensure that the new mortgage is set up correctly and make arrangements for future repayments.

11

Monitor your mortgage regularly and consider reviewing it again in the future if more favorable deals become available.

Who needs guide to your remortgage?

01

Homeowners who want to take advantage of better interest rates or terms available in the market to reduce their monthly mortgage payments.

02

Individuals who wish to switch from a variable rate mortgage to a fixed rate mortgage for better budgeting and stability.

03

People looking to release equity from their property to fund home improvements, education, or other financial needs.

04

Homeowners who want to consolidate their debts by remortgaging and using the released equity to pay off high-interest loans.

05

Those who want to extend the term of their mortgage to lower their monthly payments or have more flexibility with their finances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my guide to your remortgage in Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your guide to your remortgage and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Where do I find guide to your remortgage?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific guide to your remortgage and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I complete guide to your remortgage on an Android device?

On an Android device, use the pdfFiller mobile app to finish your guide to your remortgage. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is guide to your remortgage?

Guide to your remortgage is a document that outlines the steps and information needed to successfully remortgage a property.

Who is required to file guide to your remortgage?

Homeowners who are looking to remortgage their property are required to follow the guide to your remortgage.

How to fill out guide to your remortgage?

You can fill out the guide to your remortgage by providing all the necessary information about your property, current mortgage details, reasons for remortgaging, and any additional documents required by your lender.

What is the purpose of guide to your remortgage?

The purpose of guide to your remortgage is to help homeowners navigate the process of remortgaging their property successfully and avoid any pitfalls or mistakes.

What information must be reported on guide to your remortgage?

The guide to your remortgage should include details about the property, current mortgage terms, reasons for remortgaging, income details, and any other relevant financial information.

Fill out your guide to your remortgage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Guide To Your Remortgage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.