IN State Form 49465 2017-2025 free printable template

Show details

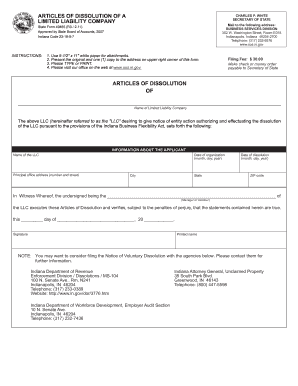

Reset Formatives OF DISSOLUTION OF A

LIMITED LIABILITY COMPANYSECRETARY OF STATE

BUSINESS SERVICES DIVISION

302 West Washington Street, Room E018

Indianapolis, IN 46204

Telephone: (317) 2326576

www.sos.in.govState

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign in form 49465 dissolution limited

Edit your indiana form 49465 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dissolution indiana get form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing indiana state form 49465 articles dissolution liability blank online

To use the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit state dissolution indiana form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IN State Form 49465 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out dissolution indiana form

How to fill out IN State Form 49465

01

Obtain IN State Form 49465 from the official website or local government office.

02

Carefully read the instructions provided on the form to understand specific requirements.

03

Fill out your personal information in the designated sections, including your name, address, and contact details.

04

Provide additional required information, such as the purpose of the form and any relevant identification numbers.

05

Review the form for completeness and accuracy to ensure all sections are filled.

06

Sign and date the form in the appropriate section.

07

Submit the completed form to the appropriate department or office as specified in the instructions.

Who needs IN State Form 49465?

01

Individuals seeking to apply for or update their information related to a specific legal or governmental process in Indiana.

02

Businesses or organizations that are required to submit this form for compliance or regulatory purposes.

03

Anyone who has been instructed by a government agency to complete this form as part of an application or verification process.

Fill

form 49465

: Try Risk Free

People Also Ask about indiana state 49465 articles dissolution

How do I dissolve a business entity in Indiana?

To formally dissolve, businesses must file with the Indiana Secretary of State first. Please note that closing your business in INBiz will only end your obligations to the Secretary of State's office. You are responsible for properly closing the business with all other agencies in which your business is registered.

How long does it take to dissolve a corporation in Indiana?

We get your IN Corporation Dissolution filing to the Indiana Secretary of State as fast as possible. Once they get the application, the IN Secretary of State usually takes 3-5 business days to process an Indiana Corporation Dissolution filing.

How much does it cost to dissolve a business in Indiana?

There is a $30 filing fee to dissolve your Limited Liability Company in Indiana. The fee is only $20 if you file the dissolution online. There is a small additional credit card fee for online filing. Your Indiana registered agent may be able to help with the dissolution process.

How do I dissolve a corporation in Indiana?

To formally dissolve, businesses must file with the Indiana Secretary of State first. Please note that closing your business in INBiz will only end your obligations to the Secretary of State's office. You are responsible for properly closing the business with all other agencies in which your business is registered.

How do you shut down a business?

Follow these steps to closing your business: Decide to close. File dissolution documents. Cancel registrations, permits, licenses, and business names. Comply with employment and labor laws. Resolve financial obligations. Maintain records.

How do I close my business in Indiana?

To formally dissolve, businesses must file with the Indiana Secretary of State first. Please note that closing your business in INBiz will only end your obligations to the Secretary of State's office. You are responsible for properly closing the business with all other agencies in which your business is registered.

How do I dissolve my business in Indiana?

To formally dissolve, businesses must file with the Indiana Secretary of State first. Please note that closing your business in INBiz will only end your obligations to the Secretary of State's office. You are responsible for properly closing the business with all other agencies in which your business is registered.

What form do I need to close a business in Indiana?

If a business does not have an INTIME account, then it is required to send an Indiana Tax Closure Request (Form BC-100). If the tax account isn't closed on INTIME or the BC-100 isn't filed, DOR may continue to send bills for estimated taxes. Do not mail and fax this form.

How do I close my business with the Indiana Secretary of State?

All businesses registered with the Secretary of State Corporate Division must first file Articles of Dissolution with the Indiana Secretary of State. You may reach their office at 317-232-6576.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send dissolution indiana information for eSignature?

Once your indiana state form dissolution limited liability sample is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

Can I create an electronic signature for signing my indiana dissolution limited liability company get in Gmail?

Create your eSignature using pdfFiller and then eSign your indiana form limited liability company get immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I fill out the indiana state form 49465 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign dissolution indiana fill and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is IN State Form 49465?

IN State Form 49465 is a form used for reporting certain tax-related information to the Indiana Department of Revenue.

Who is required to file IN State Form 49465?

Businesses and individuals who meet specific criteria related to income and tax obligations in the state of Indiana are required to file IN State Form 49465.

How to fill out IN State Form 49465?

To fill out IN State Form 49465, provide the required information regarding income, deductions, and other financial details as specified on the form, ensuring accuracy and completeness.

What is the purpose of IN State Form 49465?

The purpose of IN State Form 49465 is to ensure compliance with Indiana state tax laws by collecting necessary financial information from taxpayers.

What information must be reported on IN State Form 49465?

Information that must be reported on IN State Form 49465 includes details on income, tax withholdings, deductions claimed, and any other relevant financial data as required by the form.

Fill out your dissolution indiana printable 2017-2025 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dissolution Indiana Form is not the form you're looking for?Search for another form here.

Keywords relevant to in form 49465 dissolution limited company

Related to in 49465 liability company print

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.