IN Huntington Funds Form 50 2013-2025 free printable template

Show details

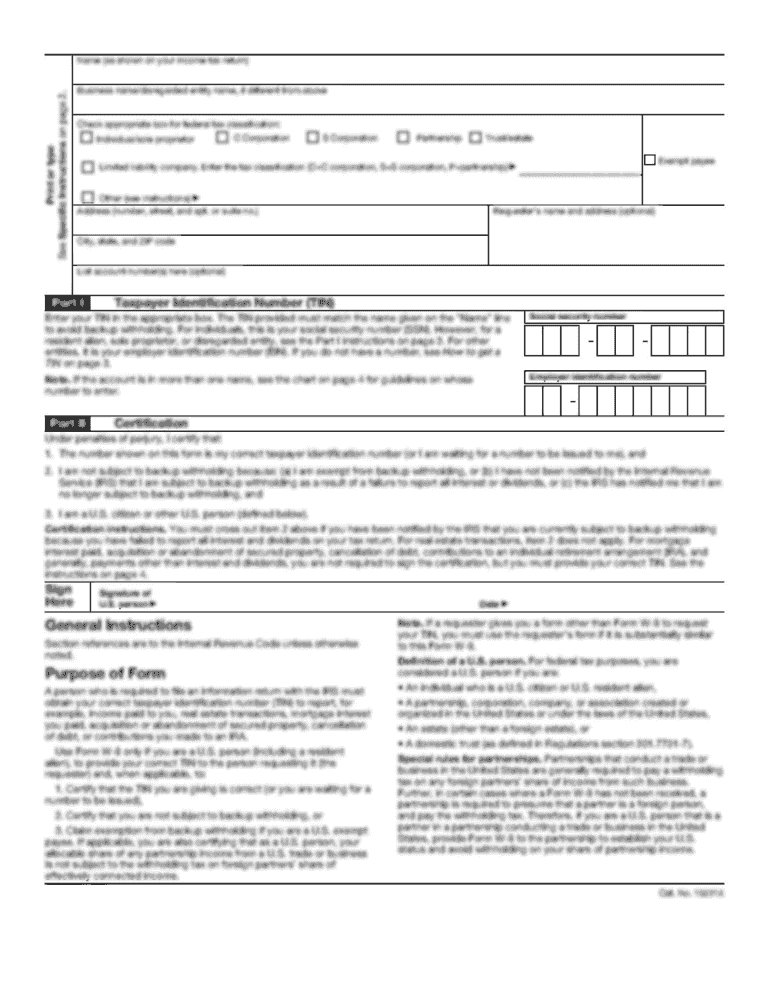

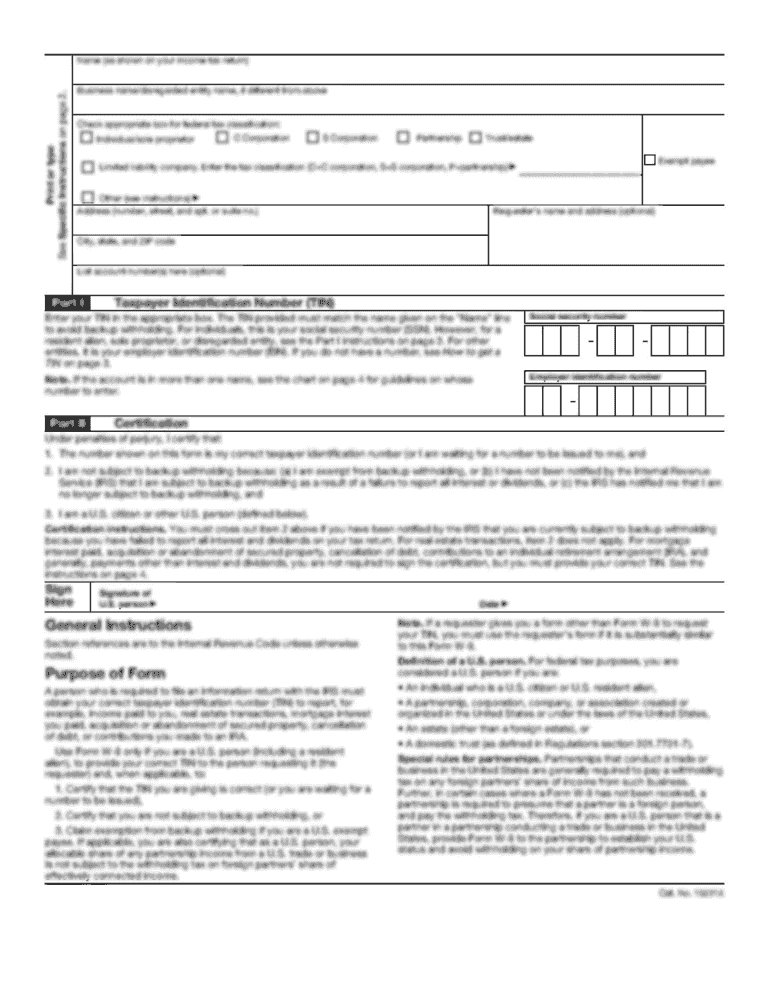

IRA CHANGE OF BENEFICIARY FORM If you have any questions regarding this form, please call Shareholder Services at 1-800-253-0412. This IRA Change of Beneficiary Form is used to change the beneficiaries

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ira change of beneficiary

Edit your ira change of beneficiary form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ira change of beneficiary form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ira change of beneficiary online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ira change of beneficiary. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ira change of beneficiary

How to fill out IN Huntington Funds Form 50

01

Begin by downloading the IN Huntington Funds Form 50 from the official website.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate the type of account you are applying for or making changes to.

04

Provide any necessary financial information, such as income and investment objectives.

05

Review the options for fund selection and mark your choices clearly.

06

Sign and date the form at the designated area to authorize the submission.

07

Double-check all entries for accuracy before submitting the form via mail or online.

Who needs IN Huntington Funds Form 50?

01

Individuals who are interested in investing in Huntington Funds.

02

Current investors looking to update their account information or fund selections.

03

Advisors managing client investments in Huntington Funds.

Fill

form

: Try Risk Free

People Also Ask about

How do I change my beneficiary on my 401k?

How to name a beneficiary on your 401(k) account Fill out the beneficiary designation form supplied by your 401(k) provider. Set your beneficiary designations directly through an online portal on your provider's website. Call your provider and choose your beneficiaries over the phone.

Can you change your beneficiary on your IRA?

You can, and usually should, name both primary and contingent beneficiaries for your IRA. If you name multiple primary or contingent beneficiaries, you should indicate how much of your IRA each beneficiary should receive. As an account owner you may change your beneficiaries as often as you like.

What is a beneficiary change form?

The beneficiary designation forms allow you to name primary and secondary beneficiaries. Your “primary beneficiaries” are the first people or entities that you want to receive your benefit after you die.

How do I change my beneficiary on my retirement account?

How to name a beneficiary on your 401(k) account Fill out the beneficiary designation form supplied by your 401(k) provider. Set your beneficiary designations directly through an online portal on your provider's website. Call your provider and choose your beneficiaries over the phone.

Can I add a beneficiary to my Huntington bank account?

Enrolling is Easy Add a family member or financial advisor to your account in a few simple steps. Log into your online banking account and look for Access Sharing in your Profile at the top of the page. Follow the prompts and you're on your way.

Can you change your beneficiary at any time?

The beneficiary can be either revocable or irrevocable. A revocable beneficiary can be changed at any time. Once named, an irrevocable beneficiary cannot be changed without his or her consent. You can name as many beneficiaries as you want, subject to procedures set in the policy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ira change of beneficiary from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including ira change of beneficiary, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

Can I create an electronic signature for the ira change of beneficiary in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your ira change of beneficiary.

How do I edit ira change of beneficiary on an Android device?

The pdfFiller app for Android allows you to edit PDF files like ira change of beneficiary. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is IN Huntington Funds Form 50?

IN Huntington Funds Form 50 is a specific form used for reporting financial data related to the Huntington Funds, which may include information such as income, investments, and distributions for tax purposes.

Who is required to file IN Huntington Funds Form 50?

Individuals or entities that have invested in Huntington Funds or received distributions from the funds are typically required to file IN Huntington Funds Form 50 to report earnings and comply with tax regulations.

How to fill out IN Huntington Funds Form 50?

To fill out IN Huntington Funds Form 50, gather all relevant financial information from your investment in Huntington Funds, follow the instructions provided with the form, filling in sections such as personal details, income earned, and other required disclosures.

What is the purpose of IN Huntington Funds Form 50?

The purpose of IN Huntington Funds Form 50 is to provide a structured way for investors to report their earnings and distributions from Huntington Funds to the tax authorities, ensuring compliance with tax laws.

What information must be reported on IN Huntington Funds Form 50?

The information that must be reported on IN Huntington Funds Form 50 includes the investor's personal details, income received from the funds, any capital gains, distributions made, and any relevant deductions that apply.

Fill out your ira change of beneficiary online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ira Change Of Beneficiary is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.