Get the free Business: Accounting (AAS)

Show details

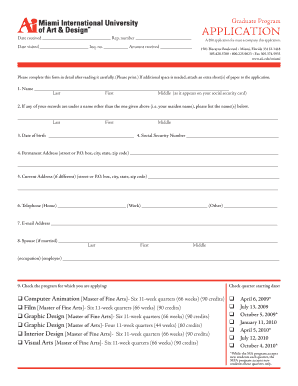

New River Community & Technical College Associate of Applied Science Business: Accounting (AAS) 20182019 Catalog Student Name Student ID # CourseTitleCreditsGradeQual. Pts. First Semester ACCT 201

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business accounting aas

Edit your business accounting aas form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business accounting aas form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit business accounting aas online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit business accounting aas. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business accounting aas

How to fill out business accounting aas

01

To fill out business accounting aas, follow these steps:

02

Gather all the necessary financial documents such as invoices, receipts, bank statements, and payroll records.

03

Organize the documents by category, such as sales, expenses, assets, and liabilities.

04

Input all the financial transactions into an accounting software or spreadsheet.

05

Categorize and classify each transaction correctly according to the Generally Accepted Accounting Principles (GAAP).

06

Reconcile the bank statements with the recorded transactions to ensure accuracy.

07

Prepare financial statements including the income statement, balance sheet, and cash flow statement.

08

Analyze the financial data to gauge the performance and profitability of the business.

09

Keep track of the financial records regularly and update them whenever there are new transactions.

10

Consult with a professional accountant or a tax advisor if needed to ensure compliance with tax regulations.

11

Review the financial statements periodically to identify any areas for improvement or potential risks.

12

Make any necessary adjustments or corrections to the accounting records.

13

Finally, store the completed accounting records securely for future reference or potential audits.

Who needs business accounting aas?

01

Business accounting aas is needed by various individuals and entities including:

02

- Small business owners who want to track their income, expenses, and profit/loss.

03

- Entrepreneurs who need accurate financial data for making informed business decisions.

04

- Startups and growing companies seeking funding or investors who require detailed financial statements.

05

- Self-employed individuals who need to report their income and expenses for tax purposes.

06

- Non-profit organizations that must maintain transparent financial records for grant applications or audits.

07

- Freelancers or independent contractors who want to manage their accounts effectively and track their earnings.

08

- Accountants or financial professionals who offer accounting services to businesses.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in business accounting aas without leaving Chrome?

business accounting aas can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I sign the business accounting aas electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your business accounting aas in seconds.

How do I complete business accounting aas on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your business accounting aas. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is business accounting aas?

Business accounting AAS (Accounting as a Service) is a type of outsourced accounting service where a professional accounting firm manages the financial tasks for a business.

Who is required to file business accounting aas?

Businesses of all sizes and types can benefit from filing business accounting AAS. It is especially useful for small businesses that may not have the resources to maintain a full-time accounting department.

How to fill out business accounting aas?

To fill out business accounting AAS, businesses can hire a professional accounting firm to handle their financial tasks and reports. Alternatively, they can use accounting software to input their financial information and generate reports.

What is the purpose of business accounting aas?

The purpose of business accounting AAS is to ensure that a business's financial activities are accurately recorded and monitored. This can help businesses make informed decisions, comply with tax regulations, and track their financial performance.

What information must be reported on business accounting aas?

Business accounting AAS typically includes reporting on income, expenses, assets, liabilities, cash flow, and other financial metrics that are important for the business's financial health.

Fill out your business accounting aas online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Accounting Aas is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.