Get the free Tax Ch 1 FlashcardsQuizlet

Show details

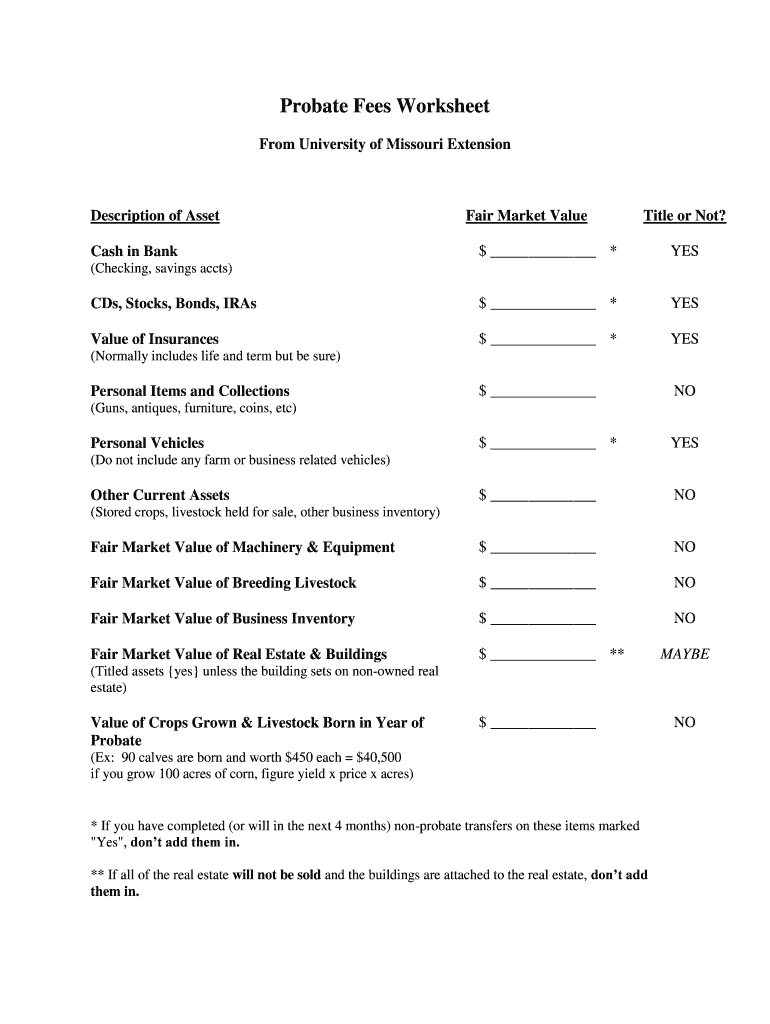

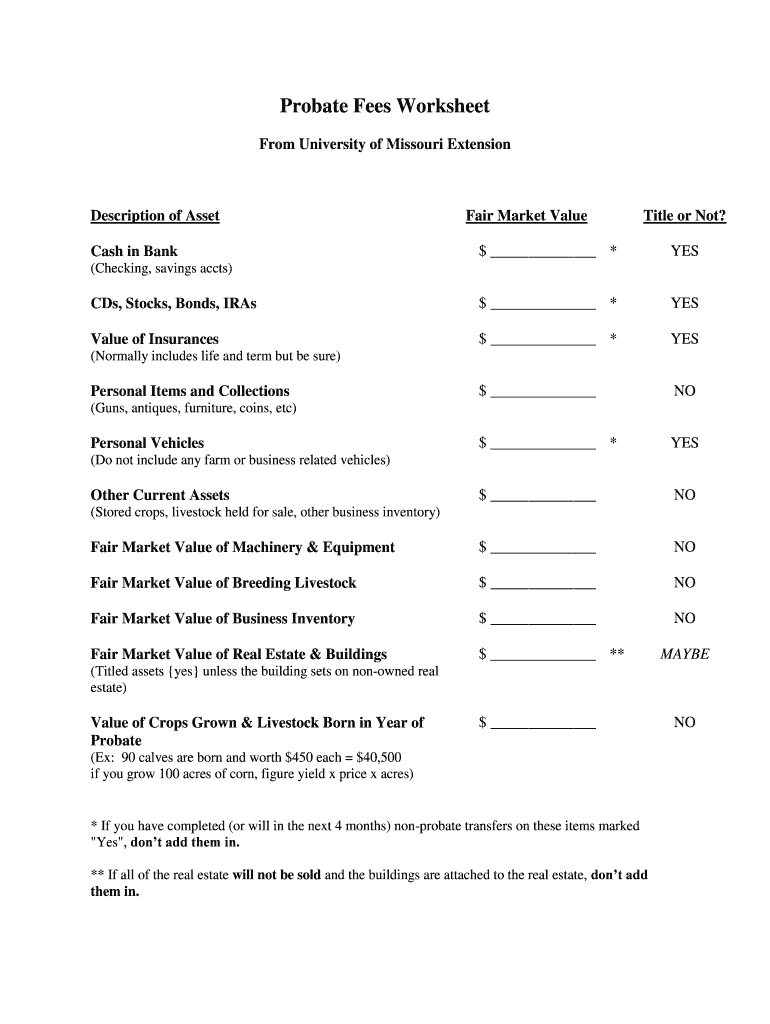

Probate Fees Worksheet From University of Missouri ExtensionDescription of Austere Market ValueTitle or Not?$ *YES CDs, Stocks, Bonds, IRAs *Devalue of Insurances *YES NOT *YES Nosier Market Value

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax ch 1 flashcardsquizlet

Edit your tax ch 1 flashcardsquizlet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax ch 1 flashcardsquizlet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax ch 1 flashcardsquizlet online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax ch 1 flashcardsquizlet. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax ch 1 flashcardsquizlet

How to fill out tax ch 1 flashcardsquizlet

01

To fill out tax ch 1 flashcards on Quizlet, follow these steps:

02

Login to your Quizlet account or create a new account if you don't have one.

03

Go to the 'Create' tab on the Quizlet homepage.

04

Click on 'New Flashcards' to create a new flashcard set.

05

Enter the title of your flashcard set, such as 'Tax Chapter 1'.

06

Click 'Add term' to enter the term or question for the flashcard.

07

Enter the definition or answer for the flashcard in the corresponding field.

08

Click 'Add another' to add more flashcards to the set.

09

You can also click 'Import from Word, Excel, Google Docs, etc.' to import flashcards from other sources.

10

Once you have added all the flashcards, click 'Create' to save the flashcard set.

11

You can now study and review the tax ch 1 flashcards by clicking on the set from your Quizlet dashboard.

Who needs tax ch 1 flashcardsquizlet?

01

Tax ch 1 flashcards on Quizlet can be helpful for anyone studying or learning about tax-related topics. Some examples of people who may need tax ch 1 flashcards include:

02

- Students taking a tax course in school or college

03

- Individuals preparing for a tax certification exam

04

- Tax professionals who want to refresh their knowledge of tax laws and regulations

05

- Anyone interested in expanding their understanding of taxes and related concepts

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send tax ch 1 flashcardsquizlet for eSignature?

When you're ready to share your tax ch 1 flashcardsquizlet, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Where do I find tax ch 1 flashcardsquizlet?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific tax ch 1 flashcardsquizlet and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

How do I fill out tax ch 1 flashcardsquizlet using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign tax ch 1 flashcardsquizlet and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is tax ch 1 flashcardsquizlet?

Tax ch 1 flashcardsquizlet is a study tool used to review and memorize key concepts related to tax chapter 1.

Who is required to file tax ch 1 flashcardsquizlet?

Anyone studying tax chapter 1 can use tax ch 1 flashcardsquizlet to help reinforce their understanding of the material.

How to fill out tax ch 1 flashcardsquizlet?

To fill out tax ch 1 flashcardsquizlet, simply review the question on one side and try to recall the answer before flipping it over to check your memory.

What is the purpose of tax ch 1 flashcardsquizlet?

The purpose of tax ch 1 flashcardsquizlet is to help users improve their retention and understanding of tax chapter 1 concepts through spaced repetition and self-quizzing.

What information must be reported on tax ch 1 flashcardsquizlet?

Tax ch 1 flashcardsquizlet typically includes questions and answers related to tax principles, definitions, formulas, and examples from chapter 1 materials.

Fill out your tax ch 1 flashcardsquizlet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Ch 1 Flashcardsquizlet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.