VA DoT ST-11 2019 free printable template

Show details

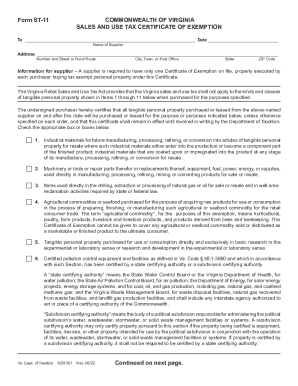

Form ST11COMMONWEALTH OF VIRGINIA SALES AND USE TAX CERTIFICATE OF EXEMPTION To Date Name of SupplierAddress Number and Street or Rural Posterity, Town, or Post OfficeStateZIP Conformation for supplier

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VA DoT ST-11

Edit your VA DoT ST-11 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VA DoT ST-11 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing VA DoT ST-11 online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit VA DoT ST-11. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA DoT ST-11 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VA DoT ST-11

How to fill out VA DoT ST-11

01

Begin by downloading the VA DoT ST-11 form from the Department of Veterans Affairs website.

02

Provide your personal information in the designated sections, including your full name, address, and contact details.

03

Fill in your service details, including your service number, branch of service, and dates of service.

04

Detail any disability claims or conditions for which you are seeking assistance.

05

Review all information for accuracy and completeness.

06

Sign and date the form at the designated area.

07

Submit the completed form as instructed, either electronically or via mail to the appropriate department.

Who needs VA DoT ST-11?

01

Veterans seeking benefits or services related to their military service.

02

Individuals applying for disability compensation from the Department of Veterans Affairs.

03

Those who require assistance with transitioning to civilian life after military service.

Instructions and Help about VA DoT ST-11

Fill

form

: Try Risk Free

People Also Ask about

Does Virginia have sales tax exemption?

Virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. A common exemption is “purchase for resale,” where you buy something with the intent of selling it to someone else.

How do I get a US sales tax exemption certificate?

To apply for an initial or renewal tax exemption card, eligible missions and their members should submit an application on the Department's E-Government (E-Gov) system. Applications are generally processed within five business days.

What is the VA form for tax exemption?

How Do I Apply? Form BOE-261-G, Claim for Disabled Veterans' Property Tax Exemption, must be used when claiming this exemption on a property for the very first time for both the basic and the low-income Disabled Veterans' Exemption. The claim form is available by contacting your county assessor.

What is tax exemption certificate in USA?

Sales tax exemption certificates enable a purchaser to make tax-free purchases that would normally be subject to sales tax. The purchaser fills out the certificate and gives it to the seller.

What is the Virginia sales tax exemption?

Virginia law allows businesses to purchase things without paying sales tax if they or their purchase meet certain criteria. A common exemption is “purchase for resale,” where you buy something with the intent of selling it to someone else.

Can you file exempt in Virginia?

Virginia allows an exemption of $930* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption. For married couples, each spouse is entitled to an exemption. When using the Spouse Tax Adjustment, each spouse must claim his or her own personal exemption.

How to fill out a VA ST 10?

How to fill out a Virginia ST-10. Date the form at the top. Name of dealer should be your registered business name. Virginia Account Number should be your registered business number in Virginia. Address should be the registered address of your company.

How do I claim exemptions on my tax form?

To claim exempt, write EXEMPT under line 4c. You may claim EXEMPT from withholding if: o Last year you had a right to a full refund of All federal tax income and o This year you expect a full refund of ALL federal income tax.

What is a VA retail sales and Use Tax Certificate of exemption?

Exemption Certificates The exemption prevents the tax being applied on goods as they are distributed before being sold at retail. A dealer who makes a sale without charging applicable sales tax must retain a copy of the exemption certificate on file to substantiate the sale was tax exempt under the law.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my VA DoT ST-11 in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your VA DoT ST-11 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit VA DoT ST-11 straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing VA DoT ST-11.

Can I edit VA DoT ST-11 on an Android device?

You can edit, sign, and distribute VA DoT ST-11 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is VA DoT ST-11?

VA DoT ST-11 is a form used by the Virginia Department of Taxation for the reporting of sales and use tax for certain business transactions within the state.

Who is required to file VA DoT ST-11?

Businesses making taxable sales or using taxable items in Virginia are required to file VA DoT ST-11.

How to fill out VA DoT ST-11?

To fill out VA DoT ST-11, gather all relevant sales data, complete the form with accurate figures for sales and use tax, and submit it according to the instructions provided by the Virginia Department of Taxation.

What is the purpose of VA DoT ST-11?

The purpose of VA DoT ST-11 is to ensure proper reporting and collection of sales and use tax in Virginia, helping to maintain compliance with state tax laws.

What information must be reported on VA DoT ST-11?

The information that must be reported on VA DoT ST-11 includes total sales, the amount of sales tax collected, the type of items sold, and any applicable exemptions.

Fill out your VA DoT ST-11 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA DoT ST-11 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.