NY Publication 910 2018 free printable template

Show details

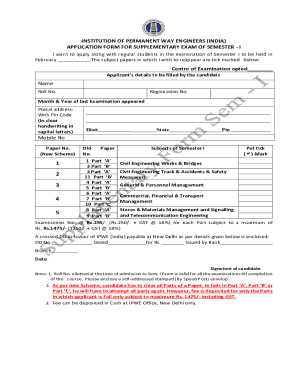

Publication 910 (6/18)NAILS Codes for Principal Business Activity for New York State Tax Purposes The following list includes North American Industry Classification System (NAILS) codes for New York

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY Publication 910

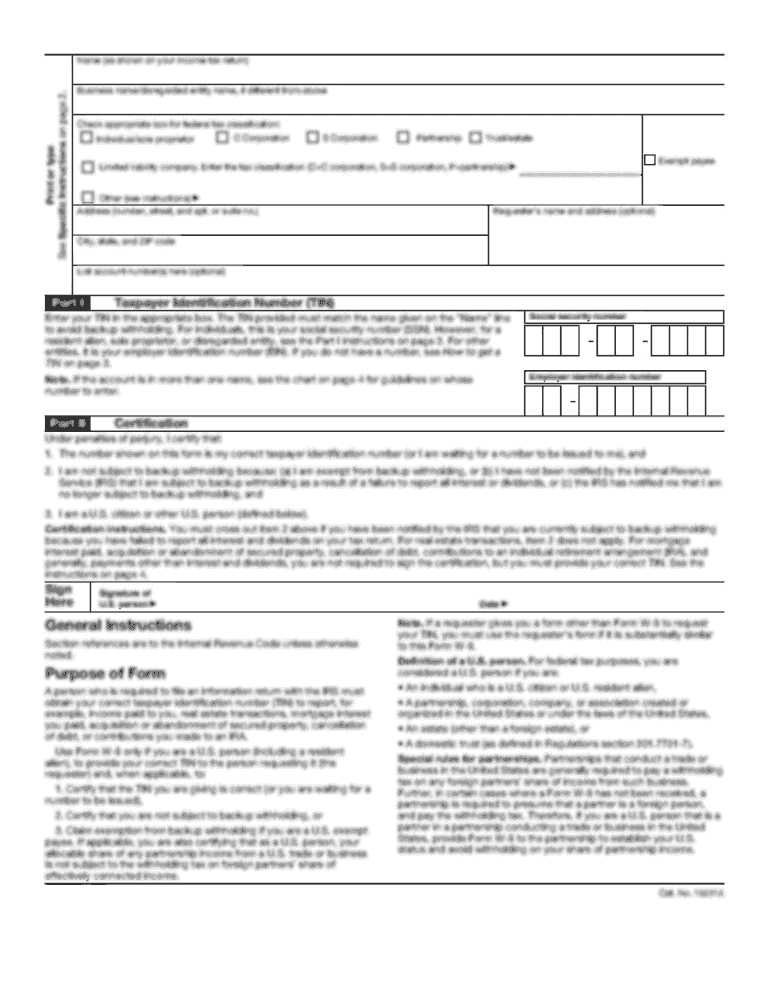

Edit your NY Publication 910 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY Publication 910 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY Publication 910 online

Use the instructions below to start using our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NY Publication 910. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY Publication 910 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY Publication 910

How to fill out NY Publication 910

01

Obtain a copy of NY Publication 910 from the New York State Department of Taxation and Finance website.

02

Read the introduction to understand the purpose of the publication.

03

Identify the specific forms or schedules that are needed based on your tax situation.

04

Follow the step-by-step instructions provided for filling out each section of the form.

05

Ensure that you have all necessary documentation, such as income statements and expense receipts, to complete the form accurately.

06

Review the completed form for any errors or omissions.

07

Submit the filled-out form according to the submission guidelines outlined in the publication.

Who needs NY Publication 910?

01

Taxpayers in New York State who need instructions for reporting certain types of income or deductions.

02

Individuals or businesses filing New York State tax returns and needing guidance on specific forms.

03

Tax professionals assisting clients with New York State tax filings.

Fill

form

: Try Risk Free

People Also Ask about

What is the principal business activity code for 2023?

As of January 25, 2023, the Instructions for Schedule C (Form 1040) have been revised to provide the updated principal business activity code for an unclassified establishment. The code has changed from 999999 to 999000. Individual filers can use either 999999 or 999000. Business filers must use 999000.

What is New York business tax?

New York Tax Rates, Collections, and Burdens New York has a 6.50 percent to 7.25 percent corporate income tax rate. New York has a 4.00 percent state sales tax rate, a max local sales tax rate of 4.875 percent, and an average combined state and local sales tax rate of 8.52 percent.

How much do small businesses pay in taxes New York?

Net income taxed at 7.1% (or 6.5%, depending on total net income) Business capital taxed at 0.15% Minimum taxable income taxed at 1.5% Fixed dollar minimum tax with flat rates on gross income.

What is the tax rate for LLC in NY?

For New York limited liability companies, limited liability partnerships, and general partnerships, corporate income tax is referred to simply as a “filing fee.”Entire Net Income. Federal Taxable IncomeENI Tax Rate$290,000 or less6.5%more than $290,000 but not more than $390,0007.1%More than $390,0004.35%

What is business activity code number?

In the US, a business activity code (sometimes referred to as business code, or professional activity code) is a six-digit code that classifies the type of products or services a business offers. It categorizes businesses by their activity and industry.

What is the principal business activity code 519100?

NAICS 519100 - Other Information Services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit NY Publication 910 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your NY Publication 910 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I edit NY Publication 910 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute NY Publication 910 from anywhere with an internet connection. Take use of the app's mobile capabilities.

How do I complete NY Publication 910 on an Android device?

On an Android device, use the pdfFiller mobile app to finish your NY Publication 910. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is NY Publication 910?

NY Publication 910 is a document issued by the New York State Department of Taxation and Finance that provides guidelines regarding the New York State Personal Income Tax and certain tax credits.

Who is required to file NY Publication 910?

Individuals who are claiming certain tax credits or need to report specific income adjustments in New York State are required to file NY Publication 910.

How to fill out NY Publication 910?

To fill out NY Publication 910, individuals should obtain the publication from the New York State Department of Taxation and Finance website, follow the instructions provided, and complete the required sections based on their tax situation.

What is the purpose of NY Publication 910?

The purpose of NY Publication 910 is to inform taxpayers about available tax credits, eligibility requirements, and the process for claiming them in New York State.

What information must be reported on NY Publication 910?

Information required on NY Publication 910 includes personal identification details, income sources, applicable tax credits, and any necessary supporting documentation.

Fill out your NY Publication 910 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY Publication 910 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.