Get the free RE: Yearly Compliance with the Deficit Reduction Act of 2005

Show details

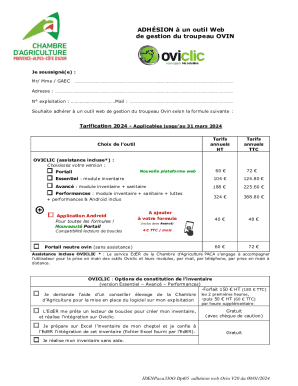

JOEL N ICO GO ELM A RY FA CLINCH IEF EXECUTIVE OFFICERGOVERN STATE OF OKLAHOMA A H HEALTH CARE AUTHOR TYO HCA 201603

January 28, 2016,

RE: Yearly Compliance with the Deficit Reduction Act of 2005

Dear

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign re yearly compliance with

Edit your re yearly compliance with form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your re yearly compliance with form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit re yearly compliance with online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit re yearly compliance with. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out re yearly compliance with

How to fill out re yearly compliance with

01

Collect all the necessary financial and business documents for the past year, such as income statements, balance sheets, and cash flow statements.

02

Review the compliance requirements specific to your industry and location. These can include reporting financial activities, filing tax returns, and maintaining certain licenses or permits.

03

Understand the deadlines for each compliance requirement and create a schedule to ensure timely submission.

04

Organize and categorize the collected documents according to the compliance requirements.

05

Fill out the necessary forms or online applications accurately and completely.

06

Double-check all the provided information for accuracy and completeness.

07

Attach any supporting documents required for each compliance item.

08

Submit the completed compliance forms and supporting documents to the appropriate authorities or regulatory bodies.

09

Keep copies of all submitted documents for your records.

10

Monitor the status of your compliance submissions and address any follow-up inquiries or requests from the authorities.

Who needs re yearly compliance with?

01

Businesses and organizations of all types and sizes may need to comply with yearly compliance requirements. This includes corporations, partnerships, sole proprietorships, non-profit organizations, and freelancers. The specific compliance obligations may vary depending on the nature of the business and the applicable laws and regulations in the country or region.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is re yearly compliance with?

Re yearly compliance is a process of ensuring that entities are meeting their regulatory obligations on an annual basis.

Who is required to file re yearly compliance with?

Entities that are subject to regulatory requirements are required to file re yearly compliance.

How to fill out re yearly compliance with?

Re yearly compliance can be filled out online or through a physical form provided by the regulatory authority.

What is the purpose of re yearly compliance with?

The purpose of re yearly compliance is to ensure that entities are operating in accordance with regulations and to maintain transparency.

What information must be reported on re yearly compliance with?

Entities must report information such as financial statements, compliance with regulations, and any changes in organizational structure.

How can I edit re yearly compliance with from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including re yearly compliance with, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make edits in re yearly compliance with without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your re yearly compliance with, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an eSignature for the re yearly compliance with in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your re yearly compliance with right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Fill out your re yearly compliance with online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Re Yearly Compliance With is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.