Get the free CRS Avoidance vs. Legitimate Planning

Show details

CRS Avoidance vs. Legitimate Planning What is legitimate planning after the Mandatory Disclosure Rules (MDR)? What is now CRS avoidance / illegitimate planning after the MDR? Explanation of the rules

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign crs avoidance vs legitimate

Edit your crs avoidance vs legitimate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your crs avoidance vs legitimate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing crs avoidance vs legitimate online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit crs avoidance vs legitimate. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out crs avoidance vs legitimate

How to fill out crs avoidance vs legitimate

01

To fill out CRS avoidance vs legitimate, follow these steps:

02

Understand the concept of CRS avoidance vs legitimate: CRS (Common Reporting Standard) is an international standard for the automatic exchange of financial account information between tax authorities. CRS avoidance refers to the act of intentionally taking measures to avoid being reported under CRS, while CRS legitimate refers to complying with CRS requirements without engaging in any tax evasion or avoidance.

03

Identify your financial accounts: Determine which financial accounts you hold that are subject to CRS reporting. These may include bank accounts, investment accounts, insurance contracts, and certain other financial assets.

04

Review your account activity: Assess the transactions and activities associated with your financial accounts to ensure that they are in compliance with CRS regulations. Ensure that you have accurate and complete documentation for all relevant transactions.

05

Consult with a tax advisor: If you are unsure about how to properly classify your financial activities as CRS avoidance or legitimate, it is recommended to seek professional advice from a tax advisor who is knowledgeable about CRS regulations.

06

Fill out the necessary forms: Based on your assessment and consultation, accurately complete the required forms or declarations related to CRS reporting. Provide all required information truthfully and transparently.

07

Submit the forms: File the completed forms or declarations with the appropriate tax authorities as per the applicable deadlines. Follow any additional procedures or requirements specified by your jurisdiction.

08

Maintain records: Keep copies of all submitted forms, declarations, and supporting documentation for your own records. These may be required for future reference or in case of any audits or inquiries by tax authorities.

09

Stay updated: Continuously monitor changes or updates to CRS regulations and ensure ongoing compliance. Keep abreast of any new reporting obligations or requirements that may arise.

10

Note: This information is provided as a general guideline. The specific steps and requirements for filling out CRS avoidance vs legitimate may vary depending on your jurisdiction and individual circumstances. It is always advisable to consult with a qualified professional for personalized advice.

Who needs crs avoidance vs legitimate?

01

CRS avoidance vs legitimate is relevant to individuals, businesses, and financial institutions that are subject to CRS reporting requirements.

02

Individuals: Individuals with financial accounts in jurisdictions that have implemented CRS regulations need to consider whether their financial activities fall under CRS avoidance or legitimate. This may include individuals with multiple international bank accounts, offshore investment portfolios, or complex financial holdings.

03

Businesses: Businesses, especially multinational corporations or entities operating in multiple jurisdictions, need to understand and comply with CRS regulations. They must assess whether their financial activities represent CRS avoidance or legitimate business practices. It is important for businesses to ensure accurate and transparent reporting to avoid any potential penalties or legal implications.

04

Financial Institutions: Financial institutions, such as banks, investment firms, insurance companies, and trust companies, play a crucial role in implementing CRS reporting. They need to correctly identify and report the accounts held by their customers and determine whether the financial activities associated with these accounts are CRS avoidance or legitimate. Compliance with CRS regulations is essential to maintain transparency in the financial sector and prevent illicit financial activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute crs avoidance vs legitimate online?

pdfFiller makes it easy to finish and sign crs avoidance vs legitimate online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

Can I create an electronic signature for the crs avoidance vs legitimate in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an electronic signature for signing my crs avoidance vs legitimate in Gmail?

Create your eSignature using pdfFiller and then eSign your crs avoidance vs legitimate immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

What is crs avoidance vs legitimate?

CRS avoidance involves deliberately avoiding reporting information required by the Common Reporting Standard (CRS) while legitimate reporting involves accurately reporting all required information.

Who is required to file crs avoidance vs legitimate?

Financial institutions and certain other entities are required to file CRS reports, either for legitimate purposes or to avoid penalties for non-compliance.

How to fill out crs avoidance vs legitimate?

To fill out CRS reports for legitimate purposes, financial institutions must accurately report all required information while those attempting to avoid reporting may provide false or misleading information.

What is the purpose of crs avoidance vs legitimate?

The purpose of legitimate CRS reporting is to ensure compliance with international tax transparency standards, while the purpose of avoiding CRS reporting is to evade tax reporting requirements.

What information must be reported on crs avoidance vs legitimate?

In CRS reports, information such as account balances, interest income, and account holders' identification details must be reported, either legitimately or in an attempt to avoid reporting.

Fill out your crs avoidance vs legitimate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Crs Avoidance Vs Legitimate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

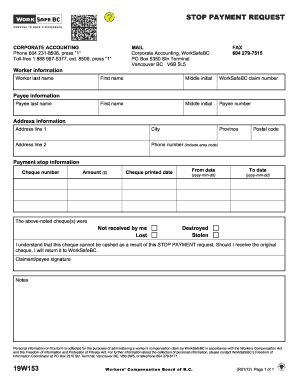

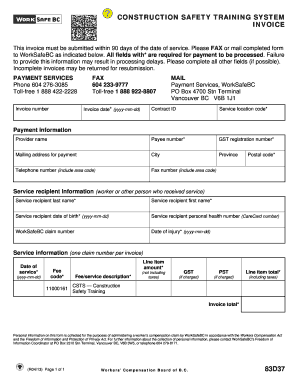

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.