Get the free Hotel Excise Tax Exemption Certificate.docx

Show details

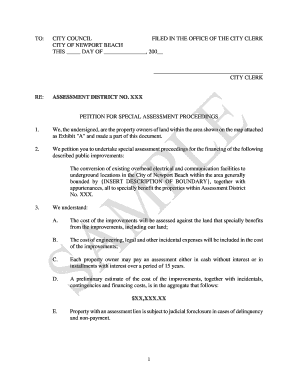

Print Formulae Form COUNTY OF MERCER HOTEL EXCISE TAX EXEMPTION CERTIFICATEName of Establishment Street CityStateZip CodeEITHER #1, #2, #3 OR #4 MUST BE CHECKED. () 1. Permanent Resident: Person has

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hotel excise tax exemption

Edit your hotel excise tax exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hotel excise tax exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing hotel excise tax exemption online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit hotel excise tax exemption. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hotel excise tax exemption

How to fill out hotel excise tax exemption

01

Obtain the necessary forms. Contact the hotel or tax authority to request the appropriate forms to fill out for the hotel excise tax exemption.

02

Provide your business information. Fill out the forms with accurate and complete details about your business, including its name, address, and taxpayer identification number.

03

Specify the purpose of exemption. Clearly state the purpose for which you are seeking the hotel excise tax exemption, such as if it's for a specific event, official government business, or a qualifying organization.

04

Provide supporting documentation. Attach any necessary supporting documents to the forms, such as official event invitations, government identification, or nonprofit organization certifications.

05

Submit the completed forms. Submit the filled-out forms and supporting documentation to the designated authority or the hotel for review and processing.

06

Follow up on the status. Inquire about the status of your hotel excise tax exemption request if necessary, and ensure that all required steps have been completed.

07

Maintain proper records. Keep copies of all submitted forms, supporting documents, and any correspondence related to the hotel excise tax exemption for future reference and audits.

08

Renew or update as needed. If the exemption is temporary or requires periodic renewal, make sure to submit the necessary renewal or updated forms within the required timeframe.

Who needs hotel excise tax exemption?

01

Nonprofit organizations: Nonprofit organizations often qualify for hotel excise tax exemption when conducting approved activities or events.

02

Official government entities: Government entities, including federal, state, or local agencies, may be eligible for hotel excise tax exemption when traveling for official business.

03

Diplomatic guests: Diplomats, representatives of foreign governments, or international organizations may enjoy hotel excise tax exemption as per diplomatic privileges and immunities.

04

Participants of qualifying events: Individuals or groups participating in specific events or conferences approved for hotel excise tax exemption may be eligible.

05

Certain business travelers: In some cases, business travelers on official duty, attending conferences, or representing qualifying organizations may be able to claim hotel excise tax exemption.

06

It's important to note that eligibility requirements for hotel excise tax exemption may vary depending on the jurisdiction and specific regulations in place. It's advisable to consult with the relevant tax authority or seek professional advice for accurate and up-to-date information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit hotel excise tax exemption in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing hotel excise tax exemption and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How can I edit hotel excise tax exemption on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit hotel excise tax exemption.

How do I complete hotel excise tax exemption on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your hotel excise tax exemption. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is hotel excise tax exemption?

Hotel excise tax exemption is a tax relief measure that exempts certain hotels from paying excise taxes on their services.

Who is required to file hotel excise tax exemption?

Hotels that meet specific criteria set by the tax authorities are required to file for hotel excise tax exemption.

How to fill out hotel excise tax exemption?

Hotel owners or managers can fill out the hotel excise tax exemption form provided by the tax authorities with all the necessary information and submit it according to the guidelines.

What is the purpose of hotel excise tax exemption?

The purpose of hotel excise tax exemption is to provide tax relief to certain hotels in order to support the tourism industry and encourage economic growth.

What information must be reported on hotel excise tax exemption?

The hotel excise tax exemption form may require information such as the hotel's location, number of rooms, annual revenue, and other specific details as specified by the tax authorities.

Fill out your hotel excise tax exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hotel Excise Tax Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.