Get the free General Liability Loss Claim Form Instructions

Show details

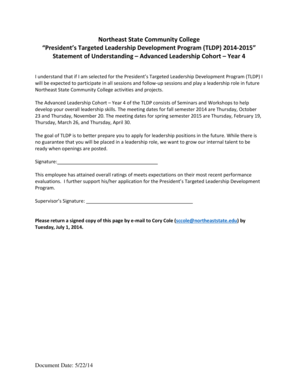

ADMINISTRATIVE OFFICES 1307 Croquet Avenue, Croquet MN 55720 Phone: 2188793347 Fax: 2188796555 www.cloquetmn.govGeneral Liability Loss Claim Form Instructions Complete the claim form as fully as possible.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign general liability loss claim

Edit your general liability loss claim form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your general liability loss claim form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing general liability loss claim online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit general liability loss claim. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out general liability loss claim

How to fill out general liability loss claim

01

To fill out a general liability loss claim, follow these steps:

02

Gather all necessary information: Collect all relevant information about the incident, including the date and time it occurred, the location, and any witnesses.

03

Contact your insurance company: Notify your insurance company about the incident as soon as possible. They will provide you with the necessary claim forms and instructions.

04

Fill out the claim form: Complete the claim form accurately and provide all requested information. Make sure to include details about the incident, damages, and any injuries or property loss that occurred.

05

Attach supporting documentation: Include any supporting documentation that might be required, such as photographs, police reports, medical bills, or repair estimates.

06

Submit the claim: Once you have completed the claim form and attached all necessary documentation, submit it to your insurance company following their instructions. Keep copies of all documents for your records.

07

Follow up with the insurance company: Stay in contact with your insurance company to ensure that your claim is being processed and to provide any additional information or documentation that they may request.

08

Await claim resolution: Depending on the complexity of the claim, it may take some time for the insurance company to process and evaluate your claim. Be patient and follow up regularly for updates.

09

Receive claim settlement: If your claim is approved, you will receive a settlement from your insurance company to cover the damages or losses incurred.

10

Note: It is always recommended to consult with your insurance agent or adjuster for specific instructions and guidance on filling out a general liability loss claim.

Who needs general liability loss claim?

01

General liability loss claims may be needed by:

02

Business owners: A general liability loss claim can be filed by business owners who have a comprehensive general liability insurance policy. This policy provides coverage for a variety of incidents, including property damage, bodily injury, and personal injury claims that may arise during business operations.

03

Individuals: Individuals who have personal liability insurance coverage may also need to file a general liability loss claim if they are held responsible for causing damage, injury, or harm to others.

04

Contractors and professionals: Contractors, construction companies, and professionals such as doctors, lawyers, and consultants may need to file general liability loss claims if they are faced with legal actions, property damage claims, or allegations of professional negligence.

05

It is important to note that the specific circumstances and insurance coverage will determine if filing a general liability loss claim is appropriate. It is advisable to consult with your insurance provider or agent if you are unsure about whether you need to file a claim.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my general liability loss claim directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your general liability loss claim and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How can I get general liability loss claim?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the general liability loss claim in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out the general liability loss claim form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign general liability loss claim and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is general liability loss claim?

General liability loss claim is a claim made by a business or individual against their insurance policy to cover costs associated with liability claims.

Who is required to file general liability loss claim?

Any business or individual who has general liability insurance coverage and experiences a loss that is covered under the policy is required to file a general liability loss claim.

How to fill out general liability loss claim?

To fill out a general liability loss claim, the insured must provide details of the loss, including date, time, location, nature of the claim, and any other relevant information requested by the insurance company.

What is the purpose of general liability loss claim?

The purpose of a general liability loss claim is to request coverage from an insurance company for costs associated with liability claims against the insured.

What information must be reported on general liability loss claim?

The information reported on a general liability loss claim typically includes details of the loss, date, time, location, nature of the claim, contact information, and any supporting documents or evidence.

Fill out your general liability loss claim online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

General Liability Loss Claim is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.