Get the free LOAN REQUESTS

Show details

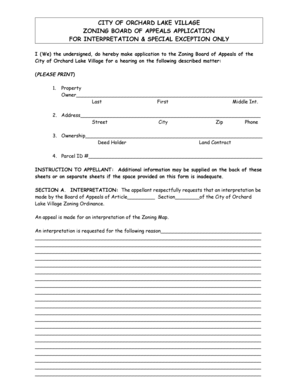

20152016 DIRECT LOAN REQUEST FORM Student Names: Student ID# Email: Home/Cell Phone LOAN REQUESTS ANN Federal Subsidized Direct Loan: Reduce my previously accepted loan to the following amount $ Increase

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan requests

Edit your loan requests form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan requests form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan requests online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit loan requests. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan requests

How to fill out loan requests

01

Start by gathering all the required documents and information. This usually includes your personal identification, proof of income, employment details, and any additional documents requested by the lender.

02

Research different lenders and compare their loan terms, interest rates, and repayment options. This will help you choose the most suitable option for your needs.

03

Once you have selected a lender, visit their website or branch office to access the loan application form.

04

Fill out the application form accurately and completely. Double-check all the provided information to avoid any mistakes.

05

Attach or upload the required documents as instructed. Make sure to provide clear and legible copies.

06

Review the terms and conditions of the loan carefully before submitting the application. Ensure that you understand the repayment schedule, interest rates, and any applicable fees.

07

Submit the completed application form and documents either online or through a physical submission method, depending on the lender's preference.

08

Wait for the lender to review your application. This may take some time, so be patient.

09

If approved, carefully review the loan offer and any associated paperwork. Make sure you understand the terms and conditions before accepting the loan.

10

If you decide to proceed, sign the necessary documents, and if required, provide any additional requested information.

11

Once all the formalities are complete, the loan amount will be disbursed to you either through a bank transfer or other agreed-upon method.

12

Make sure to keep track of your loan repayments and adhere to the agreed-upon schedule. Missing payments can result in additional fees or negatively impact your credit score.

13

If you face any difficulties or have questions during the loan repayment period, contact your lender for assistance.

Who needs loan requests?

01

Individuals who require financial assistance for various purposes, such as purchasing a home, paying for education expenses, starting a business, covering medical bills, or consolidating debt, often need loan requests. Loan requests are commonly made by people who do not have immediate access to sufficient funds and need to borrow money from financial institutions or lenders. It is important to note that the eligibility criteria and requirements for loan approval may vary depending on the lender and the type of loan being sought.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send loan requests to be eSigned by others?

When your loan requests is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Where do I find loan requests?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the loan requests in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I fill out loan requests on an Android device?

Complete your loan requests and other papers on your Android device by using the pdfFiller mobile app. The program includes all of the necessary document management tools, such as editing content, eSigning, annotating, sharing files, and so on. You will be able to view your papers at any time as long as you have an internet connection.

What is loan requests?

Loan requests are formal applications made by individuals or organizations to borrow money from a financial institution.

Who is required to file loan requests?

Any individual or organization seeking to borrow money from a financial institution is required to file loan requests.

How to fill out loan requests?

Loan requests can typically be filled out online or in person at the financial institution. The form will require information about the borrower's financial situation and the purpose of the loan.

What is the purpose of loan requests?

The purpose of loan requests is to formally request funds from a financial institution for a specific purpose, such as starting a business, buying a home, or funding a project.

What information must be reported on loan requests?

Information that must be reported on loan requests typically includes the amount of money requested, the purpose of the loan, the borrower's financial situation, and any collateral offered.

Fill out your loan requests online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Requests is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.