WA LIQ-871 2019-2025 free printable template

Show details

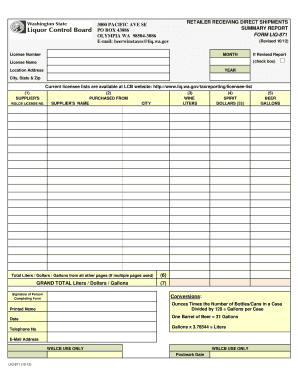

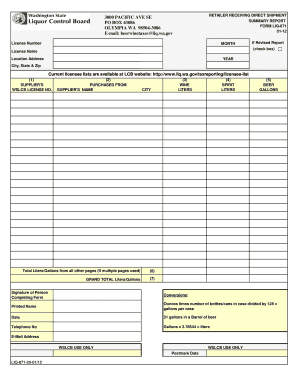

When using multiple pages of Form LIQ 871 calculate Total Wine Liters Spirit Dollars and/or Beer Gallons from all other pages and enter in the appropriate column on this line. The LIQ 871 report may be e-mailed to beerwinetaxes lcb. wa.gov. Reports may be submitted utilizing the On-Line Tax Reporting/Payment System. For Access Code and instructions contact the WSLCB Beer/Wine staff at beerwinetaxes lcb. RETAILER RECEIVING DIRECT SHIPMENTS SUMMARY REPORT PO BOX 43085 OLYMPIA WA 98504-3085...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign 871 form

Edit your liq 871 receiving direct summary download form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your washington liq871 direct shipments fill form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2019 wa liq 871 receiving direct shipments report fill online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit washington liq receiving direct shipments report print form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

WA LIQ-871 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out wa liq receiving shipments form online

How to fill out WA LIQ-871

01

Start by downloading the WA LIQ-871 form from the Washington State Liquor and Cannabis Board website.

02

Read the instructions carefully before filling out the form.

03

Provide the necessary personal and business information in the designated fields.

04

Fill in details related to the specific license or permit you are applying for.

05

Ensure that you provide any required supporting documentation as specified in the form.

06

Review all the information for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form along with any required fees to the appropriate Washington State agency.

Who needs WA LIQ-871?

01

Individuals or businesses applying for a liquor license in Washington State need to complete the WA LIQ-871 form.

02

This form is required for those seeking to establish or operate a business involving the sale or distribution of alcoholic beverages.

Fill

washington liq 871 retailer receiving direct fill

: Try Risk Free

People Also Ask about liq summary report form

How much tax is on alcohol in Washington state?

✕ Washington's general sales tax of 6.5% does not apply to the purchase of liquor. In Washington, liquor vendors are responsible for paying a state excise tax of $14.27 per gallon, plus Federal excise taxes, for all liquor sold.

Is liq 774 used to report domestic winery tax liability in Washington state?

Washington Wineries are required to submit form LIQ-774/777 WA Domestic Wine Summary Tax Report to the Board. Wineries with total taxable sales in Washington per calendar year in excess of 6,000 gallons must submit their report each month including months with no activity.

Does Washington have the highest alcohol tax?

Washington state by far has the highest excise tax rate on distilled spirits ($35.31 per gallon), followed by Oregon ($21.95), Virginia ($19.89), Alabama ($19.11) and Utah ($15.92), the Tax Foundation found. Distilled spirits are taxed the least in Wyoming and New Hampshire—less than $1 per gallon.

Which state has highest liquor tax?

Washington has the highest spirits tax in the United States at $33.22 per gallon.Alcohol Tax by State Washington - $33.22. Oregon - $21.95. Virginia - $19.89. Alabama - $19.11. Utah - $15.92. North Carolina - $14.58. Kansas - $13.03. Alaska - $12.80.

Why are Washington liquor taxes so high?

Why is our liquor tax so high? For starters, Washington state doesn't have an income tax, says Brian Smith of the Liquor and Cannabis Board. “So we rely more heavily on other so-called 'sin taxes' that tax things like alcohol, cigarettes, and now marijuana, to bring in revenue,” he said.

Is alcohol delivery legal in Washington state?

FAQs about alcohol delivery in Washington Are you sure alcohol delivery is legal? Yes, alcohol delivery is perfectly legal in the cities and states we serve. We've been helping local stores deliver beer, wine and liquor since 2012, so you can trust us that it's all above board!

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute liq 871 online?

pdfFiller makes it easy to finish and sign liq871 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make changes in wa liq871?

The editing procedure is simple with pdfFiller. Open your form liq 871 in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit state of washington form liq 871 in Chrome?

washington liq 871 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is WA LIQ-871?

WA LIQ-871 is a tax form used in Washington State for reporting and paying the liquor excise tax.

Who is required to file WA LIQ-871?

Businesses and individuals who manufacture, import, or distribute alcoholic beverages in Washington State are required to file WA LIQ-871.

How to fill out WA LIQ-871?

To fill out WA LIQ-871, gather all necessary sales and tax information related to alcoholic beverages, provide business identification details, report total sales, calculate the liquor excise tax owed, and submit the completed form to the Washington Department of Revenue.

What is the purpose of WA LIQ-871?

The purpose of WA LIQ-871 is to ensure compliance with liquor excise tax regulations in Washington State and to facilitate the collection of taxes from businesses involved in the alcohol industry.

What information must be reported on WA LIQ-871?

The information that must be reported on WA LIQ-871 includes the taxpayer's identification, total sales of alcoholic beverages, amount of liquor excise tax owed, and any exemptions or deductions applicable.

Fill out your WA LIQ-871 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Liq 871 Report is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.