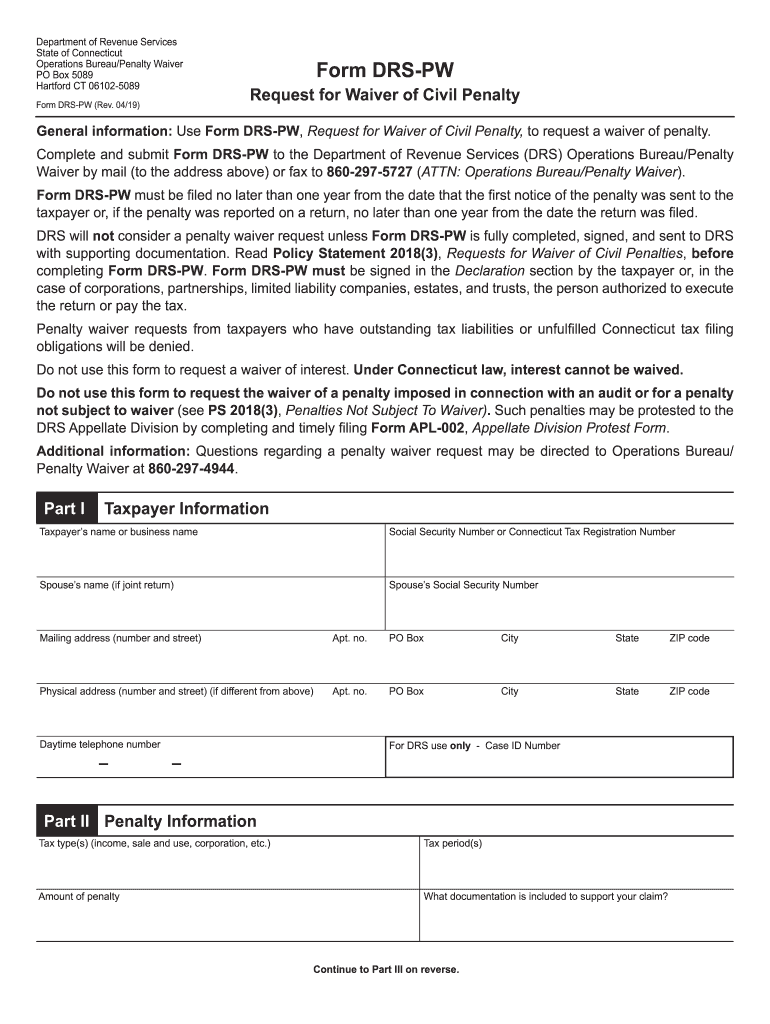

Who needs a DRS-PW form?

This form is used by taxpayers to request a waiver of a civil penalty in the state of Connecticut. In other words, you have the right to complete and submit this form if you think the failure to pay taxes in time was because of some reasonable cause. This form can’t be used to request an interest waiver or in connection with audit.

What is the purpose of the DRS-PW form?

The request form provides information about the taxpayer and penalty. These details are required by the Commissioner of Revenue Service to determine whether the penalty was imposed by mistake or not. If the request is approved, the taxpayer will be released from the penalty.

What documents must accompany the DRS-PW form?

The request form should be accompanied by the supporting documents, which will provide the reason why you couldn’t pay taxes on time. These can be copies of police or fire reports and documents from the insurance company (in case the business records were destroyed by fire), letters from the physician or other medical provider (in case the taxpayer was ill), etc.

When is the DRS-PW form due?

This request form should be filed as soon as possible, so the Commissioner of Revenue Service has enough time to consider and investigate the case.

What information should be provided in the DRS-PW form?

The taxpayer should add the following information:

- Taxpayer’s name or business name

- Social Security Number or Connecticut Tax Registration Number

- Spouse’s name and their Social Security Number

- Mailing address

- Phone number

- Type of the tax

- Tax period

- Amount of penalty

- List of included documents

- Details explaining why the taxpayer was unable to comply with his tax obligations

The request form must also be signed and dated by the taxpayer.

Where do I send the completed form?

The request is forwarded to the Department of Revenue Services, Operations Bureau/Penalty Waiver, Hartford CT.