Get the free Verklaring dubbelbelastingverdrag met Canada

Show details

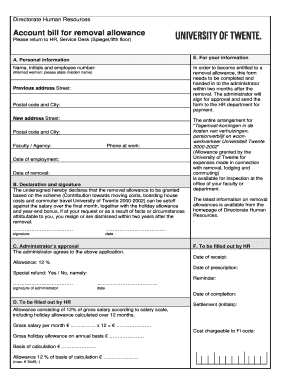

Declaring dubbelbelastingverdrag met Canada Dee declaring beveled he is formulaic NR301, en die took ingested en gehandtekend the wooden opgestuurd, same me teen ingested en gehandtekend formulaic

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign verklaring dubbelbelastingverdrag met canada

Edit your verklaring dubbelbelastingverdrag met canada form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your verklaring dubbelbelastingverdrag met canada form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit verklaring dubbelbelastingverdrag met canada online

Follow the steps below to use a professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit verklaring dubbelbelastingverdrag met canada. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out verklaring dubbelbelastingverdrag met canada

How to fill out verklaring dubbelbelastingverdrag met Canada:

01

Begin by obtaining the necessary form. The verklaring dubbelbelastingverdrag met Canada can be found on the website of the Dutch tax authorities or requested from their office.

02

Carefully read the instructions provided with the form. Make sure you understand the purpose of the form and the information required.

03

Start filling out the personal details section. Provide your full name, address, and contact information. It is essential to provide accurate and up-to-date information.

04

Specify the type of income you are referring to. The form allows you to select different categories such as employment income, self-employment income, rental income, and royalties. Choose the appropriate option according to your situation.

05

Provide details about the income in question. This may include the amount of income earned, the country in which it was earned, and any relevant tax identification numbers.

06

Indicate whether you have claimed a tax credit or exemption under the double taxation agreement between the Netherlands and Canada. If so, provide the details of the claimed credit or exemption.

07

If you have already paid taxes in Canada on the income in question, provide information about the taxes paid, including the amount and the method of payment.

08

Sign and date the form once you have completed all the required sections. Remember to review the form for any errors or omissions before submitting it.

09

Keep a copy of the completed form for your records.

Who needs verklaring dubbelbelastingverdrag met Canada:

01

Individuals who have income from Canada and want to benefit from the double taxation agreement between the Netherlands and Canada may need to fill out the verklaring dubbelbelastingverdrag met Canada.

02

This form is relevant for Dutch residents who have earned income in Canada and want to prevent double taxation, claim tax credits, or exemptions according to the provisions outlined in the bilateral tax treaty between the two countries.

03

It is important to note that the need for this form may vary depending on individual circumstances and the specific provisions of the double taxation agreement. Consulting with a tax advisor or the Dutch tax authorities can provide further guidance on whether this form is necessary for a particular situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is verklaring dubbelbelastingverdrag met canada?

Verklaring dubbelbelastingverdrag met Canada is a declaration of adherence to the double taxation treaty between the Netherlands and Canada.

Who is required to file verklaring dubbelbelastingverdrag met canada?

Individuals or entities that are residents of both the Netherlands and Canada and wish to avoid double taxation on their income.

How to fill out verklaring dubbelbelastingverdrag met canada?

The form can be filled out online on the website of the tax authorities of the Netherlands. It requires personal information, details of income sources, and proof of tax residency.

What is the purpose of verklaring dubbelbelastingverdrag met canada?

The purpose is to provide evidence to tax authorities that the taxpayer is eligible for reduced or waived withholding tax rates under the double taxation treaty.

What information must be reported on verklaring dubbelbelastingverdrag met canada?

Income sources, tax residency status, personal details, and details of income that may be subject to taxation in both countries.

How can I manage my verklaring dubbelbelastingverdrag met canada directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your verklaring dubbelbelastingverdrag met canada and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I edit verklaring dubbelbelastingverdrag met canada on an iOS device?

You certainly can. You can quickly edit, distribute, and sign verklaring dubbelbelastingverdrag met canada on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

How can I fill out verklaring dubbelbelastingverdrag met canada on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your verklaring dubbelbelastingverdrag met canada by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Fill out your verklaring dubbelbelastingverdrag met canada online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Verklaring Dubbelbelastingverdrag Met Canada is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.