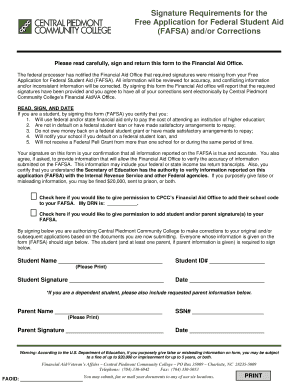

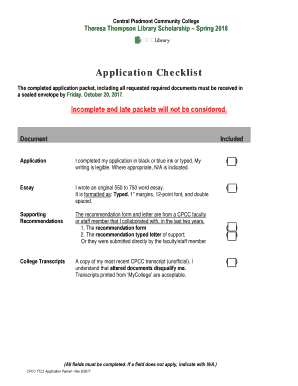

Get the free IPP Code

Show details

Centennial High School Grade 10 Course Selection Form 2012-2013 Surname: Check if Applicable IPP Code KANE ESL Advanced Placement (AP) Given Names: Student CBE ID. No. Junior High Attended: Home Phone:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ipp code

Edit your ipp code form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ipp code form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ipp code online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ipp code. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ipp code

How to fill out IPP code:

01

Begin by gathering all necessary information and documents required for filling out the IPP code. This may include the company's name, address, tax identification number, and other relevant details.

02

Next, access the relevant government website or portal where the IPP code can be obtained. This could be the website of the tax authority or any other designated platform.

03

Look for the appropriate section on the website or portal that allows you to apply for or fill out an IPP code. This section may be labeled as "IPP Code Application" or similar.

04

Click on the designated link or button to access the IPP code application form. Carefully read through any instructions or guidelines provided before proceeding.

05

Fill out the application form with accurate and up-to-date information. Ensure that all mandatory fields are completed and any supporting documents are uploaded as required.

06

Double-check all the information provided on the application form to ensure accuracy and clarity. Mistakes or inaccuracies in the information provided may lead to delays or complications in obtaining the IPP code.

07

Once the application form is completed, review the terms and conditions if any are presented. Accept or agree to the terms, if required, to proceed with the submission.

08

Submit the completed application form by clicking on the designated button or link. Some platforms may require you to create an account and log in before submitting the application.

09

After submitting the application, you may receive a confirmation message or email acknowledging the receipt of your IPP code application. Keep this confirmation for future reference.

10

The IPP code will typically be processed within a specified period of time, which can vary depending on the country or tax authority. Monitor your email or online account for any updates or notifications regarding the status of your application.

Who needs IPP code:

01

Businesses or individuals engaged in international trade or cross-border transactions often need an IPP code. It acts as a unique identifier for importers, exporters, and other entities involved in such transactions.

02

Companies or individuals who import or export goods or services from one country to another may require an IPP code to facilitate customs procedures and comply with international trade regulations.

03

Some countries may also require an IPP code for specific types of transactions, such as sending or receiving international payments, participating in government tenders, or registering as a foreign business entity.

04

Additionally, logistics providers, freight forwarders, and other intermediaries involved in international trade processes may also need an IPP code to efficiently coordinate and track shipments.

05

It is important to consult with the relevant government authorities or regulatory bodies in your country or the country of import/export to determine if an IPP code is required for your specific business activities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ipp code?

IPP code stands for Identification Protection Plan code, which is a unique code assigned to each individual or entity that is required to file taxes.

Who is required to file ipp code?

Any individual or entity that is liable to pay taxes is required to file an ipp code.

How to fill out ipp code?

You can fill out the ipp code by accessing the official tax website and following the instructions provided.

What is the purpose of ipp code?

The purpose of the ipp code is to uniquely identify taxpayers and ensure accurate reporting of tax information.

What information must be reported on ipp code?

The ipp code must include personal or entity details, income information, deductions, and any other relevant tax data.

How can I edit ipp code from Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including ipp code, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make changes in ipp code?

With pdfFiller, the editing process is straightforward. Open your ipp code in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for the ipp code in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your ipp code and you'll be done in minutes.

Fill out your ipp code online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ipp Code is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.