MD Homeownership Information Packet 2018 free printable template

Get, Create, Make and Sign MD Homeownership Information Packet

Editing MD Homeownership Information Packet online

Uncompromising security for your PDF editing and eSignature needs

MD Homeownership Information Packet Form Versions

How to fill out MD Homeownership Information Packet

How to fill out MD Homeownership Information Packet

Who needs MD Homeownership Information Packet?

Instructions and Help about MD Homeownership Information Packet

Maryland is pouring resources into a popular initiative that health borrowers with significant student loan debt to move with the homeownership or Sean Metzger standing by at the State Department of Housing headquarters in New Carrollton with more I'm here with Tiffany Robinson who heads the community development administration for Maryland's Department of Housing and Community Development, and today we're talking about a fairly new initiative that essentially aims to move young people out of the parents basement and into homeownership tell us about this initiative it's called to've earned it initiative it's an innovative program in the state of Maryland and frankly across the nation to address the student debt crisis in America it really turns a DE- of the student loan crisis into a positive of homeownership by offering low interest rates to students with $25,000 or more of student debt now has the response been to this initiative which was established back in May well it could, we committed 20 million dollars in funds and that was depleted within less than two months it was wildly successful seventy-seven percent of the people accessing the program or Millennials average age of 30 average household size of two which is a little smaller and a little younger than our typical home buyer, so the state is expanding the shin dish active since it's been so popular, and it's now moving into a second phase with more funding tell us about that that's correct it was so successful that we've now allocated 70 million additional dollars to the program the terms are a little different it's a quarter percent under market rate with $5,000 down payment assistance, and we're waving our Maryland mortgage credit certificate which is actually up to two thousand dollars of a tax credit which is much more valuable than a deduction and that's available to the home buyer for the life of the loan how can people find out if they're eligible they can go to our website, and you have our 1-800 number they can also like I said when they call the office we have people that will walk them through these mortgages are available to people purchasing homes in sustainable communities, so we have a map available online that they can put in the address and find out if the home they're looking to buy is within one of those communities, and you were telling me that this comes on the heels of another initiative that you've been working on here in France George's County talk to us about that that's right it actually comes right on the heels of a wildly successful initiative called the triple play it was a partnership between our department the housing the Department of Housing and Community Development and the Prince George's County we received six million dollars from the county from attorney general's settlement and put in our own funds for a similar type initiative where we had a lower interest rate waiver of our credit certificate and offered down payment assistance we also offered...

People Also Ask about

Who qualifies as a first-time home buyer in Maryland?

How can I buy a house with no money down in Maryland?

How much do you have to put down to buy a house in Maryland?

Does MD have a first time home buyer program?

Do first-time home buyers need a down payment in Maryland?

What qualifies you as a first-time home buyer in Maryland?

How does the Maryland first-time home buyer program work?

How much do I have to put down on a $300 000 house?

How much money do I need to buy a house in MD?

Can I buy a house with no money down in Maryland?

Does MD have a first-time home buyer program?

How can I get money for a downpayment?

Does Maryland have a down payment assistance program?

How much of a down payment do I need for a $250000 house?

What is the minimum down payment for a house in Maryland?

What benefits do first-time home buyers get in Maryland?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in MD Homeownership Information Packet without leaving Chrome?

Can I edit MD Homeownership Information Packet on an iOS device?

How do I edit MD Homeownership Information Packet on an Android device?

What is MD Homeownership Information Packet?

Who is required to file MD Homeownership Information Packet?

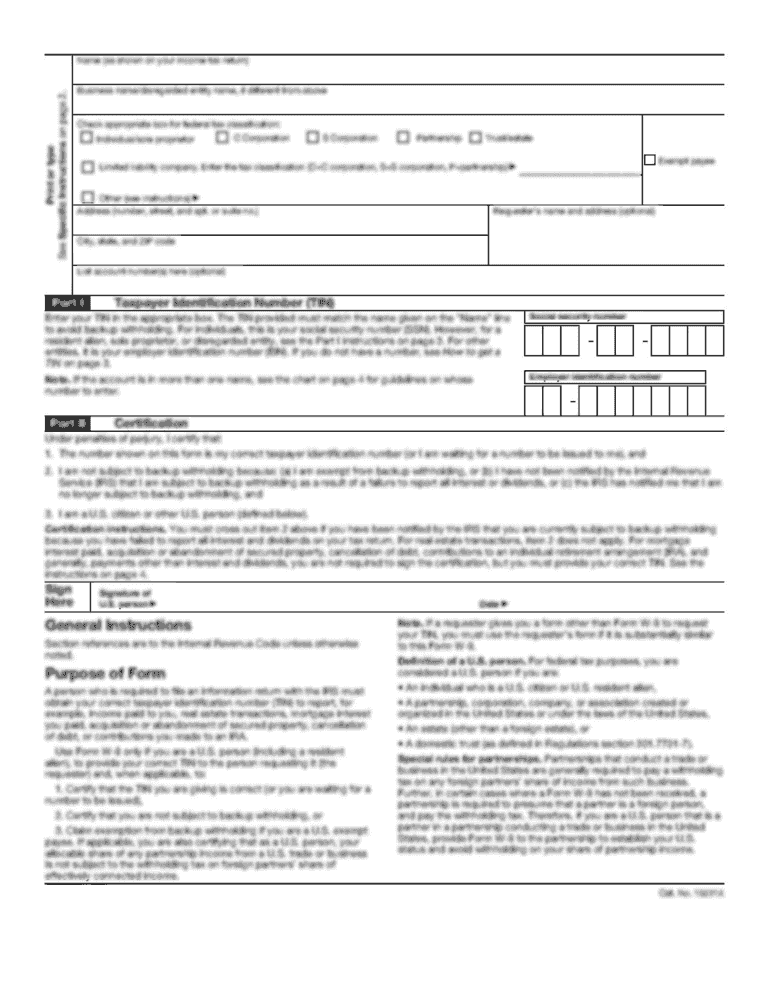

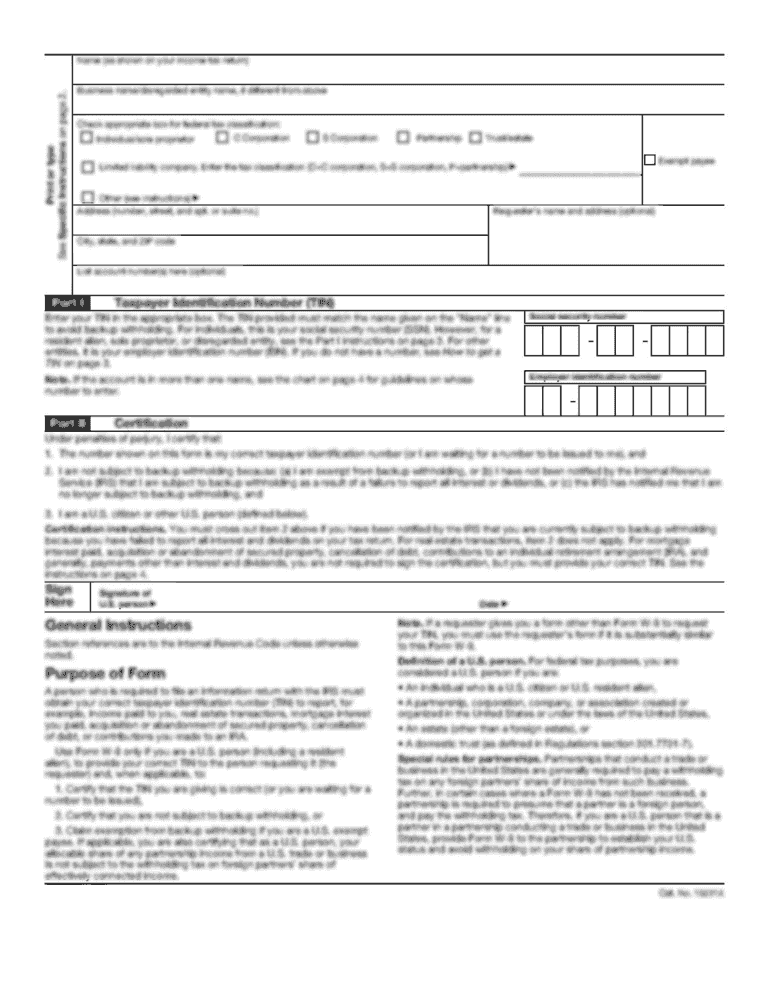

How to fill out MD Homeownership Information Packet?

What is the purpose of MD Homeownership Information Packet?

What information must be reported on MD Homeownership Information Packet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.