Get the free A non-profit 501e3 organization

Show details

A nonprofit 501e3 organization Federal Tax ID# 237122200 www.portagelittleleague.org Yes, we would like to support Portage Little League in providing the children with the best possible experience

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign a non-profit 501e3 organization

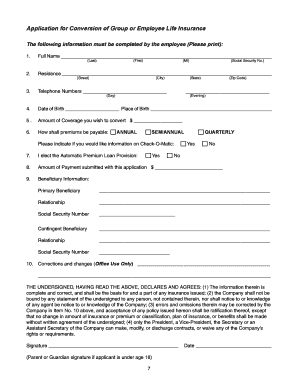

Edit your a non-profit 501e3 organization form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a non-profit 501e3 organization form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing a non-profit 501e3 organization online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit a non-profit 501e3 organization. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out a non-profit 501e3 organization

How to fill out a non-profit 501e3 organization

01

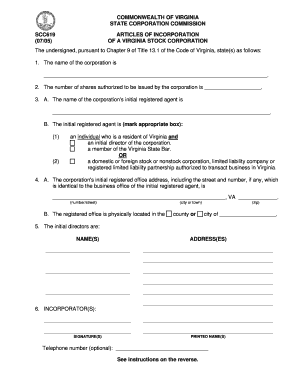

Start by researching the requirements for a non-profit 501(c)(3) organization in your country or region.

02

Create a mission statement that clearly outlines the purpose and goals of your organization.

03

Assemble a board of directors who will oversee the organization and ensure it operates in compliance with the law.

04

Register your organization's name and obtain any required licenses or permits.

05

Develop a business plan that outlines your organization's activities, funding sources, and budget.

06

Apply for tax-exempt status by filing Form 1023 or Form 1023-EZ with the appropriate government agency.

07

Establish a system for financial record-keeping and reporting to ensure transparency and accountability.

08

Create a website and social media presence to promote your organization and attract potential donors and volunteers.

09

Develop fundraising strategies and implement campaigns to secure funding for your organization's activities.

10

Regularly evaluate and assess your organization's impact and make necessary adjustments to achieve your goals.

11

Comply with all legal and reporting requirements to maintain your non-profit status.

12

Continuously engage with your community and stakeholders to build support and promote the mission of your organization.

Who needs a non-profit 501e3 organization?

01

Non-profit 501(c)(3) organizations are typically needed by individuals, groups, or communities who want to address a specific social or community need.

02

Examples of who may benefit from a non-profit 501(c)(3) organization include:

03

- Charitable organizations focusing on providing services or resources to underserved populations.

04

- Educational institutions or programs that aim to enhance access to education for disadvantaged individuals.

05

- Health organizations focused on research, prevention, or treatment of specific diseases or health conditions.

06

- Environmental or conservation groups working towards protecting natural resources and ecosystems.

07

- Arts and cultural organizations striving to promote and preserve artistic traditions.

08

- Religious or faith-based organizations seeking to provide spiritual guidance and support to their communities.

09

- Social or advocacy groups aiming to address social justice issues, human rights, or civil liberties.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find a non-profit 501e3 organization?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific a non-profit 501e3 organization and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I edit a non-profit 501e3 organization on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share a non-profit 501e3 organization on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

How do I fill out a non-profit 501e3 organization on an Android device?

On Android, use the pdfFiller mobile app to finish your a non-profit 501e3 organization. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is a non-profit 501e3 organization?

A non-profit 501(c)(3) organization is a tax-exempt organization under the Internal Revenue Code, specifically section 501(c)(3), that is organized and operated exclusively for charitable, religious, educational, scientific, or literary purposes.

Who is required to file a non-profit 501e3 organization?

Non-profit 501(c)(3) organizations are required to file with the IRS to obtain and maintain tax-exempt status.

How to fill out a non-profit 501e3 organization?

To fill out a non-profit 501(c)(3) organization, organizations need to complete and submit Form 1023 or Form 1023-EZ to the IRS.

What is the purpose of a non-profit 501e3 organization?

The purpose of a non-profit 501(c)(3) organization is to operate exclusively for charitable, religious, educational, scientific, or literary purposes, and not for the benefit of private interests.

What information must be reported on a non-profit 501e3 organization?

Non-profit 501(c)(3) organizations must report information such as their mission statement, activities, financial information, board members, and compliance with IRS regulations.

Fill out your a non-profit 501e3 organization online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

A Non-Profit 501E3 Organization is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.