Get the free Deferred Income Tax Definition - Investopedia

Show details

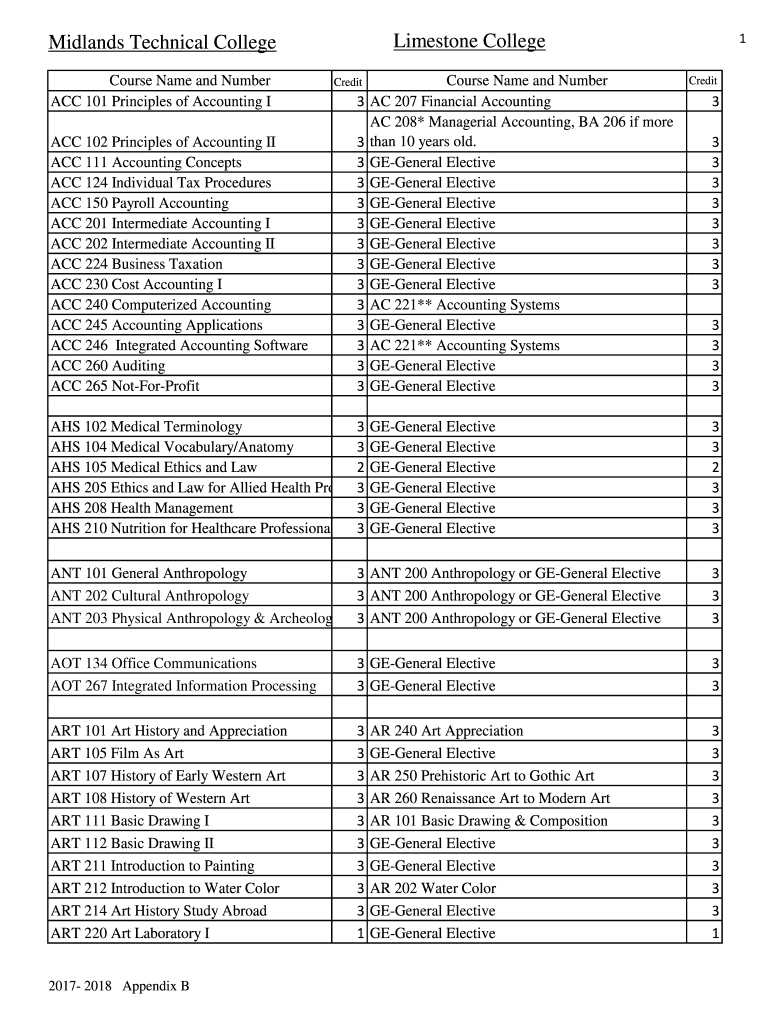

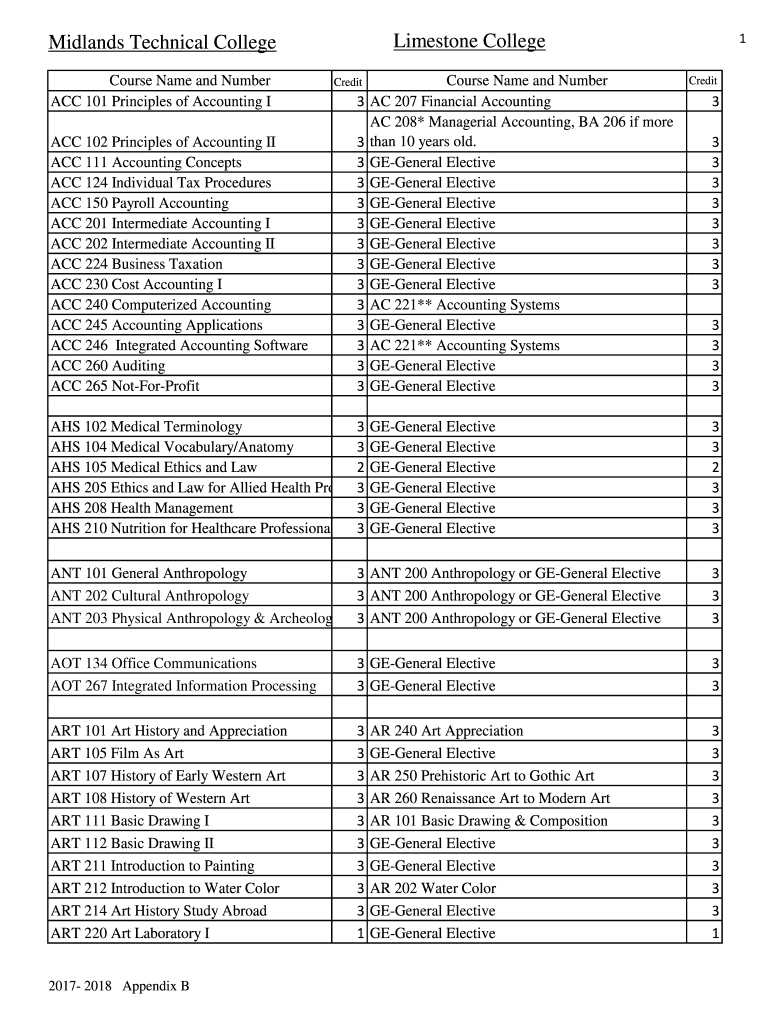

Course Name and Number

ACC 101 Principles of Accounting I1Limestone College Midlands Technical College

Credit ACC 102 Principles of Accounting II

ACC 111 Accounting Concepts

ACC 124 Individual Tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign deferred income tax definition

Edit your deferred income tax definition form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your deferred income tax definition form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing deferred income tax definition online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit deferred income tax definition. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out deferred income tax definition

How to fill out deferred income tax definition

01

To fill out deferred income tax definition, follow these steps:

02

Start by understanding the concept of deferred income tax. Deferred income tax refers to taxes that are payable in the future due to temporary differences between the accounting and taxation treatment of certain items.

03

Gather all the necessary information and documentation related to the company's financial statements, including the income statement and balance sheet.

04

Identify any temporary differences that may give rise to deferred income tax. Temporary differences can arise from factors such as timing differences between when revenue or expenses are recognized for accounting and tax purposes, or the use of different depreciation methods for accounting and tax purposes.

05

Calculate the deferred income tax liability or asset for each temporary difference. This involves determining the future tax consequences of the temporary difference and applying the appropriate tax rate.

06

Prepare the deferred income tax schedule or disclosure, which provides a breakdown of the deferred income tax liability or asset for each temporary difference.

07

Review and verify the accuracy of the deferred income tax definition. Ensure that all calculations are correct and supported by appropriate documentation.

08

Include the deferred income tax definition in the company's financial statements or financial disclosures as required by accounting standards or regulatory requirements.

09

Continuously monitor and reassess the deferred income tax definition to account for any changes in tax laws or regulations that may impact the company's tax liabilities or assets.

10

It is recommended to consult with a tax professional or accountant to ensure accurate completion of the deferred income tax definition.

Who needs deferred income tax definition?

01

Deferred income tax definition is essential for:

02

- Companies that prepare financial statements in accordance with accounting standards

03

- Companies that are subject to taxation and need to report their tax liabilities

04

- Financial analysts and investors who analyze a company's financial performance

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify deferred income tax definition without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your deferred income tax definition into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit deferred income tax definition on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as deferred income tax definition. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

How do I fill out deferred income tax definition on an Android device?

Complete your deferred income tax definition and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is deferred income tax definition?

Deferred income tax refers to taxes that are paid or received in future periods for transactions that have already occurred.

Who is required to file deferred income tax definition?

Companies and individuals who have deferred income tax liabilities or assets are required to file deferred income tax definitions.

How to fill out deferred income tax definition?

Deferred income tax definitions are filled out by calculating the difference between taxable income and accounting income and determining the tax implications.

What is the purpose of deferred income tax definition?

The purpose of deferred income tax definition is to account for differences between taxable income and accounting income that arise due to timing differences in recognizing revenue and expenses.

What information must be reported on deferred income tax definition?

Information such as taxable income, accounting income, deferred tax assets, and deferred tax liabilities must be reported on deferred income tax definition.

Fill out your deferred income tax definition online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Deferred Income Tax Definition is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.